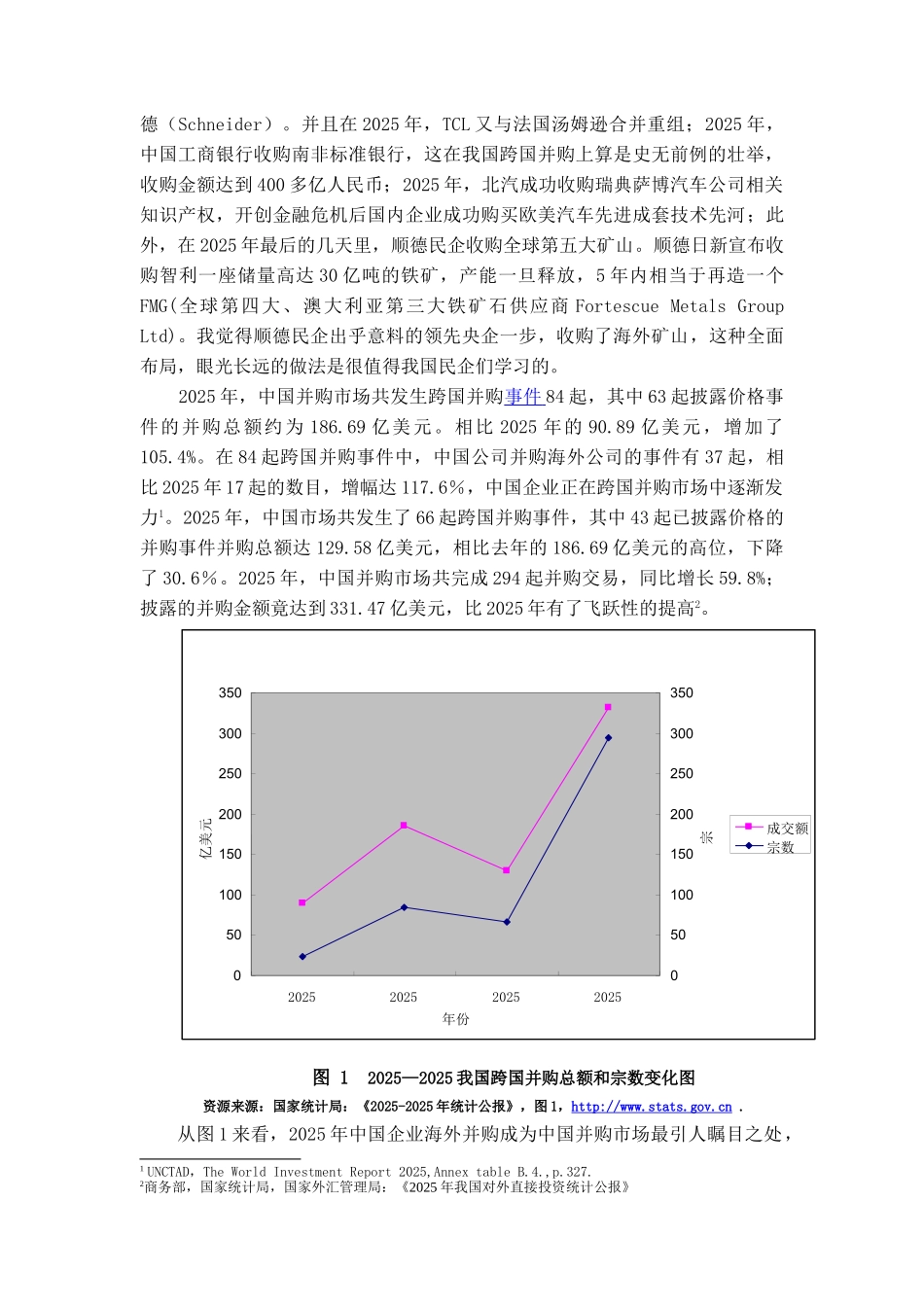

Abstract2025 global outbreak began in the United States as the center of the financial crisis, but the cross-border mergers and acquisitions investment has been the global industry structure we have identified the strategic choice of reconstruction. First, the paper across the M & implications of a simple analysis of the status of Chinese enterprises to conduct cross-border M & A note on the theory of cross-border mergers and acquisitions are reviewed. Introduction of foreign M & A Chinese Enterprises characteristics and background, and favorable factors, and then deep future location of Chinese enterprises and industries strategic choice, and summed up the experience category, for Chinese enterprises to provide basis for future cross-border mergers and acquisitions.Key Words : Cross-border Mergers & Acquisitions , Location Choice,Industry Select 引 言自从美国发生次贷危机从而引发新一次全球性金融危机以来,世界各国的对外直接投资都受到不少的影响,首当其冲的是资本市场经济比较发达和美国经济高度联合的欧盟国家,而我国是美国最大的外贸贸易国家,不可避开的陷入了这一场可怕的金融风暴,但是这一次金融风暴也给我国企业带来了历史的机遇。因为许多优良企业陷入破产的边缘,我国企业可以通过跨国并购把这些外部资源融入到我们的运行和进展中来,提升自身的国际竞争水平。1. 跨国并购的进展及中国企业的实践1.1 跨国并购概述1.1.1 跨国并购的含义跨国并购(Cross-border Mergers & Acquisitions)是指跨国兼并和跨国收购的合称。而企业并购包括企业兼并和收购。在法律上的概念界定还是要看在实务中的具体操作,兼并与收购都有着密切的联系。从动机上看,都是为了取得对其公司的控制权;从手段上看,都是通过产权交易来实现企业控制权的让渡;从结果上看,都是为了满足企业外部扩张的需求。而这两者的区别,从主体上看,收购的主体可以是法人和自然人,而兼并的主体只能是法人。联合国贸发会议(UNCTAD)在其出版的《2000 年世界投资报告》中,对跨国兼并和跨国收购进行了界定和划分。根据 UNCTAD 的分类,跨国兼并是...