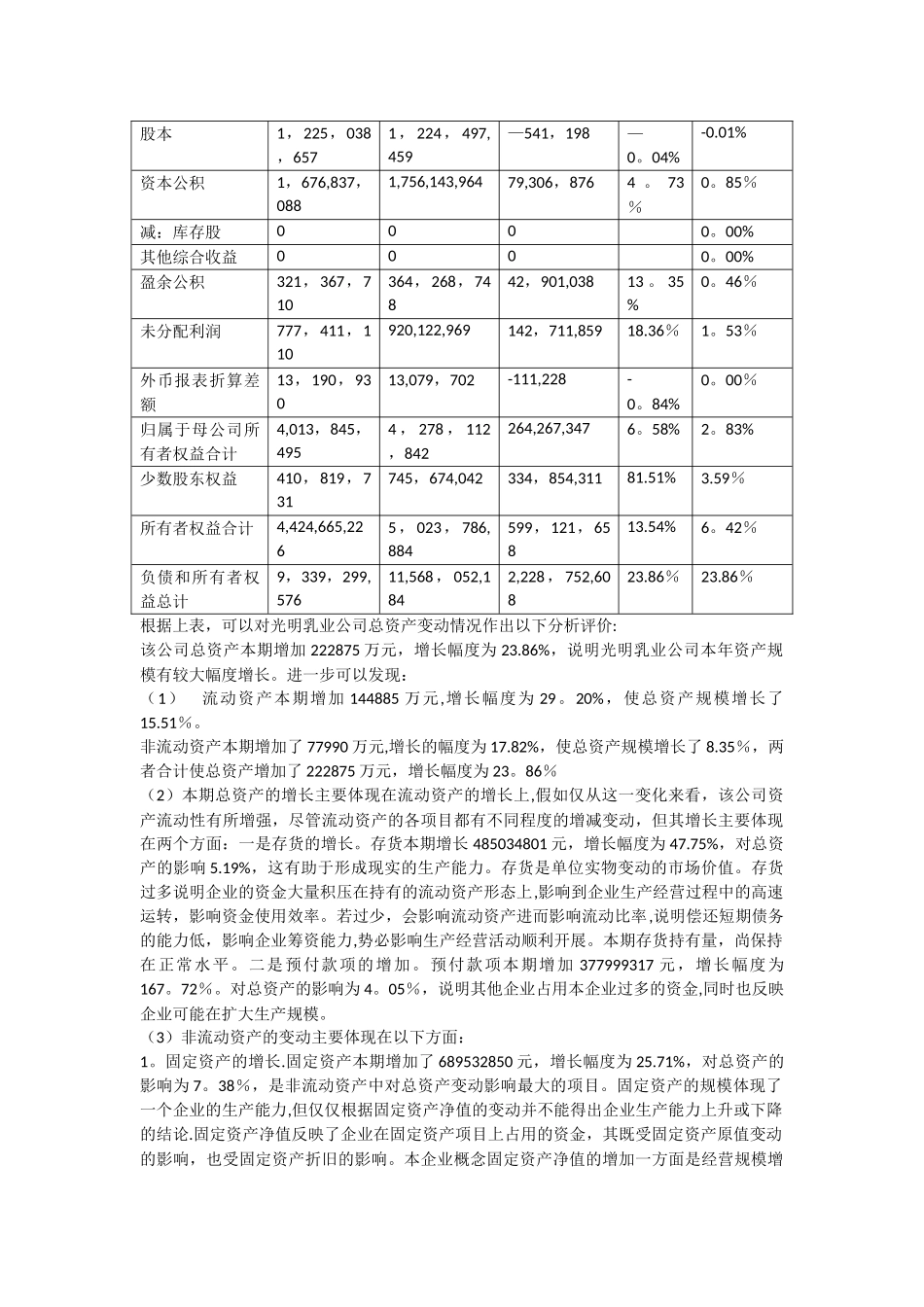

2025 年与 2025 年资产负债表水平分析单位:元项目2025 年 12 月31 日2025 年 12 月31 日变动情况对总额的影响变动额变动率流动资产:货币资金2,339,384,038 2,600,367,233 260,983,195 11.16%2.79%交易性金融资产11,781,416 18,537,959 6,756,543 57.35%0.07%应收票据1,511,278 2,678,307 1,167,029 77.22%0.01%应收账款1,310,077,082 1,386,392,941 76,315,859 5.83%0。82%预付款项225,373,435 603,372,752 377,999,317 167.72%4。05%其他应收款58,358,609 79,125,091 20,766,482 35 。 58%0。22%存货1,015,752,178 1,500,786,979 485,034,801 47 。 75%5.19%其他流动资产0 219,829,683 219,829,683 2。35%流动资产合计4,962,238,036 6,411,090,945 1,448,852,909 29 。 20%15.51%非流动资产:可供出售金融资0 0 0 0 0。00%长期应收款1,523,939 1,223,939 -300,000-19 。 69%0。00%长期股权投资30,213,980 18,719,300 -11,494,680-38 。 04%-0。12%固定资产2,681,667,349 3 , 371 , 200,199 689,532,850 25.71%7。38%在建工程709,740,369 672,880,766 —36,859,603)-5。19%-0.39%生产性生物资产142,171,709 205,140,803 62,969,094 44.29%0。67%无形资产280,102,296 281,590,505 1,488,209 0。53%0。02%商誉258,884,662 258,884,662 0 0.00%0。00%长期待摊费用0 3,286,520 3,286,520 0。04%递延所得税资产272,757 , 236 344,034,545 71,277,309 26.13%0。76%其他非流动资产0 0 0 0。00%非流动资产合计4,377,061,540 5,156,961,239 779,899,699 17.82%8。35%资产总计9,339,299,511,568,052,--—83。21%76 184 7 , 771,247 ,39283 。 21%流动负债:短期借款793,362,976 949,638,200 156,275,224 19.70%1.67%以公允价值加量的金融负债0 0 0 0。00%交易性金融负债17,340,157 4,036,740 -13,303,417—76.72%—0.14%应付账款1,378,858,771 1,998,690,181 619,831,410 44 。 95%6.64%预收款项335,197 , 904 748,733,090 413,535,186 123.37%4.43%应付职工薪酬152,544,591 183,033,041 30,488,450 19 。 99%0。33%应交税费111 , 924,439 288,613,574 176,689,135 157.86%1。89%应付利息3,020,271 3,531,167 510...