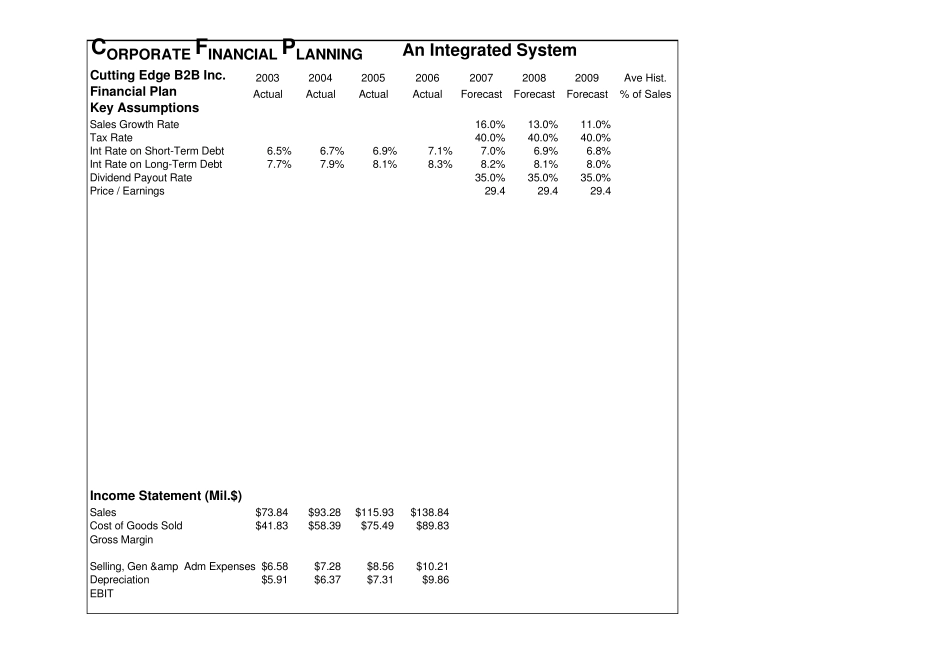

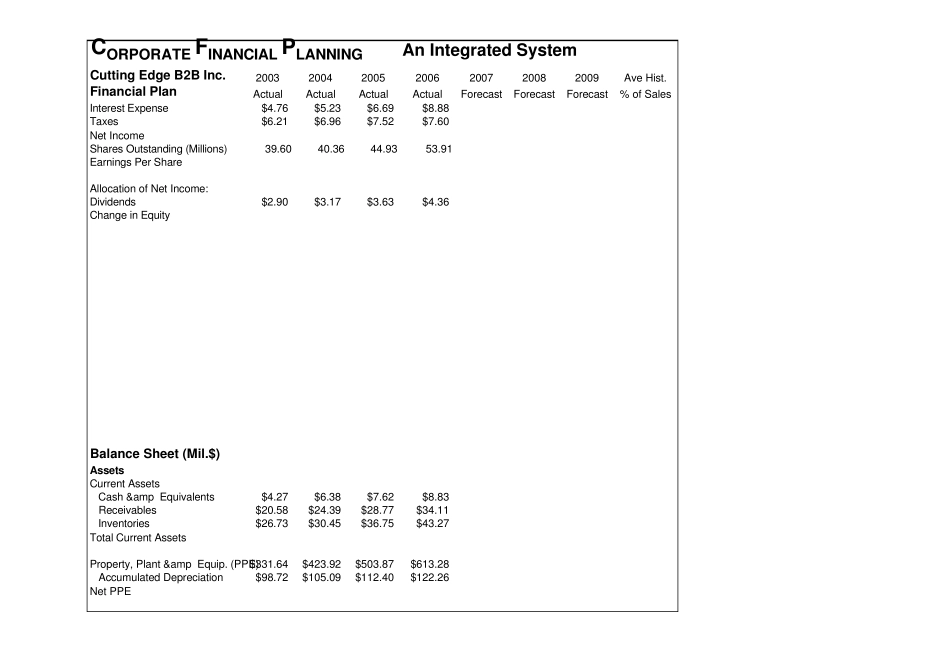

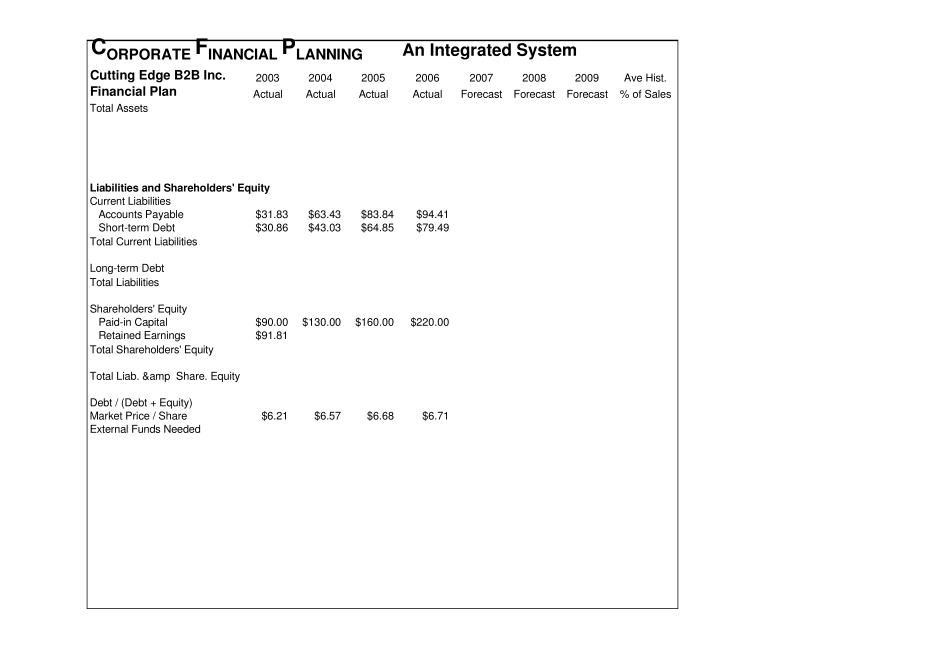

CORPORATE FINANCIAL PLANNINGAn Integrated SystemCutting Edge B2B Inc.2003200420052006200720082009Ave Hist.Financial PlanActualActualActualActualForecastForecastForecast% of SalesKey AssumptionsSales Growth Rate16.0%13.0%11.0%Tax Rate40.0%40.0%40.0%Int Rate on Short-Term Debt6.5%6.7%6.9%7.1%7.0%6.9%6.8%Int Rate on Long-Term Debt7.7%7.9%8.1%8.3%8.2%8.1%8.0%Dividend Payout Rate35.0%35.0%35.0%Price / Earnings29.429.429.4Income Statement (Mil.$)Sales$73.84$93.28$115.93$138.84Cost of Goods Sold$41.83$58.39$75.49$89.83Gross MarginSelling, Gen & Adm Expenses $6.58$7.28$8.56$10.21Depreciation$5.91$6.37$7.31$9.86EBITCORPORATE FINANCIAL PLANNINGAn Integrated SystemCutting Edge B2B Inc.2003200420052006200720082009Ave Hist.Financial PlanActualActualActualActualForecastForecastForecast% of SalesInterest Expense$4.76$5.23$6.69$8.88Taxes$6.21$6.96$7.52$7.60Net IncomeShares Outstanding (Millions)39.6040.3644.9353.91Earnings Per ShareAllocation of Net Income:Dividends$2.90$3.17$3.63$4.36Change in EquityBalance Sheet (Mil.$)AssetsCurrent Assets Cash & Equivalents$4.27$6.38$7.62$8.83 Receivables$20.58$24.39$28.77$34.11 Inventories$26.73$30.45$36.75$43.27Total Current AssetsProperty, Plant & Equip. (PPE)$331.64$423.92$503.87$613.28 Accumulated Depreciation$98.72$105.09$112.40$122.26Net PPECORPORATE FINANCIAL PLANNINGAn Integrated SystemCutting Edge B2B Inc.2003200420052006200720082009Ave Hist.Financial PlanActualActualActualActualForecastForecastForecast% of SalesTotal AssetsLiabilities and Shareholders' EquityCurrent Liabilities Accounts Payable$31.83$63.43$83.84$94.41 Short-term Debt$30.86$43.03$64.85$79.49Total Current LiabilitiesLong-term DebtTotal LiabilitiesShareholders' Equity Paid-in Capital$90.00$130.00$160.00$220.00 Retained Earnings$91.81Total Shareholders' EquityTotal Liab. & Share. EquityDebt / (Debt + Equity)Market Price / Share$6.21$6.57$6.68$6.71Exter...