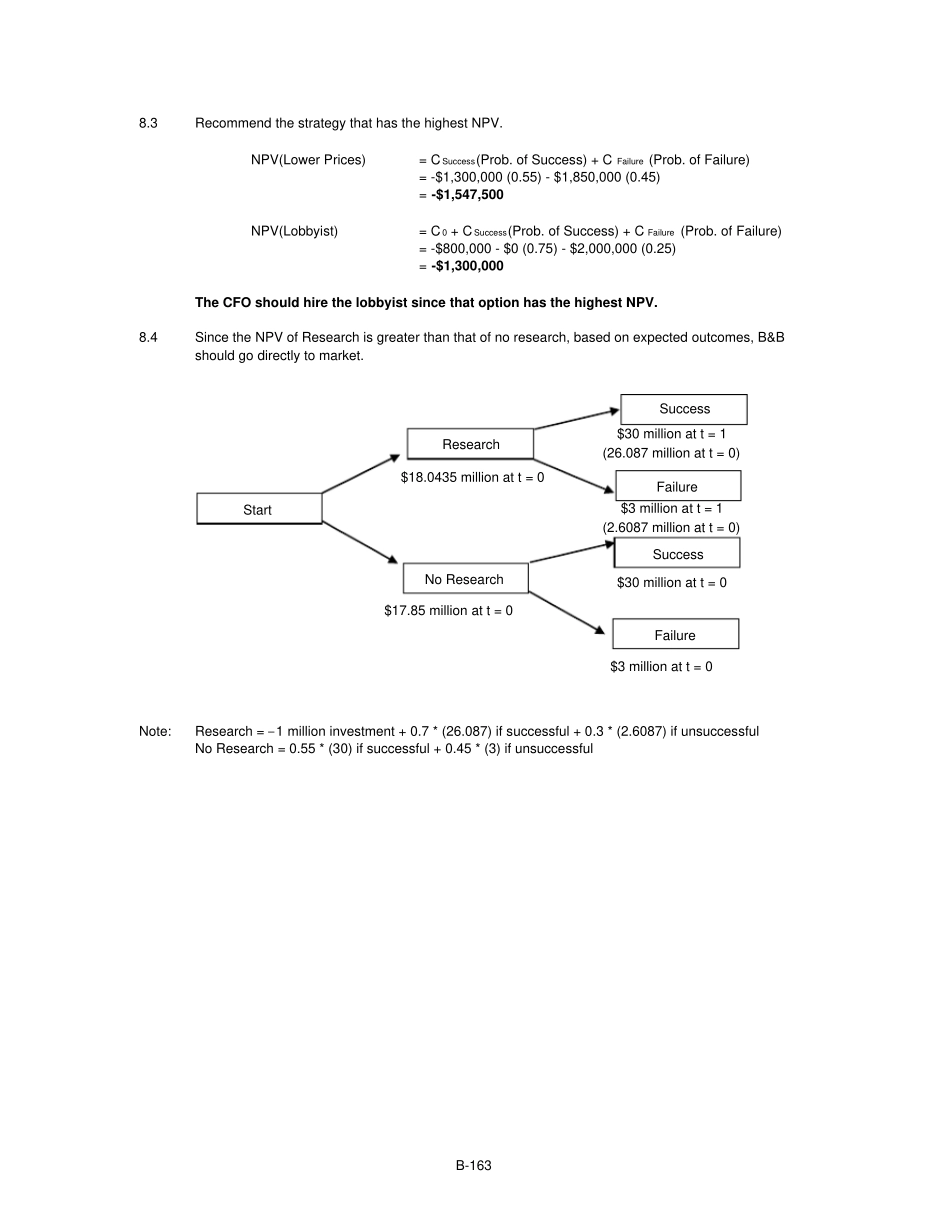

B-162Chapter8:RiskAnalysis,RealOptions,andCapitalBudgeting8.1CalculatetheNPVoftheexpectedpayofffortheoptionofgoingdirectlytomarket.NPV(GoDirectly)=CSuccess(Prob.ofSuccess)+CFailure(Prob.ofFailure)=$20,000,000(0.50)+$5,000,000(0.50)=$12,500,000Theexpectedpayoffofgoingdirectlytomarketis$12,500,000.Thetestmarketingrequiresa$2millioncashoutlay.Choosingthetestmarketingoptionwillalsodelaythelaunchoftheproductbyoneyear.Thus,theexpectedpayoffisdelayedbyoneyearandmustbediscountedbacktoyear0.NPV(TestMarket)=-C0+[CSuccess(Prob.ofSuccess)]/(1+r)T+[CFailure(Prob.ofFailure)]/(1+r)T=-$2,000,000+[$20,000,000(0.75)]/(1.15)+[$5,000,000(0.25)]/(1.15)=$12,130,434.78Theexpectedpayoffoftestmarketingtheproductis$12,130,434.78.Sonyshouldgodirectlytomarketwiththeproductsincethatoptionhasthehighestexpectedpayoff.8.2CalculatetheNPVofeachoption.ThemanagershouldpursuetheoptionwiththehighestNPV.NPV(GoDirectly)=CSuccess(Prob.ofSuccess)=$1,200,000(0.50)=$600,000TheNPVofgoingdirectlytomarketis$600,000.NPV(FocusGroup)=C0+CSuccess(Prob.ofSuccess)=-$120,000+$1,200,000(0.70)=$720,000TheNPVwhenconductingafocusgroupis$720,000.NPV(ConsultingFirm)=C0+CSuccess(Prob.ofSuccess)=-$400,000+$1,200,000(0.90)=$680,000TheNPVwhenhiringaconsultingfirmis$680,000.ThefirmshouldconductafocusgroupsincethatoptionhasthehighestNPV.B-1638.3RecommendthestrategythathasthehighestNPV.NPV(LowerPrices)=CSuccess(Prob.ofSuccess)+CFailure(Prob.ofFailure)=-$1,300,000(0.55)-$1,850,000(0.45)=-$1,547,500NPV(Lobbyist)=C0+CSuccess(Prob.ofSuccess)+CFailure(Prob.ofFailure)=-$800,000-$0(0.75)-$2,000,000(0.25)=-$1,300,000TheCFOshouldhirethelobbyistsincethatoptionhasthehighestNPV.8.4SincetheNPVofResearchisgreaterthanthatofnoresearch,basedonexpectedoutcomes,B&Bshouldgodirectlytomarket.Note:Research=–1millioninvestment+0.7*(26.087)ifsuccessful+0.3*(2.6087)ifunsuccessfulNoResearch=0.55*(30)ifsuccessful+0.45*(3)ifunsuccessfulStartResearchNoResearch$18.0435millionatt=0$17.85millionatt=0SuccessFailureSuccessFailure$30millionatt=1(26.087millionatt=0)$3millionatt=1(2.6087millionatt=0)$30millionatt=0$3millionatt=08.5Carlshouldhavetakenthe$5,000.Expectedreturnfor1%ofmovieprofitsis$3,000.Sinceonlygoodscriptsaremadeintomoviesandonlyagoodmoviewouldmakeaprofit:(10%x30%x$10milx1%)Moviestudiodecisiontree:ScriptisbadDon’tmakemovie90%NoprofitReadscriptScriptisgoodMakeMovieMovieisgoodMovieisbadBigAudienceSmallAudience10%Noprofit30%70%Profit=$10millionNoProfitB-164B-1658.6Applytheaccountingprofitbreak-evenpoint(BEP)formulaandsolveforthesalesprice,x,thatallowsthefirmtobreakevenwhenproducing20,000calculators.Inorderforthefirmtobreakeven,therevenuesfromthecalculatorsales(numberofcalculatorssoldsalespriceperunit)mustequalthetotalannualcostofproducingthecalculators.Remembertoincludetaxesintheanalysis.Variablecosts=$15percalculatorFixedcosts=$900,000peryearDepreciation=(InitialInvestment/EconomicLife)=($600,000/5)=$120,000peryearDividetheafter-taxsumofthedepreciationexpenseandthefixedcostsbythecalculator’safter-taxcontributionmargin(sellingprice,x,minusvariablecost).Theafter-taxcontributionmarginistheamountthateachadditionalcalculatorcontributestothefirm’sprofit.Beforethefirmcanrealizeapositiveprofit,itmusthaveearnedenoughtocoveritsfixedcostsanddepreciationexpense.Solveforx.[(FixedCosts+Depr.)(1–Tc)]/[(SalesPrice-VariableCost)(1-Tc)]=BEP[($900,000+$120,000)(1–0.30)]/[(...