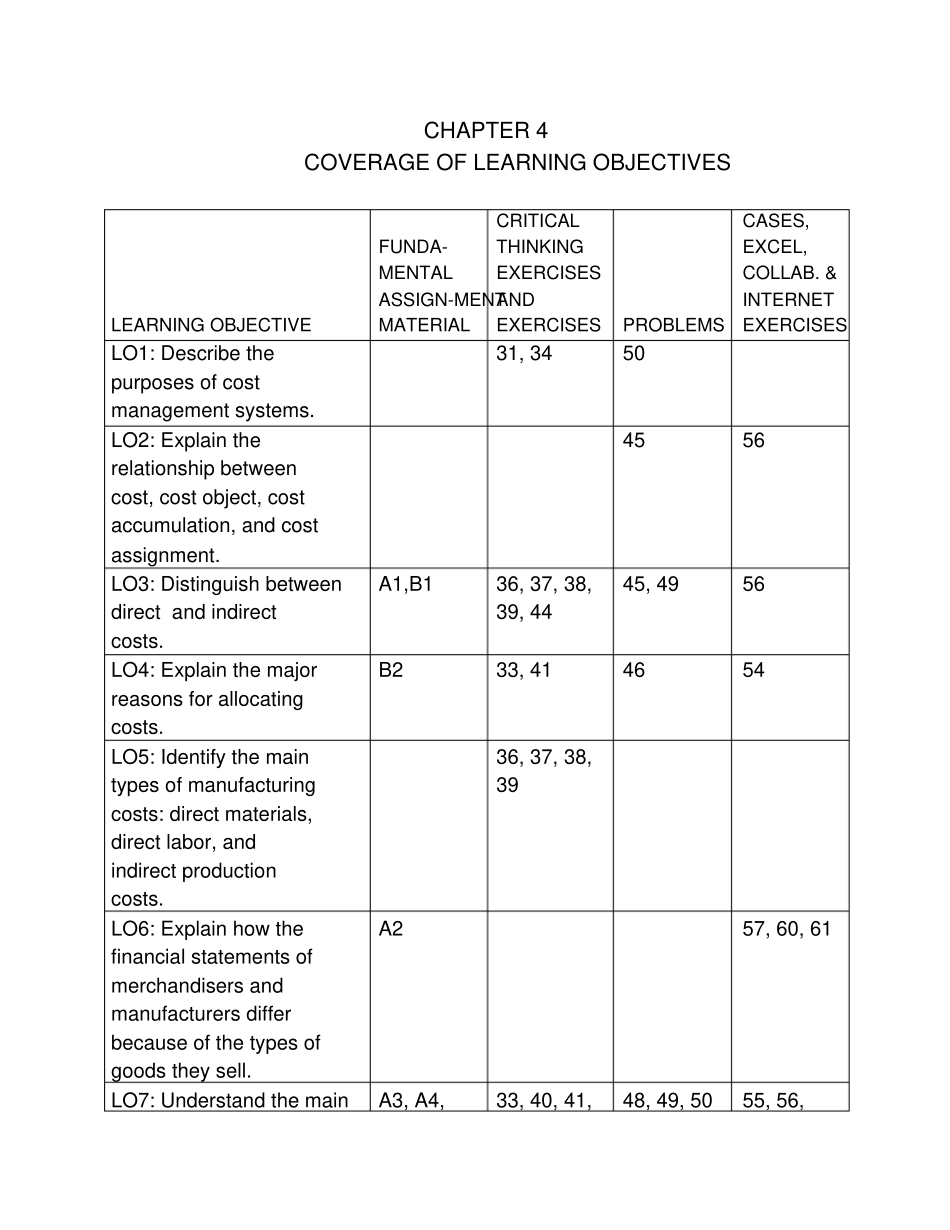

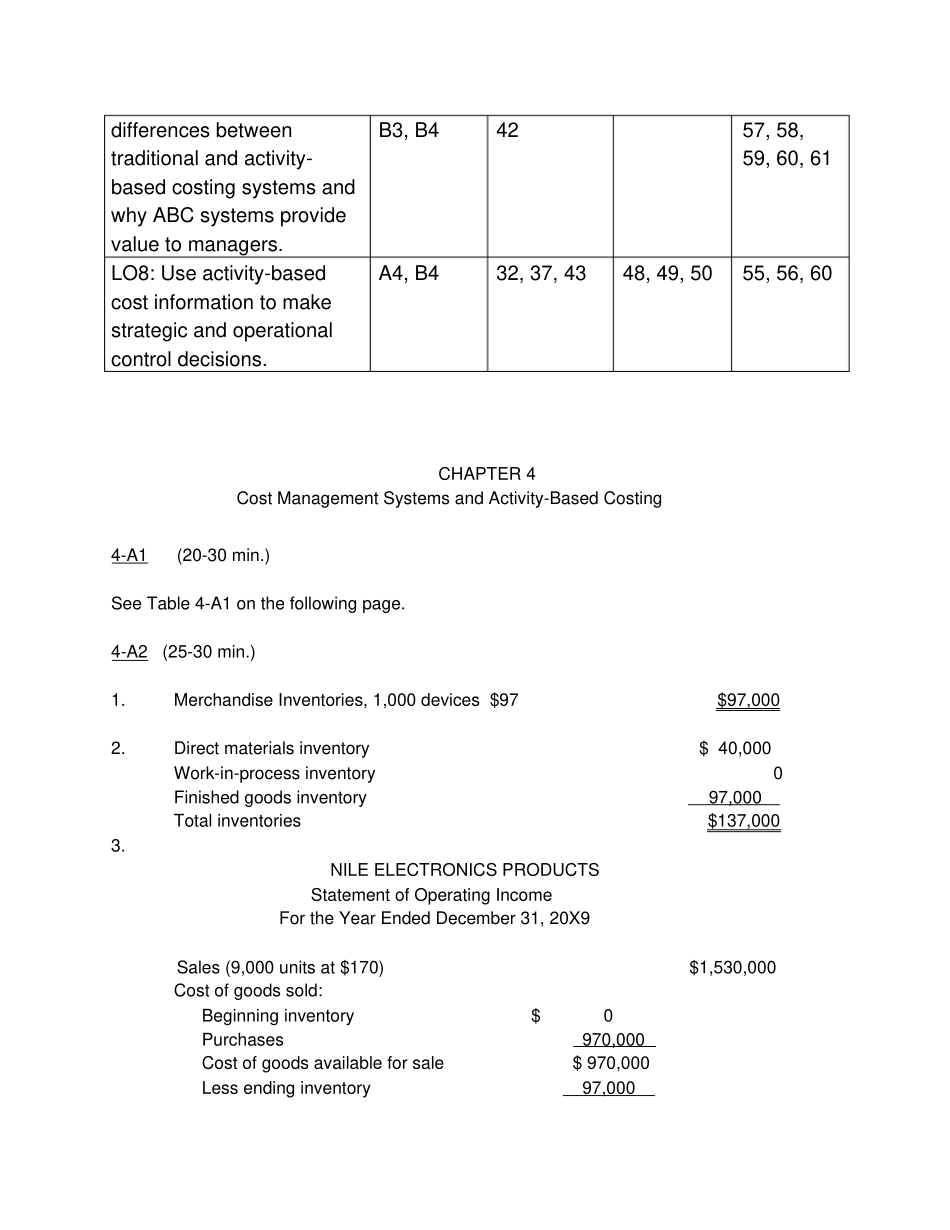

CHAPTER4COVERAGEOFLEARNINGOBJECTIVESLEARNINGOBJECTIVEFUNDA-MENTALASSIGN-MENTMATERIALCRITICALTHINKINGEXERCISESANDEXERCISESPROBLEMSCASES,EXCEL,COLLAB.&INTERNETEXERCISESLO1:Describethepurposesofcostmanagementsystems.31,3450LO2:Explaintherelationshipbetweencost,costobject,costaccumulation,andcostassignment.4556LO3:Distinguishbetweendirectandindirectcosts.A1,B136,37,38,39,4445,4956LO4:Explainthemajorreasonsforallocatingcosts.B233,414654LO5:Identifythemaintypesofmanufacturingcosts:directmaterials,directlabor,andindirectproductioncosts.36,37,38,39LO6:Explainhowthefinancialstatementsofmerchandisersandmanufacturersdifferbecauseofthetypesofgoodstheysell.A257,60,61LO7:UnderstandthemainA3,A4,33,40,41,48,49,5055,56,differencesbetweentraditionalandactivity-basedcostingsystemsandwhyABCsystemsprovidevaluetomanagers.B3,B44257,58,59,60,61LO8:Useactivity-basedcostinformationtomakestrategicandoperationalcontroldecisions.A4,B432,37,4348,49,5055,56,60CHAPTER4CostManagementSystemsandActivity-BasedCosting4-A1(20-30min.)SeeTable4-A1onthefollowingpage.4-A2(25-30min.)1.MerchandiseInventories,1,000devices$97$97,0002.Directmaterialsinventory$40,000Work-in-processinventory0Finishedgoodsinventory97,000Totalinventories$137,0003.NILEELECTRONICSPRODUCTSStatementofOperatingIncomeFortheYearEndedDecember31,20X9Sales(9,000unitsat$170)$1,530,000Costofgoodssold:Beginninginventory$0Purchases970,000Costofgoodsavailableforsale$970,000Lessendinginventory97,000Costofgoodssold(anexpense)873,000Grossmarginorgrossprofit$657,000Lessotherexpenses:selling&administrativecosts185,000Operatingincome(alsoincomebeforetaxesinthisexample)$472,000TABLE4-A1STATEMENTOFOPERATINGINCOMEOPERATINGINCOMEBYPRODUCTLINEEXTERNALREPORTINGPURPOSEINTERNALSTRATEGICDECISIONMAKINGPURPOSECustomLargeSmallDetailedStd.Std.CostType,AssignmentMethodSales$155,000$30,000$45,000$80,000Costofgoodssold:Directmaterial40,0005,00015,00020,000Direct,DirectTraceIndirectmanufacturing41,00028,00015,0008,000Indirect,Alloc.–Mach.Hours81,00033,00020,00028,000Grossprofit74,000(3,000)25,00052,000Sellingandadministrativeexpenses:Commissions15,0001,5003,50010,000Direct,DirectTraceDistributiontowarehouses10,4001,00023,0006,400Indirect,Allocation-WeightTotalsellingandadmin.expenses25,4002,5006,50016,400Contributiontocorporateexpensesandprofit48,600$(5,500)$18,500$35,600Unallocatedexpenses:Administrativesalaries8,000Otheradministrativeexpenses4,000Totalunallocatedexpenses12,000Operatingincomebeforetax$36,6001Totalmachinehoursis1,400+250+400=2,050.Indirectmanufacturingcostpermachinehouristhen$41,000÷2,050=$20.Theallocationtocustomdetailedis$20×1,400machinehours=$28,000.2Totalweightshippedis25,000kg+75,000kg+160,000kg=260,000kg.Indirectdistributioncostsperkilogramisthen$10,400÷260,000kg=$0.04.Theallocationtocustomdetailedis$0.04×25,000kg=$1,000.4.ORINOCO,INC.StatementofOperatingIncomeFortheYearEndedDecember31,20X9Sales(9,000unitsat$170)$1,530,000Costofgoodsmanufacturedandsold:Beginningfinishedgoodsinventory$0Costofgoodsmanufactured:BeginningWIPinventory$0Directmaterialsused530,000Directlabor290,000Indirectmanufacturing150,000Totalmfg.coststoaccountfor$970,000Lessendingwork-in-processinventory0970,000Costofgoodsavailableforsale$970,000Lessendingfinishedgoodsinventory97,000Costofgoodssold(anexpense)873,000Grossmarginorgrossprofit$657,000Lessotherexpenses:sellingandadminis...