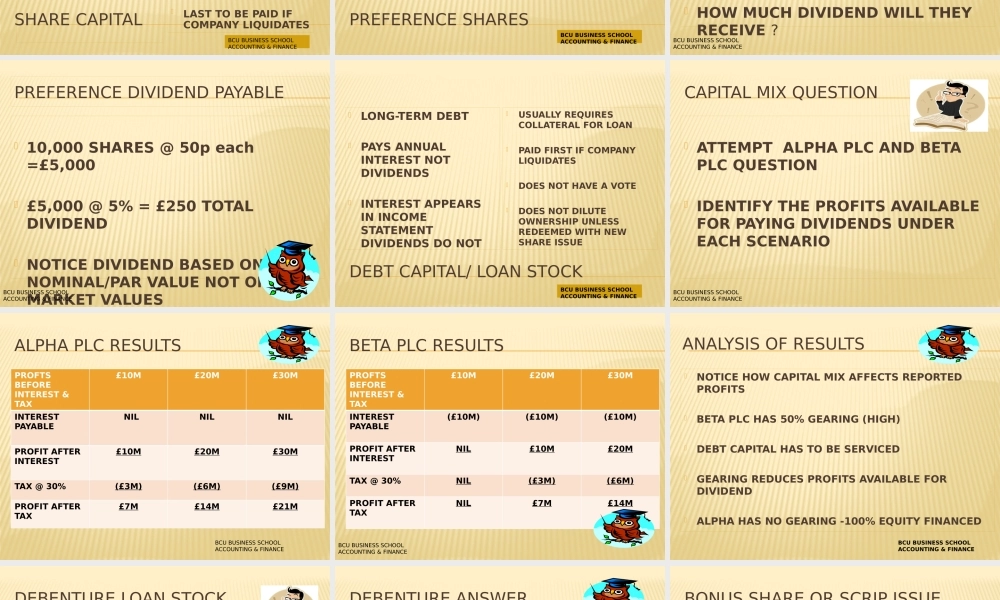

MSCMANAGERIAL FINANCE - 5BCU BUSINESS SCHOOL ACCOUNTING & FINANCESOURCES OF CAPITAL EXTERNAL & INTERNAL INTERNAL RESERVES EXTERNAL: SHARE CAPITAL DEBT /LOAN CAPITAL CONVERTIBLES, WARRANTS & SHARE OPTIONS BANK BORROWINGBCU BUSINESS SCHOOL ACCOUNTING & FINANCECAPITAL BALANCE MIXADMIN & LEGAL COSTSSERVICING LEVELSINTEREST OBLIGATIONSREPAYMENT OF PRINCIPAL AMOUNT BORROWEDTAX IMPLICATIONSIMPACTS ON EXISTING SHAREHOLDERSDILUTION OF OWNERSHIPBCU BUSINESS SCHOOL ACCOUNTING & FINANCEFINANCE SUPPLIERS REQUIREMENTSREQUIRED LEVELS OF RETURNLEVELS OF INVESTMENT RISKABILITY TO LIQUIDATE CAPITALTAX POSITIONLEVEL OF CONTROL & INFLUENCE THEY CAN EXERCISEBCU BUSINESS SCHOOL ACCOUNTING & FINANCESHARE CAPITALORDINARY SHARE CAPITAL – EQUITIESCONFERS PART OWNESHIP OF THE COMPANYCONFERS RIGHT TO VOTE AT COMPANY’S AGMRIGHT TO PARTICIPATE IN PROFITS IN FORM OF DIVIDENDSDIVIDENDS NOT ASSUREDVALUE OF SHARES CAN RISE OR FALL ON MARKETSLAST TO BE PAID IF COMPANY LIQUIDATESBCU BUSINESS SCHOOL ACCOUNTING & FINANCEPREFERENCE SHARES ENTITLED TO A FIXED ANNUAL DIVIDEND IRRESPECTIVE OF COMPANY’S PERFORMANCEDO NOT HAVE A VOTEPAID BEFORE ORDINARY SHAREHOLDERSATTRACTS RISK AVERSE INVESTORSBCU BUSINESS SCHOOL ACCOUNTING & FINANCEPREFERENCE DIVIDEND WORKED EXAMPLE AN INVESTOR HAS 10,000 5% PREFERENCE SHARES 50p THEY ARE CURRENTLY TRADING AT 120p ON THE STOCK MARKET HOW MUCH DIVIDEND WILL THEY RECEIVE ?BCU BUSINESS SCHOOL ACCOUNTING & FINANCEPREFERENCE DIVIDEND PAYABLE 10,000 SHARES @ 50p each =£5,000 £5,000 @ 5% = £250 TOTAL DIVIDEND NOTICE DIVIDEND BASED ON NOMINAL/PAR VALUE NOT ON MARKET VALUESBCU BUSINESS SCHOOL ACCOUNTING & FINANCEDEBT CAPITAL/ LOAN STOCKLONG-TERM DEBTPAYS ANNUAL INTEREST NOT ...