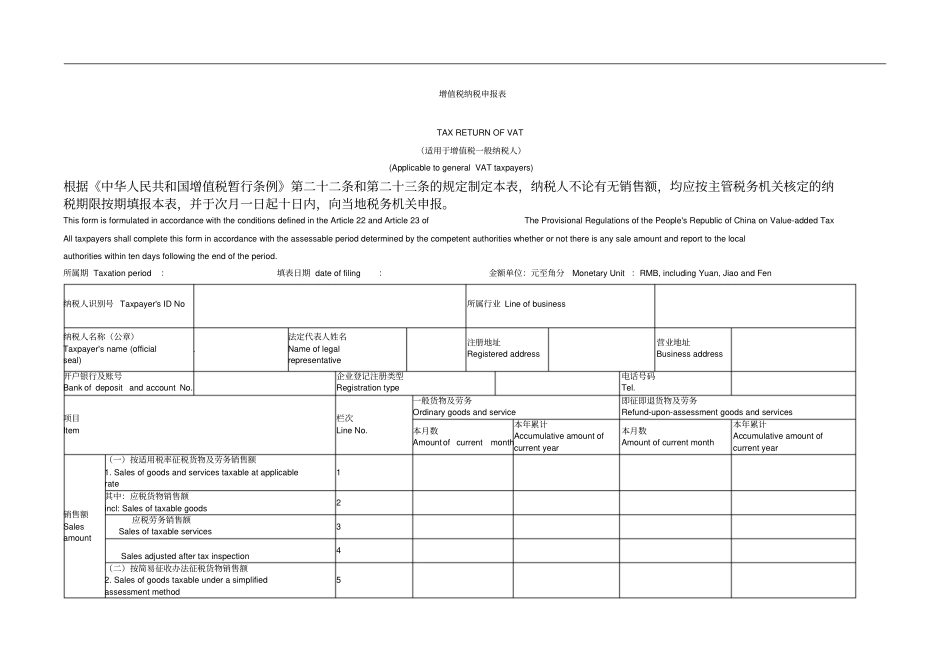

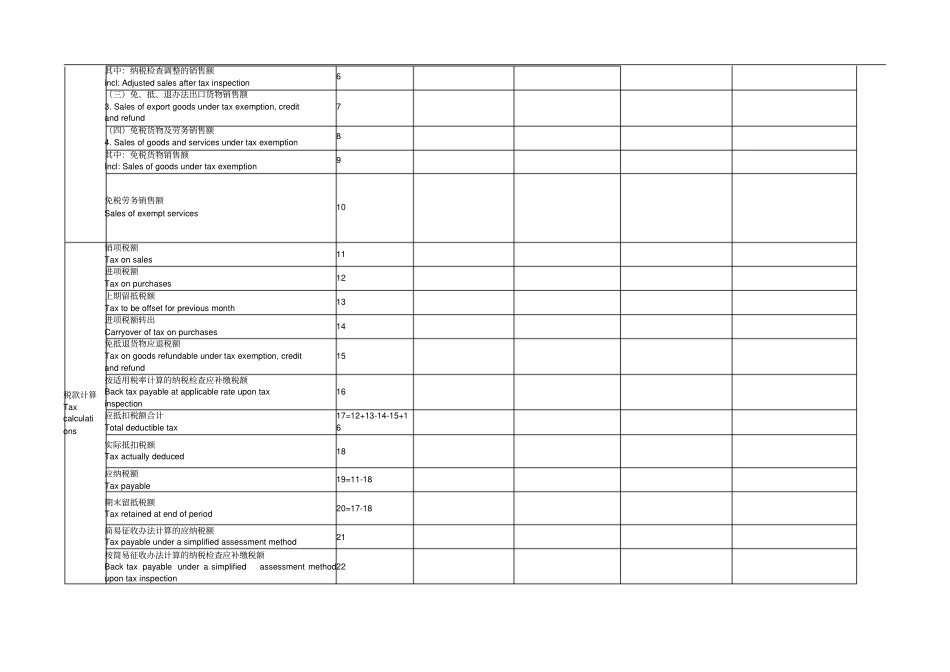

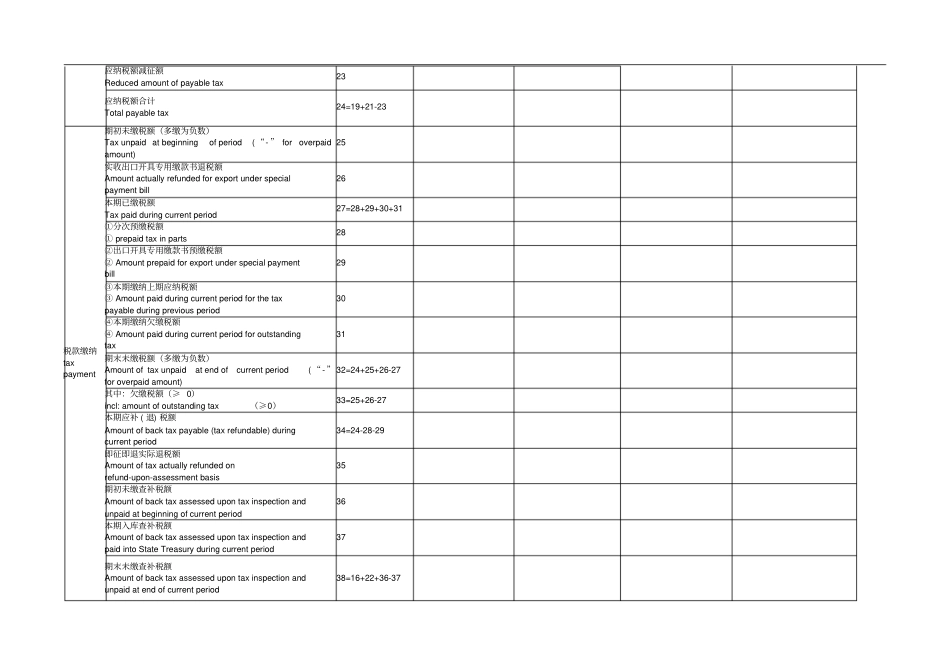

增值税纳税申报表TAX RETURN OF VAT(适用于增值税一般纳税人)(Applicable to general VAT taxpayers) 根据《中华人民共和国增值税暂行条例》第二十二条和第二十三条的规定制定本表,纳税人不论有无销售额,均应按主管税务机关核定的纳税期限按期填报本表,并于次月一日起十日内,向当地税务机关申报。This form is formulated in accordance with the conditions defined in the Article 22 and Article 23 of The Provisional Regulations of the People's Republic of China on Value-added Tax All taxpayers shall complete this form in accordance with the assessable period determined by the competent authorities whether or not there is any sale amount and report to the local authorities within ten days following the end of the period.所属期 Taxation period:填表日期 date of filing:金额单位:元至角分Monetary Unit :RMB, including Yuan, Jiao and Fen 纳税人识别号 Taxpayer's ID No 所属行业 Line of business 纳税人名称(公章)Taxpayer's name (official seal).法定代表人姓名Name of legal representative 注册地址Registered address 营业地址Business address 开户银行及账号Bank of deposit and account No.企业登记注册类型Registration type电话号码Tel.项目Item栏次Line No.一般货物及劳务Ordinary goods and service即征即退货物及劳务Refund-upon-assessment goods and services本月数Amount of current month本年累计Accumulative amount of current year 本月数Amount of current month本年累计Accumulative amount of current year销售额Sales amount(一)按适用税率征税货物及劳务销售额1. Sales of goods and services taxable at applicable rate1其中:应税货物销售额incl: Sales of taxable goods2应税劳务销售额 Sales of taxable services3 Sales adjusted after tax inspection4(二)按简易征收办法征税货物销售额2. Sales of goods taxable under a simplified assessment method5其中:纳税检查调整的销售额incl: Adjusted sales after tax inspection6(三)免、抵、退办法出口货物销售额3. S...