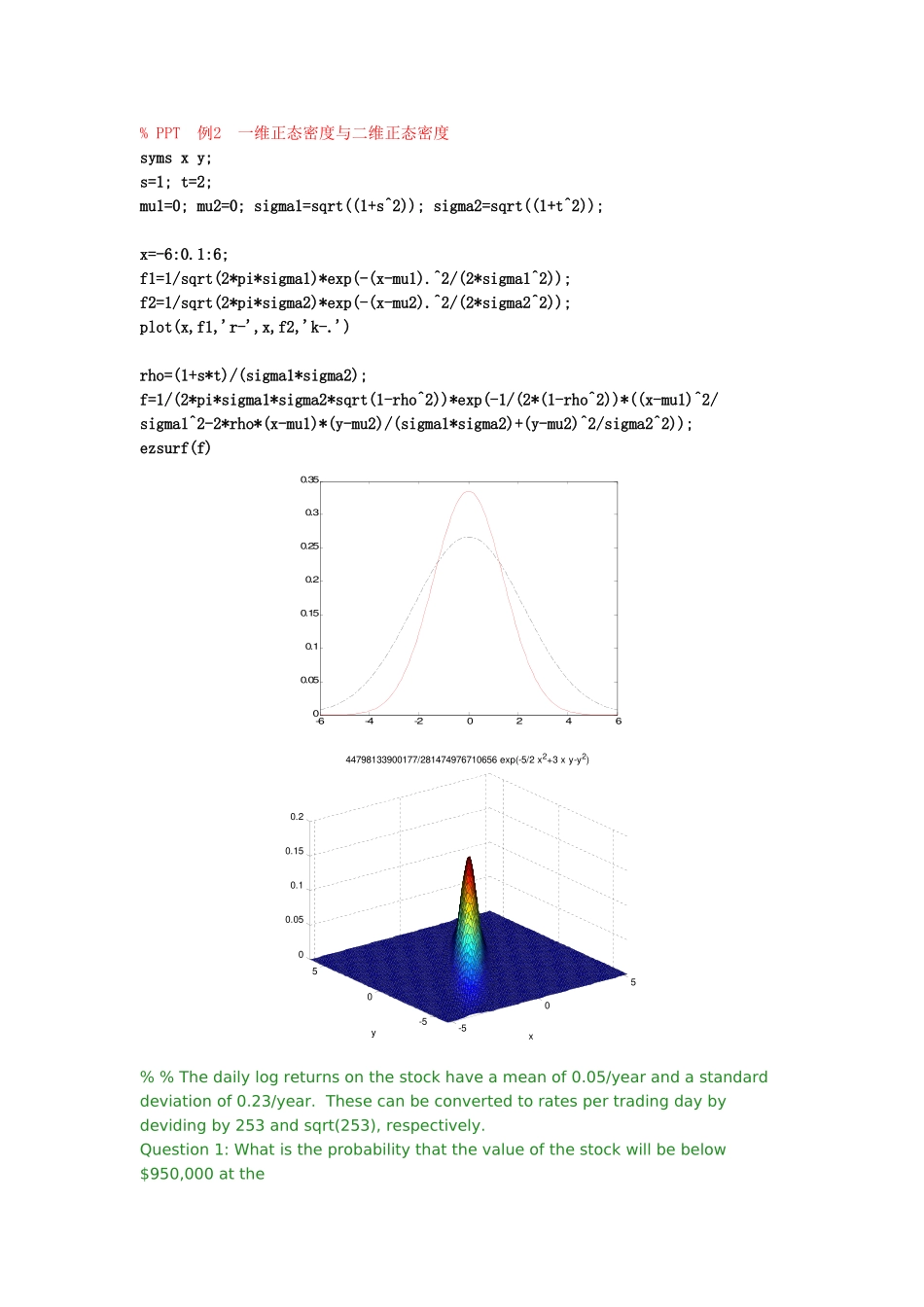

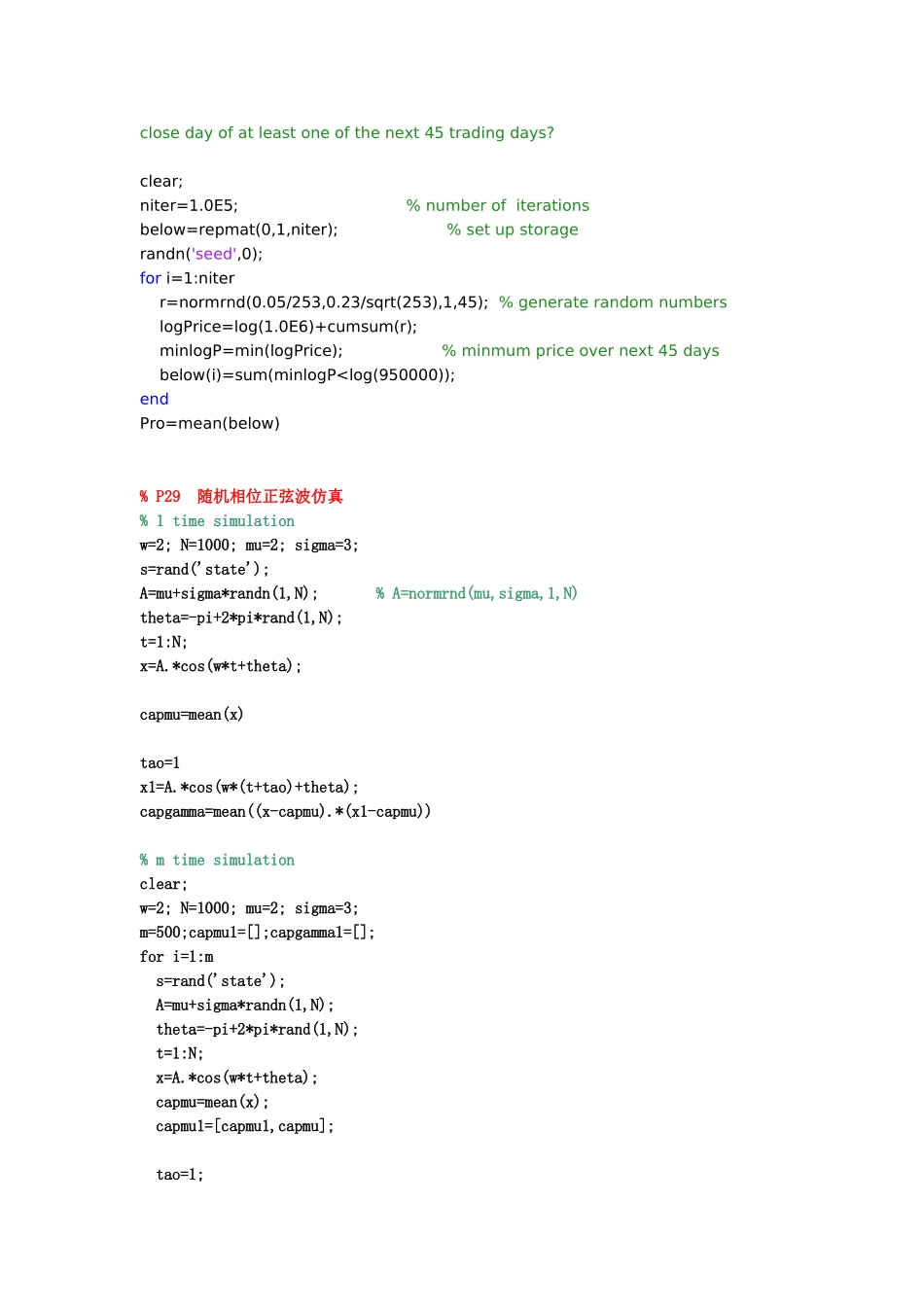

%PPT例2一维正态密度与二维正态密度symsxy;s=1;t=2;mu1=0;mu2=0;sigma1=sqrt((1+s^2));sigma2=sqrt((1+t^2));x=-6:0.1:6;f1=1/sqrt(2*pi*sigma1)*exp(-(x-mu1).^2/(2*sigma1^2));f2=1/sqrt(2*pi*sigma2)*exp(-(x-mu2).^2/(2*sigma2^2));plot(x,f1,'r-',x,f2,'k-.')rho=(1+s*t)/(sigma1*sigma2);f=1/(2*pi*sigma1*sigma2*sqrt(1-rho^2))*exp(-1/(2*(1-rho^2))*((x-mu1)^2/sigma1^2-2*rho*(x-mu1)*(y-mu2)/(sigma1*sigma2)+(y-mu2)^2/sigma2^2));ezsurf(f)-6-4-2024600.050.10.150.20.250.30.35-505-50500.050.10.150.2x44798133900177/281474976710656exp(-5/2x2+3xy-y2)y%%Thedailylogreturnsonthestockhaveameanof0.05/yearandastandarddeviationof0.23/year.Thesecanbeconvertedtoratespertradingdaybydevidingby253andsqrt(253),respectively.Question1:Whatistheprobabilitythatthevalueofthestockwillbebelow$950,000attheclosedayofatleastoneofthenext45tradingdays?clear;niter=1.0E5;%numberofiterationsbelow=repmat(0,1,niter);%setupstoragerandn('seed',0);fori=1:niterr=normrnd(0.05/253,0.23/sqrt(253),1,45);%generaterandomnumberslogPrice=log(1.0E6)+cumsum(r);minlogP=min(logPrice);%minmumpriceovernext45daysbelow(i)=sum(minlogP=t1(i)&tt1(m)N=[N,m];endendplot(0:0.1:(t1(m)+1),N,'r-')%输出:01020304050607080901000102030405060708090100%P48非齐次泊松过...