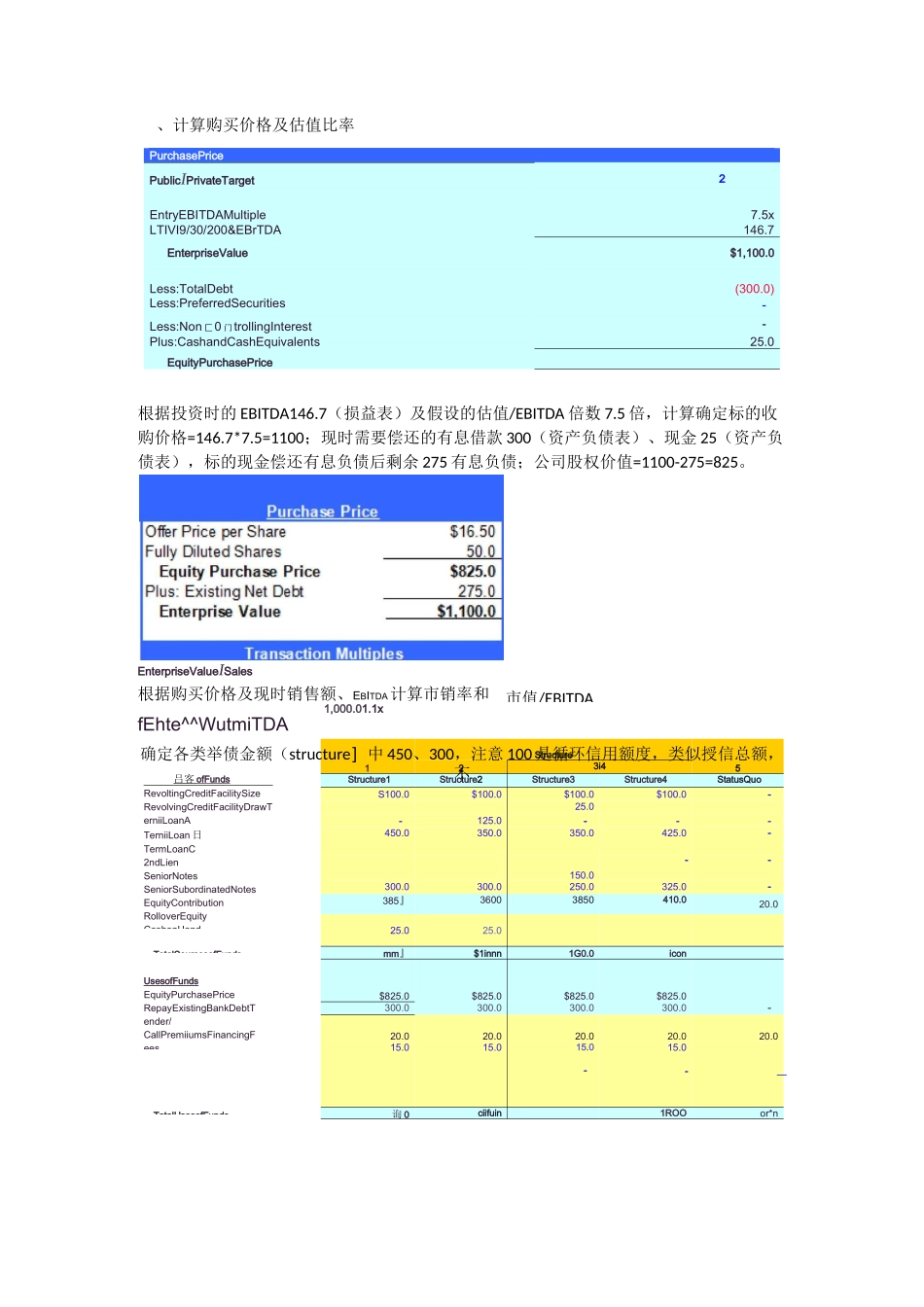

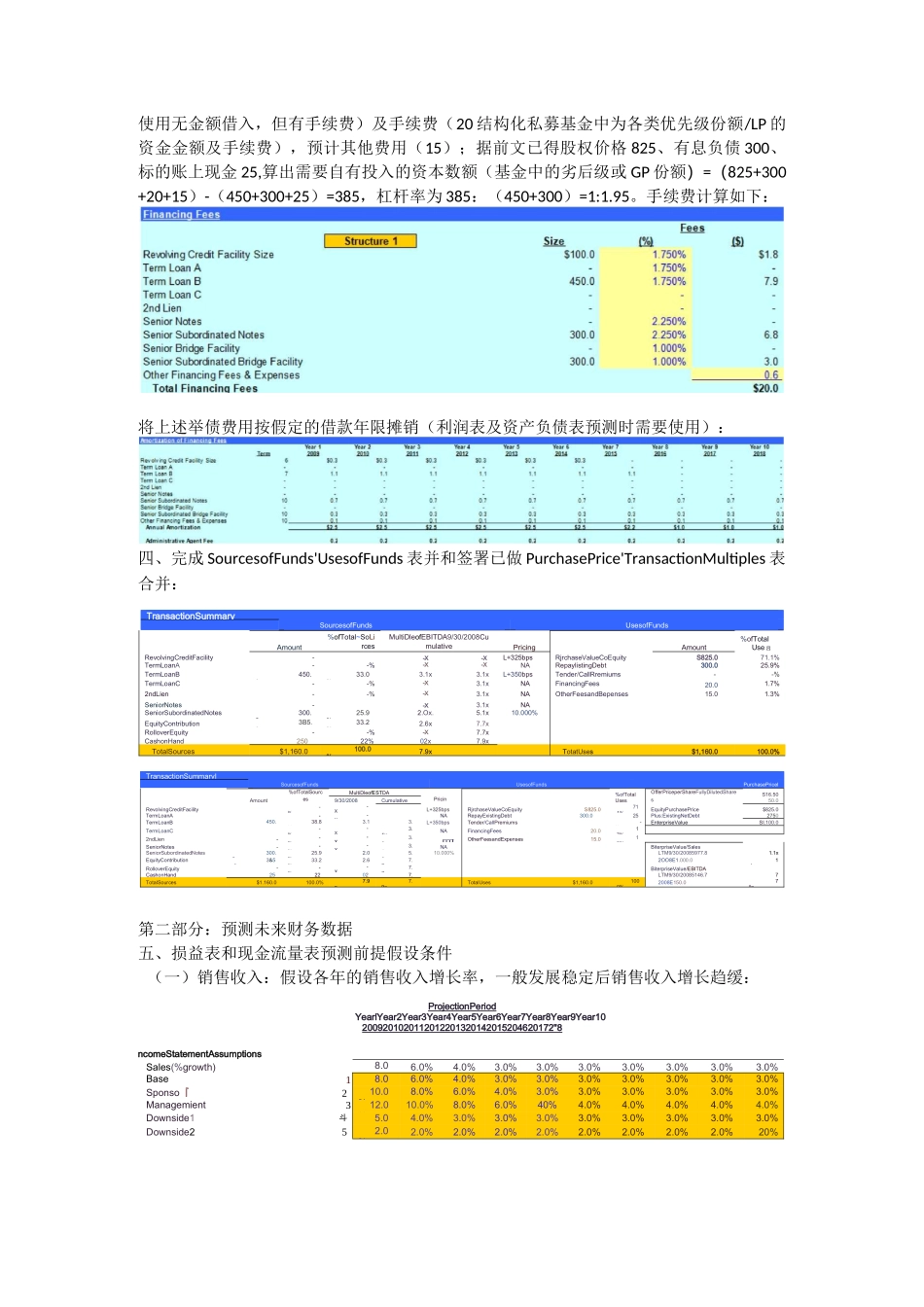

第一部分:确定投资资金的结构一、近 3 年一期损益表,并预测近一期的完整年度损益表;现时资产负债表;IncomeStatement2005HistoricalPeriodLTM9/^0/2008Proforma200820062007Sales$780.0$850.05925.0$977.S$1,000.0%growthNA9.0%8.8%NA8.1%CostofGoodsSold471.9512.1555.0585.7600.0GrossProfit$308.1$337.9S37D.0$381.1$400.0%margin395%39.S%40.0%40.0%40.0%Selling,General&Admiinistrative198.9214.6231.3244.4250.0%sales255%253%25.0%25.0%25.0%OtherExpense/(Income]EBITDA$109.2$123.35138.8$146.7$150.0%margin14.0%14.5%15.0%15.0%15.0%Depreciation&Amiortization15.617.018.519.620.0Amortization一--一一EBITS93L6$106351203$127.1$130.0%margin12.0%12.5%13.0%13.0%13.0%创 Sheet Opening2DDBCashandCashEquivalentsS25.D:AocDuntsReceivable165.0:Inventories125.D:PrepsidsandOtherCurrentAssetsTotalCurrentAssets5325.D:Property.PlantandEquipment,netfiBD.D:GoodwillandIntangible 畑175.D:OtherAssets75.D;[JeferredFinancingFees■;TotalAsset51 矜 bAccauntsPayable75.D;AccruedLiabilities1DD.D;OtherCurrentLisbilitiesTotalCurrentLiabilities52OD.D:RevolvingCreditFacility11TermLoanA1■■1TermLoanB■1TermLoanC1™1ExistingTermLoan3DD.D:2ndLien■■■iSeniorMotes■iSeninrSubordinstedNfotssiiOtherDebtiiOtherLong-TermLiabilities卫 5 一应TotalLiabilities5525.D:iNtonccintrDllingInterest-:Shareholder^Equity了叩.氏TotalShmreholders'Equit57DD.D:TotalLiabilitiesandEquity51 年 5 工]Ba/anceCfieckD.DDDNetWorkingCapital1DD.D(Increase)/LucresBEinNetWorkingCspiti市值/EBITDA吕客 ofFunds RevoltingCreditFacilitySizeRevolvingCreditFacilityDrawTerniiLoanATerniiLoan 日TermLoanC2ndLienSeniorNotesSeniorSubordinatedNotesEquityContributionRolloverEquityCashonHandTotalSourcesofFundsUsesofFundsEquityPurchasePriceRepayExistingBankDebtTender/CallPremiiumsFinancingFeesTotalUsesofFunds1Structure523i4Structure1Structure2Structure3Structure4StatusQuoS100.0$100.0$100.0$100.0-25.0-125.0---450.0350.0350.0425.0-150.0--300.0300.0250.0325.0-385』36003850410.020.025.025.0mm』$1innn1G0.0icon$825.0$825.0$825.0$825.0300.0300.0300.0300.0-20....