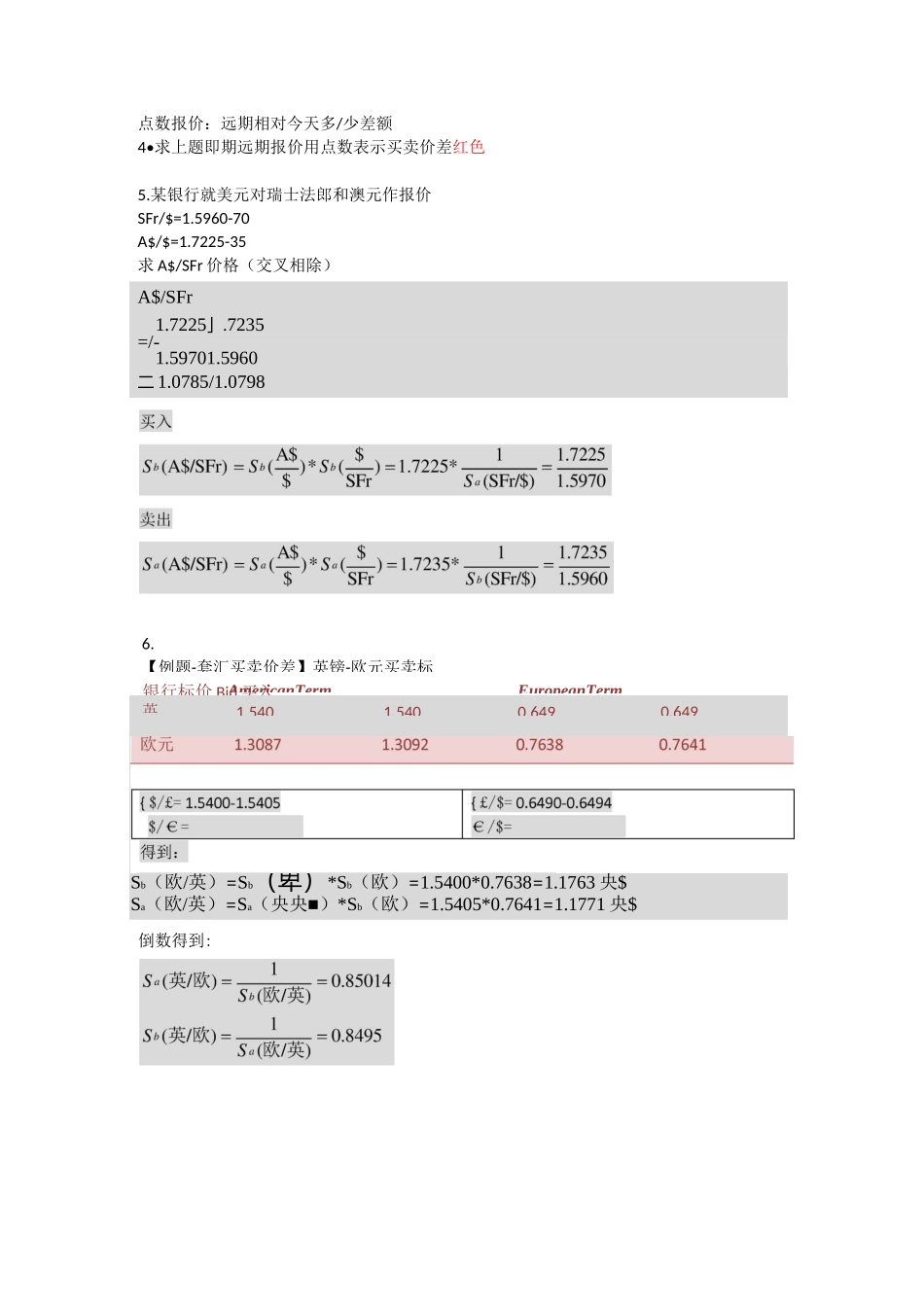

Ch5外汇市场1.SampleProblem■AbusinessmanhasjustcompletedtransactionsinItalyandEngland.Heisnowholding€250/)00and£50000。andwfuitstoconverttoU.S.dollars.■Hiscurrencydealerprovidesthisquotation:GBI7USD0.5025-76USD/EUR1.4739-44・Whatarehisproceedsfromconversion?sfills€QJ5OfOOOatthsd&aUr's匕沐严心:Hiesells^500^000attkecU伉LEFEtuktprice:苗gwg卜主严=电药8尹2.交叉外汇(哪个是基础货币处以哪个)已知基础货币相同而标价货币不同USD-CHF0.9230/0.9240USD-SGD1.2710/1.2720求1新元SGD=?瑞郎CHF,1瑞郎=?新元以新元为基础货币SGD1=CHF(0.9230/1.2720)=CHF0.7526SGD1=CHF(0.9240/1.2710)=CHF0.7270则SGD/CHF=0.7526/0.72703.当美元与英镑汇率为1.55时,美国银行有5000000英镑外汇头寸,后来美元与英镑汇率为1.61,就交易者而言,这一变化是否有利?该银行负债发生多少变化?美元与英镑汇率上升,美元贬值,英镑升值,汇率变化有利5000000*1.55=7750000美元5000000*1.61=8050000美元8050000美元-7750000美元=300000看涨30万赚;看跌30万亏3•用远期点数表示1个月,3个月,6个月直接远期货币的欧式买卖标价即期1.3431-1.3436(3)(4)51个月1.3432-1.344201-06103个月1.3448-1.346317-27156个月1.3448-1.350857-7220AmericanTermEuropeanTerm银行标价Bid买入Ask卖Bid买Ask卖点数报价:远期相对今天多/少差额4•求上题即期远期报价用点数表示买卖价差红色5.某银行就美元对瑞士法郎和澳元作报价SFr/$=1.5960-70A$/$=1.7225-35求A$/SFr价格(交叉相除)A$/SFr1.7225」.7235=/-1.59701.5960二1.0785/1.0798Sb(欧/英)=Sb(卑)*Sb(欧)=1.5400*0.7638=1.1763央$Sa(欧/英)=Sa(央央■)*Sb(欧)=1.5405*0.7641=1.1771央$6.【例题-套汇买卖价差】英镑-欧元买卖标英1.5401.5400.6490.649倒数得到:欧元/英镑=1.1763-1.17717.确定新西兰元-新加坡元买卖标价AmericanTermsEuropeanTerms银行标价BidAskBidAsk新西兰元0.72650.72721.37511.3765新加坡元0.61350.61401.62871.6300Sb(NZD/SGD)=Sb($/SGD)xSb(NZD/$)=.6135x1.3765=.8445.取倒数l/Sb(NZD/SGD)=Sa(SGD/NZD)=1.1841.Sa(NZD/SGD)=Sa($/SGD)xSa(NZD/$)=.6140x1.3765=.8452.取倒数1/Sa(NZD/SGD)=Sb(SGD/NZD)=1.1832.Thus,theNZD/SGDbid-askspreadisNZD0.8445-NZD0.8452andtheSGD/NZDspreadisSGD1.1832-SGD1.1841.8.【例题】三角套汇Bid买入Ask卖出A($/£)1.5400B(€/£)算出1.1763套汇!1.1705C(€/$)0.7638套利:$5000000*0.7368=€381D000卖出美元,买入欧元€38100001.1705=£3262708卖出欧元,买入英镑£3262708*1.5400=$5024570卖出英镑,买入美元$5024570-$5000000=$24570套利赚8.三角套汇瑞士法郎/$SFr1.5971/$澳元/$A$1.8215/$澳元/瑞士法郎A$1.1440/SFr可以套利?如何套利?有100万$如何赚?(1.8215/1.1440)=1.5922—低买SFr1.5971/$高卖$1=SFr1.5922交叉汇率1.5971*(1/1.8215)*1.1440=1.0031>1有套利$100万*1.5971=DDDDD万DDD卖出美元,买入SFrDDDDD万DDDfflDDDDDDD万DDD]卖出SFr,买入A$DDDDD万fflfflfflDDDDDDDDDDD□卖出A$,买入美元$100.31-$100=$0.31万套利赚10.A标价0.7627/$1.00B标价SFr1.1806/$1.00.直接市场(瑞士法郎-欧元)Swissfrancandtheeuro,current/SFr0.6395.如何三角套汇?假设有$5,000,000如何?若先卖出dollars买入Swissfrancs?hat/SFrice不存在三角套利?$5,000,000x.7627=3,813,500卖出$,买入3,813,500/.6395=SF5,963,253卖出,头入SISF5,963,253/1.1806=$5,051,036卖出SF,买入$$51,036赚$5,000,000x1.1806=SF5,903,000卖出$,买入SfSF5,903,000x0.6395=3,774,969卖出SF,买入3,774,969/0.7627=$4,949,481卖出,买入$$50,519亏TheS(/SF)crossexchangerateshouldbe.7627/1.1806=.6460>0.6395.11.目前美元/英镑即期汇率$1.95/£3个月远期汇率是$1.90/£.预计三个月后即期汇率$1.92/£你愿意买入/卖出£1,000,000a.如果在远期市场投机需要怎么做?投机美元预期收益多少?b.如果即期汇率最终为1.86美元/英镑($1.86/£)你投机美元收益多少?a.应该用£1,000,000买入三个月远期$1.90/£.预期利...