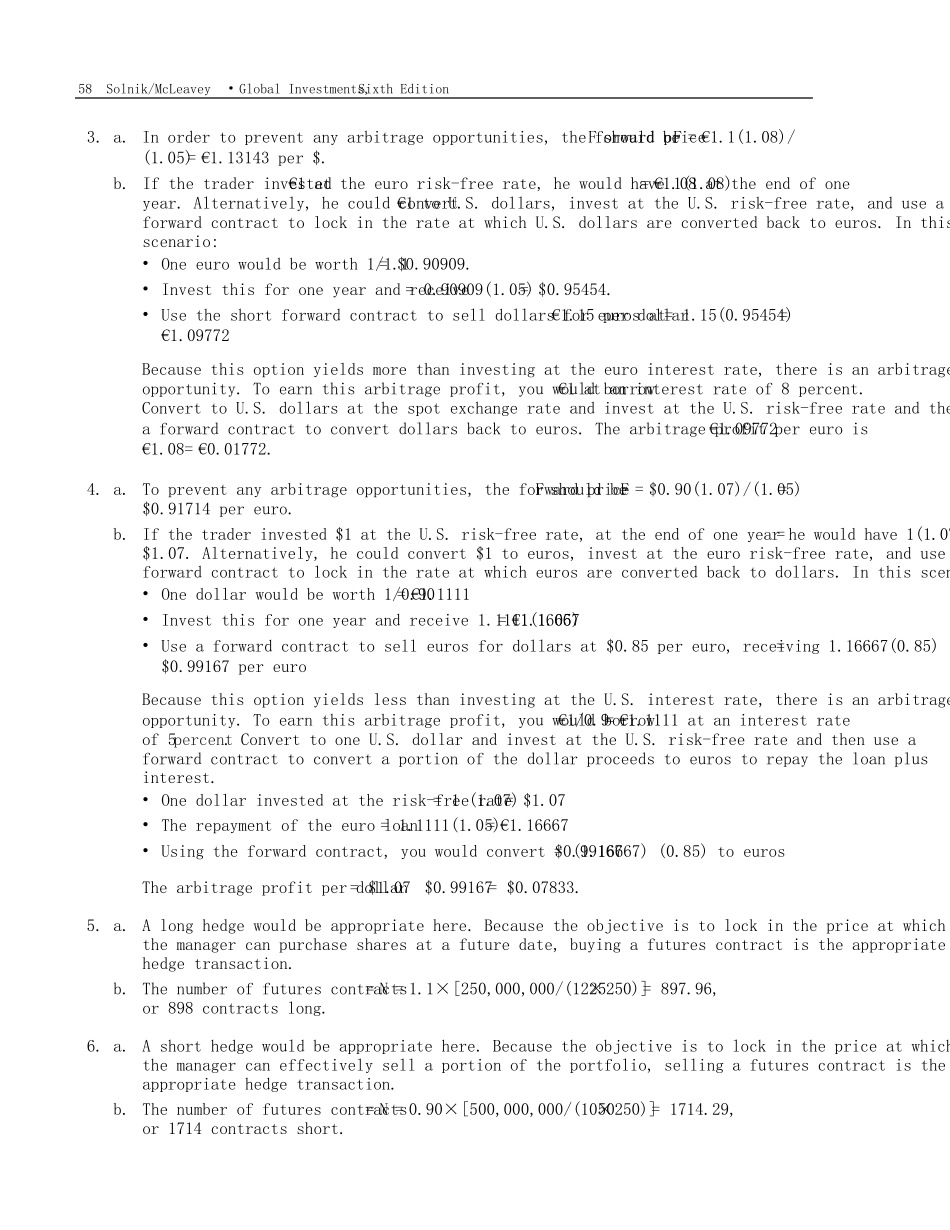

Chapter10Derivatives:RiskManagementwithSpeculation,Hedging,andRiskTransfer1.Followingaretheresultsfor10contracts,indollars:April1April2April3April4June16June17Gain/loss0−2,500−51,250183,750−11,250−63,750Marginbeforecashflow017,750−33,500204,0009,000−43,500Cashflowfrominvestor20,250053,750−183,75011,25043,500Marginaftercashflow20,25017,75020,25020,25020,2500•OnApril2,youlose$2,500=(12,500,000)(10)(0.01054−0.01056).Yourmarginisreducedto$17,750,butyouremainabovethemaintenancemarginof(10)(1,500)=$15,000.Nocashadditionisneeded.•OnApril3,youloseanother$51,250=(12,500,000)(10)(0.01013−0.01054).Youmustgetthemarginbacktotheinitiallevelof$20,250andtransfer$53,750toyourmarginaccount.•OnApril4,yougain$183,750=(12,500,000)(10)(0.01160−0.01013).Youcanwithdrawexactlythisamount,keepingthemarginat$20,250.•OnJune16,youlose$11,250=(12,500,000)(10)(0.01151−0.01160)andmusttransferthisamounttoreconstitutetheinitialmargin.•OnJune17,youlose$63,750=(12,500,000)(10)(0.01100−0.01151),andthecontractsexpire.Youmustadd$43,500toyourinitialmarginandclosetheposition.Thetotalgainis$55,000.Thisdoesnotincludeanyfinancingcostofthemargin.2.a.Theimplicitinterestrateis100−93.28=6.72percent.Thisisaforwardinterestrate.Itsuggeststhatthetermstructureoftheinterestrateisupwardsloping(long-termrateshigherthanshort-termrates).b.Yourpositionwillbetoborrow(i.e.,selldebtpaper).Yourriskexposurehereisthatinterestrateswillrise,andthatthepriceoftheEurodollarcontractwillfall.Tohedgeinterestraterisk,youneedtosellforwarddebtpaper.Therefore,tolockintheborrowingrate,youshouldsell10Eurodollarcontracts.c.Therewouldhavebeenvariousmarking-to-marketgainsandlossesfromApril1toJune17.Thenetresult,neglectingfinancingcosts(orprofits)onthemargin,isagainof(10)(1,000,000)(0.9328−0.91)/4=$57,000.Thisgainoffsetsyourincreasedborrowingcosts.58Solnik/McLeavey•GlobalInvestments,SixthEdition3.a.Inordertopreventanyarbitrageopportunities,theforwardpriceFshouldbeF=€1.1(1.08)/(1.05)=€1.13143per$.b.Ifthetraderinvested€1attheeurorisk-freerate,hewouldhave1(1.08)=€1.08attheendofoneyear.Alternatively,hecouldconvert€1toU.S.dollars,investattheU.S.risk-freerate,anduseaforwardcontracttolockintherateatwhichU.S.dollarsareconvertedbacktoeuros.Inthisscenario:•Oneeurowouldbeworth1/1.1=$0.90909.•Investthisforoneyearandreceive=0.90909(1.05)=$0.95454.•Usetheshortforwardcontracttoselldollarsforeurosat€1.15perdollar=1.15(0.95454)=€1.09772Becausethisoptionyieldsmorethaninvestingattheeurointerestrate,thereisanarbitrageopportunity.Toearnthisarbitrageprofit,youwouldborrow€1ataninterestrateof8percent.ConverttoU.S.dollarsatthespotexchangerateandinvestattheU.S.risk-freerateandthenuseaforwardcontracttoconvertdollarsbacktoeuros.Thearbitrageprofitpereurois€1.09772−€1.08=€0.01772.4.a.Topreventanyarbitrageopportunities,theforwardpriceFshouldbeF=$0.90(1.07)/(1.05)=$0.91714pereuro.b.Ifthetraderinvested$1attheU.S.risk-freerate,attheendofoneyearhewouldhave1(1.07)=$1.07.Alternatively,hecouldconvert$1toeuros,investattheeurorisk-freerate,anduseaforwardcontracttolockintherateatwhicheurosareconvertedbacktodollars.Inthisscenario:•Onedollarwouldbeworth1/0.90=€1.1111•Investthisforoneyearandreceive1.1111(1.05)=€1.16667•Useaforwardcontracttoselleurosfordollarsat$0.85pereuro,receiving1.16667(0.85)=$0.99167pereuroBecausethisoptionyieldslessthaninvestingattheU...