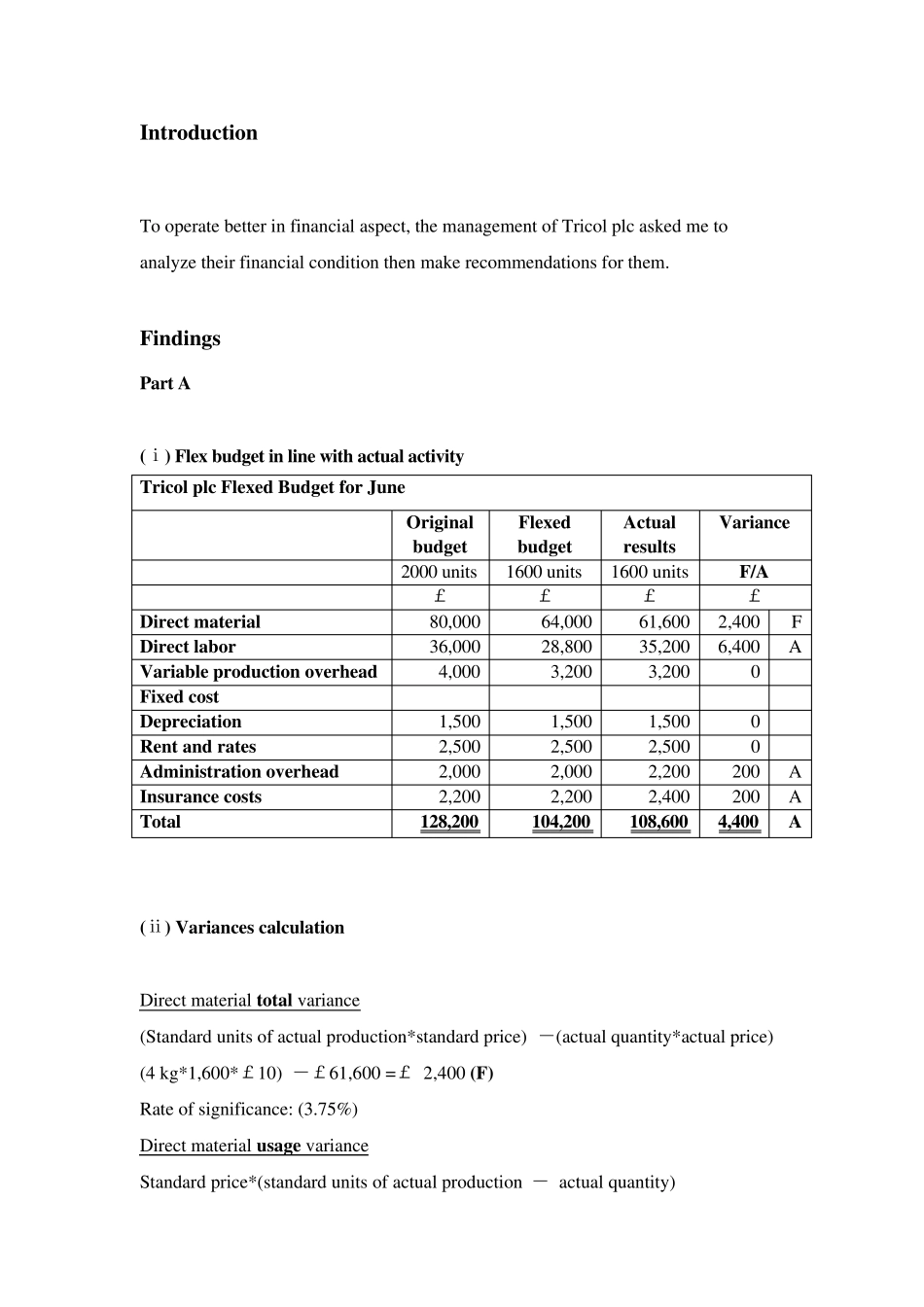

A financial analysis report for Tricol plc Outcome 3and4 Class;10E6 Name:Ma boda SCN:125099297 Candidate Num:22 Introduction To operate better in financial aspect, the management of Tricol plc asked me to analyze their financial condition then make recommendations for them. Findings Part A (ⅰ) Flex budget in line with actual activity Tricol plc Flexed Budget for June Original budget Flexed budget Actual results Variance 2000 units 1600 units 1600 units F/A £ £ £ £ Direct material 80,000 64,000 61,600 2,400 F Direct labor 36,000 28,800 35,200 6,400 A Variable production overhead 4,000 3,200 3,200 0 Fixed cost Depreciation 1,500 1,500 1,500 0 Rent and rates 2,500 2,500 2,500 0 Administration overhead 2,000 2,000 2,200 200 A Insurance costs 2,200 2,200 2,400 200 A Total 128,200 104,200 108,600 4,400 A (ⅱ) Variances calculation Direct material total variance (Standard units of actual production*standard price) -(actual quantity*actual price) (4 kg*1,600*£10) -£61,600 =£ 2,400 (F) Rate of significance: (3.75%) Direct material usage variance Standard price*(standard units of actual production - actual quantity) £ 10*[ (4kgⅹ1,600) -5,600kg]= £8,000 (F) Rate of significance (12.5%) Direct material price v ariance Actu al qu antity * (standard price - actu al price) 5,600kg*[£ 10 -(£61,600/ 5,600kg) ]= £ (5,600) (A) Rate of significance: (8.75%) Direct labou r total v ariance (Standard hou rs of actu al produ ction*standard rate ph) - (actu al hou rs*actu al rate ph) [ (2hrs*1,600) *£9]-£35,200=£(6,400) (A) Rate of significance: (22.22%) Direct labou r efficiency v ariance Standard rate ph* (standard hou rs of actu al produ ction - actu al hou rs) £9*(2hrs*1,600-3,520hrs)=(2,880) (A) Rat...