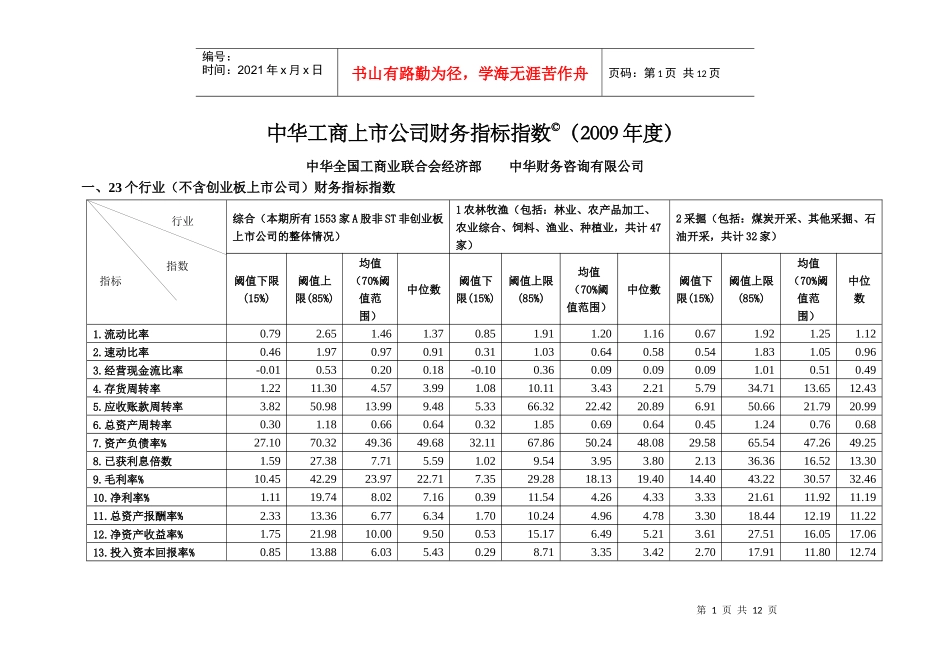

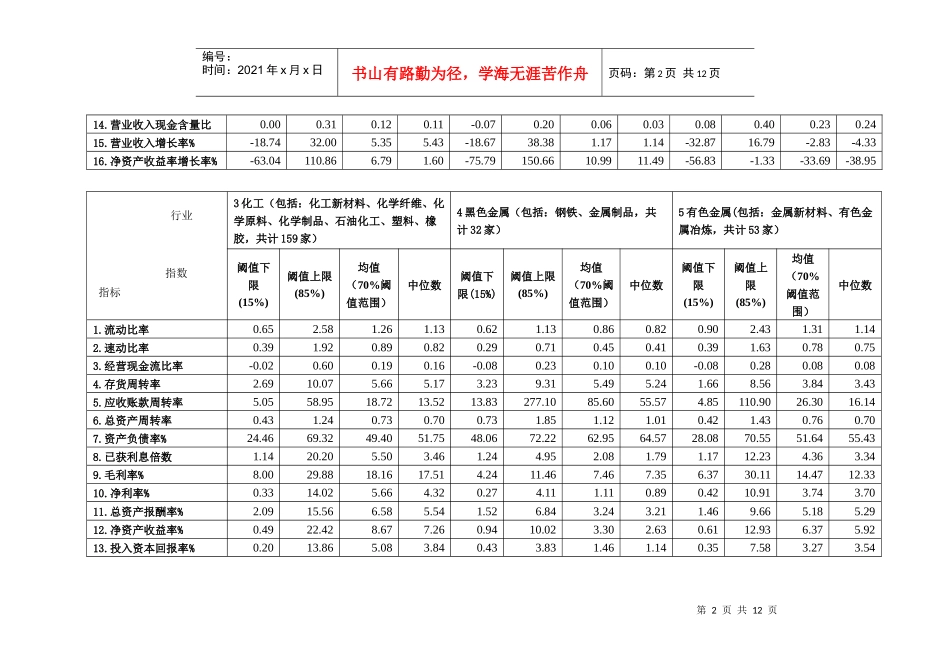

第1页共12页指标指数行业编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第1页共12页中华工商上市公司财务指标指数©(2009年度)中华全国工商业联合会经济部中华财务咨询有限公司一、23个行业(不含创业板上市公司)财务指标指数综合(本期所有1553家A股非ST非创业板上市公司的整体情况)1农林牧渔(包括:林业、农产品加工、农业综合、饲料、渔业、种植业,共计47家)2采掘(包括:煤炭开采、其他采掘、石油开采,共计32家)阈值下限(15%)阈值上限(85%)均值(70%阈值范围)中位数阈值下限(15%)阈值上限(85%)均值(70%阈值范围)中位数阈值下限(15%)阈值上限(85%)均值(70%阈值范围)中位数1.流动比率0.792.651.461.370.851.911.201.160.671.921.251.122.速动比率0.461.970.970.910.311.030.640.580.541.831.050.963.经营现金流比率-0.010.530.200.18-0.100.360.090.090.091.010.510.494.存货周转率1.2211.304.573.991.0810.113.432.215.7934.7113.6512.435.应收账款周转率3.8250.9813.999.485.3366.3222.4220.896.9150.6621.7920.996.总资产周转率0.301.180.660.640.321.850.690.640.451.240.760.687.资产负债率%27.1070.3249.3649.6832.1167.8650.2448.0829.5865.5447.2649.258.已获利息倍数1.5927.387.715.591.029.543.953.802.1336.3616.5213.309.毛利率%10.4542.2923.9722.717.3529.2818.1319.4014.4043.2230.5732.4610.净利率%1.1119.748.027.160.3911.544.264.333.3321.6111.9211.1911.总资产报酬率%2.3313.366.776.341.7010.244.964.783.3018.4412.1911.2212.净资产收益率%1.7521.9810.009.500.5315.176.495.213.6127.5116.0517.0613.投入资本回报率%0.8513.886.035.430.298.713.353.422.7017.9111.8012.74第2页共12页第1页共12页指标指数行业编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第2页共12页14.营业收入现金含量比0.000.310.120.11-0.070.200.060.030.080.400.230.2415.营业收入增长率%-18.7432.005.355.43-18.6738.381.171.14-32.8716.79-2.83-4.3316.净资产收益率增长率%-63.04110.866.791.60-75.79150.6610.9911.49-56.83-1.33-33.69-38.953化工(包括:化工新材料、化学纤维、化学原料、化学制品、石油化工、塑料、橡胶,共计159家)4黑色金属(包括:钢铁、金属制品,共计32家)5有色金属(包括:金属新材料、有色金属冶炼,共计53家)阈值下限(15%)阈值上限(85%)均值(70%阈值范围)中位数阈值下限(15%)阈值上限(85%)均值(70%阈值范围)中位数阈值下限(15%)阈值上限(85%)均值(70%阈值范围)中位数1.流动比率0.652.581.261.130.621.130.860.820.902.431.311.142.速动比率0.391.920.890.820.290.710.450.410.391.630.780.753.经营现金流比率-0.020.600.190.16-0.080.230.100.10-0.080.280.080.084.存货周转率2.6910.075.665.173.239.315.495.241.668.563.843.435.应收账款周转率5.0558.9518.7213.5213.83277.1085.6055.574.85110.9026.3016.146.总资产周转率0.431.240.730.700.731.851.121.010.421.430.760.707.资产负债率%24.4669.3249.4051.7548.0672.2262.9564.5728.0870.5551.6455.438.已获利息倍数1.1420.205.503.461.244.952.081.791.1712.234.363.349.毛利率%8.0029.8818.1617.514.2411.467.467.356.3730.1114.4712.3310.净利率%0.3314.025.664.320.274.111.110.890.4210.913.743.7011.总资产报酬率%2.0915.566.585.541.526.843.243.211.469.665.185.2912.净资产收益率%0.4922.428.677.260.9410.023.302.630.6112.936.375.9213.投入资本回报率%0.2013.865.083.840.433.831.461.140.357.583.273.54第3页共12页第2页共12页编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第3页共12页14.营业收入现金含量比-0.010.200.090.08-0.050.110.040.04-0.050.140.040.0415.营业收入增长率%-24.3923.39-3.72-4.18-30.41-7.97-21.29-22.96-25.0021.82-7.41-9.1216.净资产收益率增长率%-88.72126.401.86-12.20-88.17112.01-15.63-18.07-83.19108.96-4.11-6.486建筑材料(包括:建筑材料、建筑装饰,共计82家)7机...