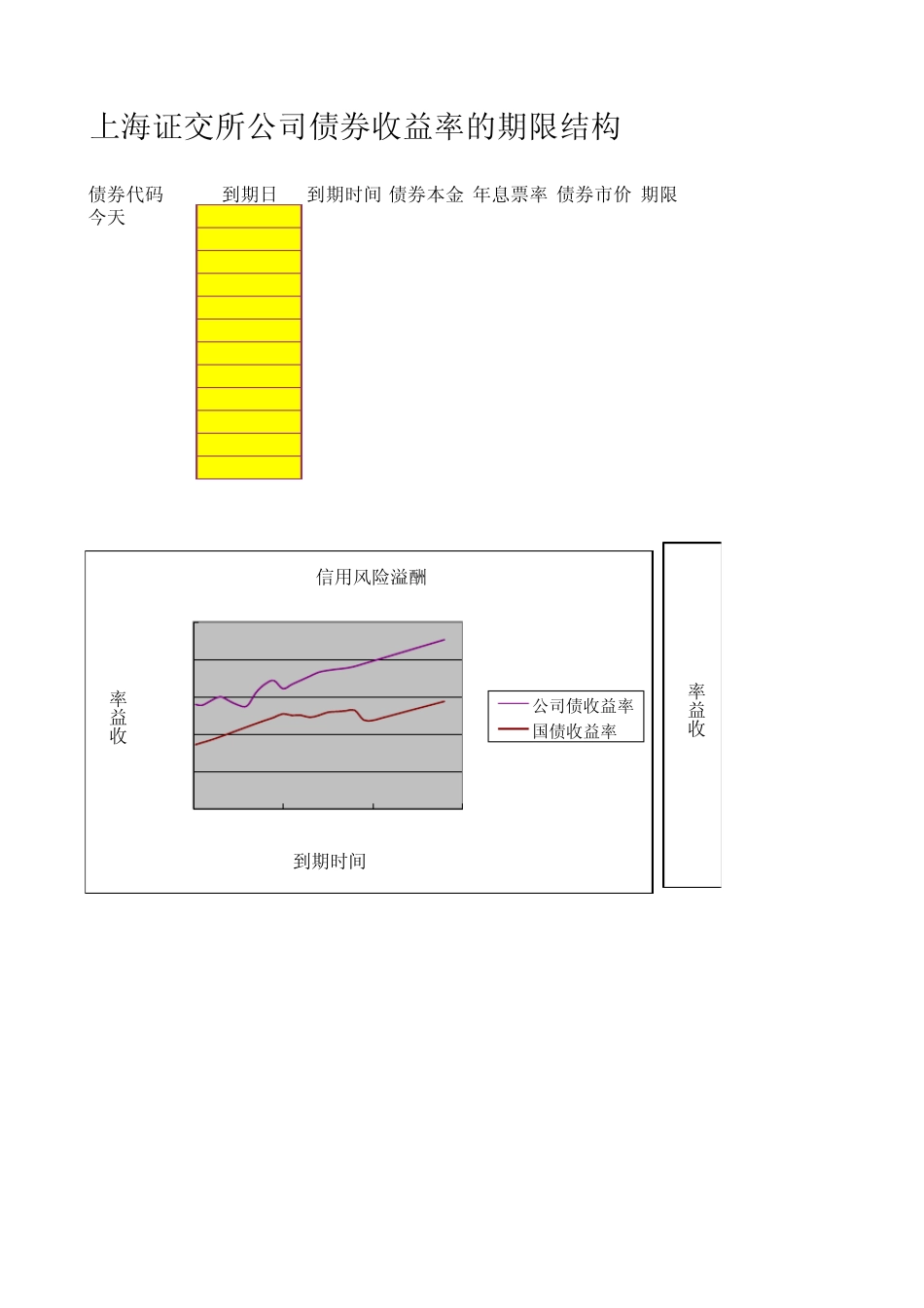

上海证交所公司债券收益率的期限结构债券代码到期日到期时间 债券本金 年息票率 债券市价 期限今天2002-9-13129803 2003-6-100.74100 8.60%140.15129806 2003-12-241.28100 6.95%129.585129901 2004-10-122.08100 3.80%112.085120001 2005-8-102.91100 4.00%103.85129904 2006-6-153.76100 5.48%108.84129805 2007-1-174.34100 6.20%115.081299052007-9-84.99100 4.50%105.68129902 2009-10-137.08100 4.50%111.71 10129903 2010-7-257.87100 4.00%102.22120101 2011-6-178.76100 4.00%102.44120102 2016-11-814.15 100 5.21%114.050.150.340.500.760.760.870.910.991.001.151.341.501.761.761.871.911.992.002.152.342.502.762.762.872.912.993.003.153.343.500.010.020.030.040.05收益率0.00%1.00%2.00%3.00%4.00%5.00%051015收益率到期时间信用风险溢酬公司债收益率国债收益率3.763.763.873.913.994.004.154.344.504.764.764.874.914.995.005.155.345.505.765.765.875.915.996.006.156.346.506.766.766.876.916.997.007.157.347.507.767.767.877.917.998.008.158.348.508.768.768.878.918.999.009.159.349.509.769.769.879.919.9910.0010.1510.3410.5010.7610.7610.8710.9110.9911.0011.1511.3411.5011.7611.7611.8711.9111.9912.0012.1512.3412.5012.7612.7612.8712.9112.9913.0013.1513.3413.5013.7613.7613.8713.9113.9914.0014.150.130.511.522.533.544.555.566.577.588.599.51010.51111.51212.51313.51414.51515.51616.51717.51818.5连续复利收益率单变量求解2.76%3.06%2.88%2.69%103.84999433.30%108.83998653.41%115.08000653.23%105.6800273.68%3.74%102.21992623.79%102.43990554.56%114.04969382.80%2.79%2.78%2.77%2.77%2.83%2.85%2.90%2.90%2.99%3.04%3.01%2.95%2.95%2.93%2.92%2.90%2.90%2.86%2.82%2.78%2.73%2.73%2.70%2.69%2.75%2.76%2.87%3.00%3.12%00.010.020.030.040.050.005.0010.0015.00到期时间公司债收益率曲线3.30%3.30%3.32%3.33%3.34%3.35%3.37%3.41%3.44%3.29%3.29%3.26%3.25%3.23%3.22%3.26%3.30%3.34%3.39%3.39%3.42%3.43%3.44%3.45%3.48%3.52%3.56%3.61%3.61%3.64%3.64%3.66%3.66%3.69%3.70%3.71%3.73%3.73%3.74%3.74%3.74%3.74%3.75%3.76%3.77%3.79%3.79%3.80%3.81%3.82%3.82%3.84%3.87%3.89%3.93%3.93%3.94%3.95%3.96%3.96%3.98%4.01%4.03%4.07%4.07%4.09%4.09%4.10%4.11%4.13%4.16%4.18%4.21%4.21%4.23%4.24%4.25%4.25%4.27%4.30%4.32%4.36%4.36%4.37%4.38%4.39%4.39%4.41%4.44%4.46%4.50%4.50%4.52%4.52%4.53%4.54%4.56%公司债收益率国债收益率信用风险溢酬2.80%1.72%1.08%2.78%1.77%1.01%2.90%1.84%1.06%3.01%1.93%1.08%2.90%2.01%0.88%2.78%2.10%0.68%2.76%2.19%0.57%3.12%2.28%0.84%3.35%2.36%0.98%3.44%2.45%0.99%3.22%2.54%0.68%3.34%2.50%0.84%3.45%2.50%0.94%3.56%2.45%1.11%3.66%2.50%1.16%3.71%2.58%1.13%3.74%2.60%1.14%3.77%2.62%1.15%3.82%2.64%1.18%3.89%2.38%1.51%3.96%2.36%1.60%4.03%2.43%1.61%4.11%2.49%1.61%4.18%2.56%1.62%4.25%2.62%1.63%4.32%2.68%1.64%4.39%2.75%1.64%4.46%2.81%1.65%4.54%2.88%1.66%