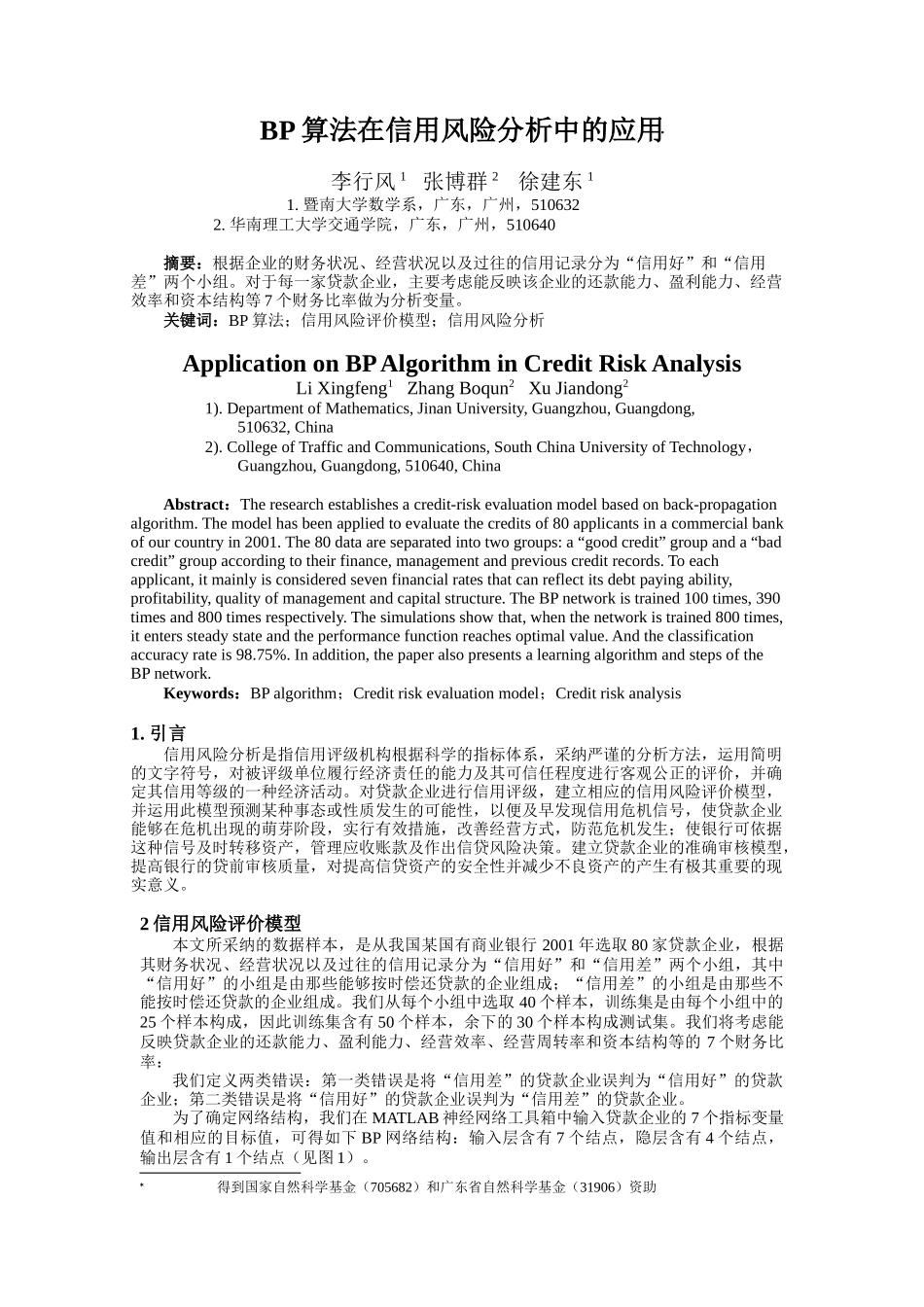

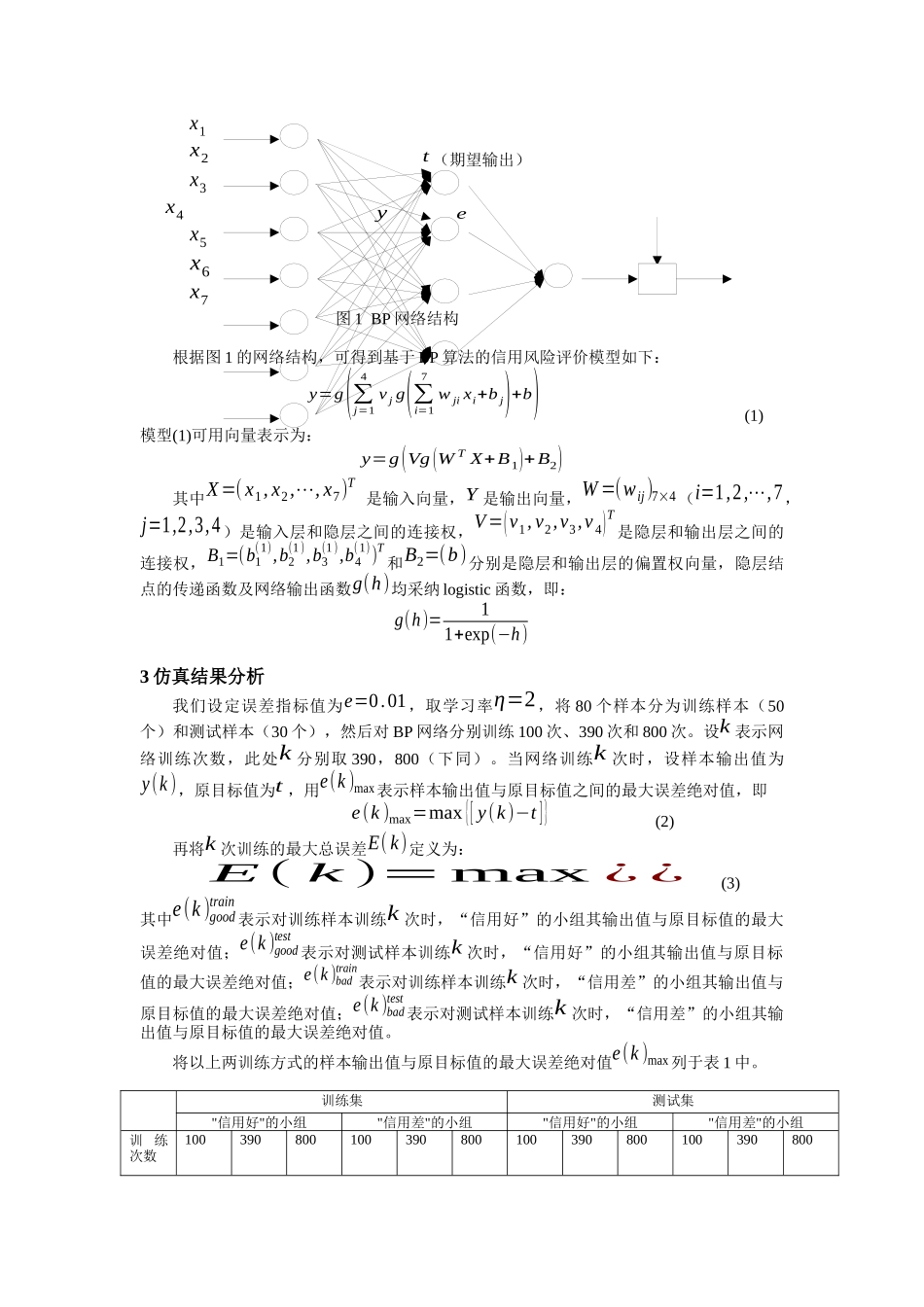

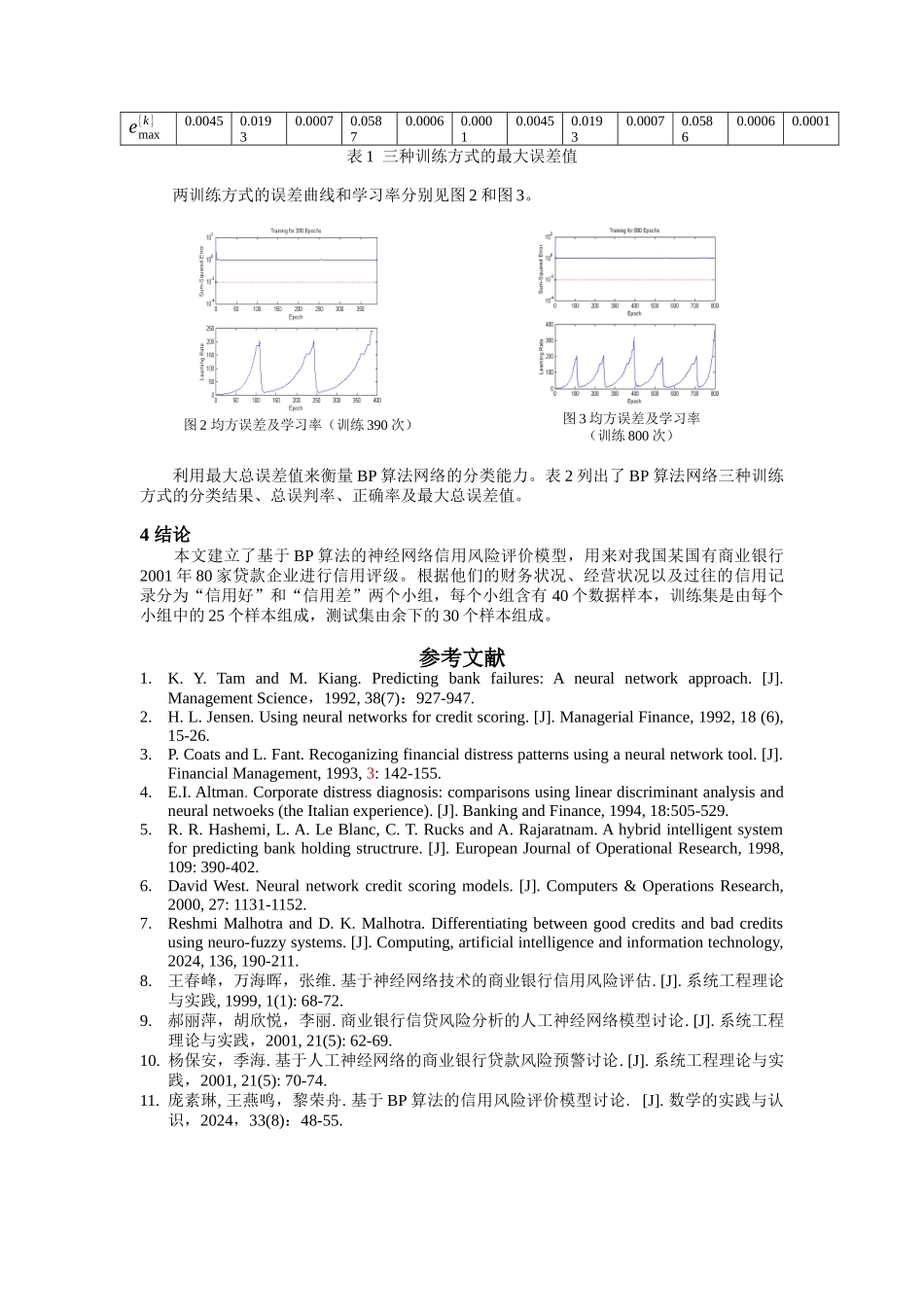

BP 算法在信用风险分析中的应用 李行风 1 张博群 2 徐建东 1 1. 暨南大学数学系,广东,广州,510632 2. 华南理工大学交通学院,广东,广州,510640摘要:根据企业的财务状况、经营状况以及过往的信用记录分为“信用好”和“信用差”两个小组。对于每一家贷款企业,主要考虑能反映该企业的还款能力、盈利能力、经营效率和资本结构等 7 个财务比率做为分析变量。关键词:BP 算法;信用风险评价模型;信用风险分析Application on BP Algorithm in Credit Risk AnalysisLi Xingfeng1 Zhang Boqun2 Xu Jiandong2 1). Department of Mathematics, Jinan University, Guangzhou, Guangdong, 510632, China2). College of Traffic and Communications, South China University of Technology,Guangzhou, Guangdong, 510640, ChinaAbstract:The research establishes a credit-risk evaluation model based on back-propagation algorithm. The model has been applied to evaluate the credits of 80 applicants in a commercial bank of our country in 2001. The 80 data are separated into two groups: a “good credit” group and a “bad credit” group according to their finance, management and previous credit records. To each applicant, it mainly is considered seven financial rates that can reflect its debt paying ability, profitability, quality of management and capital structure. The BP network is trained 100 times, 390 times and 800 times respectively. The simulations show that, when the network is trained 800 times, it enters steady state and the performance function reaches optimal value. And the classification accuracy rate is 98.75%. In addition, the paper also presents a learning algorithm and steps of the BP network. Keywords:BP algorithm;Credit risk evaluation model;Credit risk analysis1. 引言信用风险分析是指信用评级机构根据科学的指标体系,采纳严谨的分析方法,运用简明的文字符号,对被评级单位履行经济责任的能力及其可信任程度进行客观公正的评价...