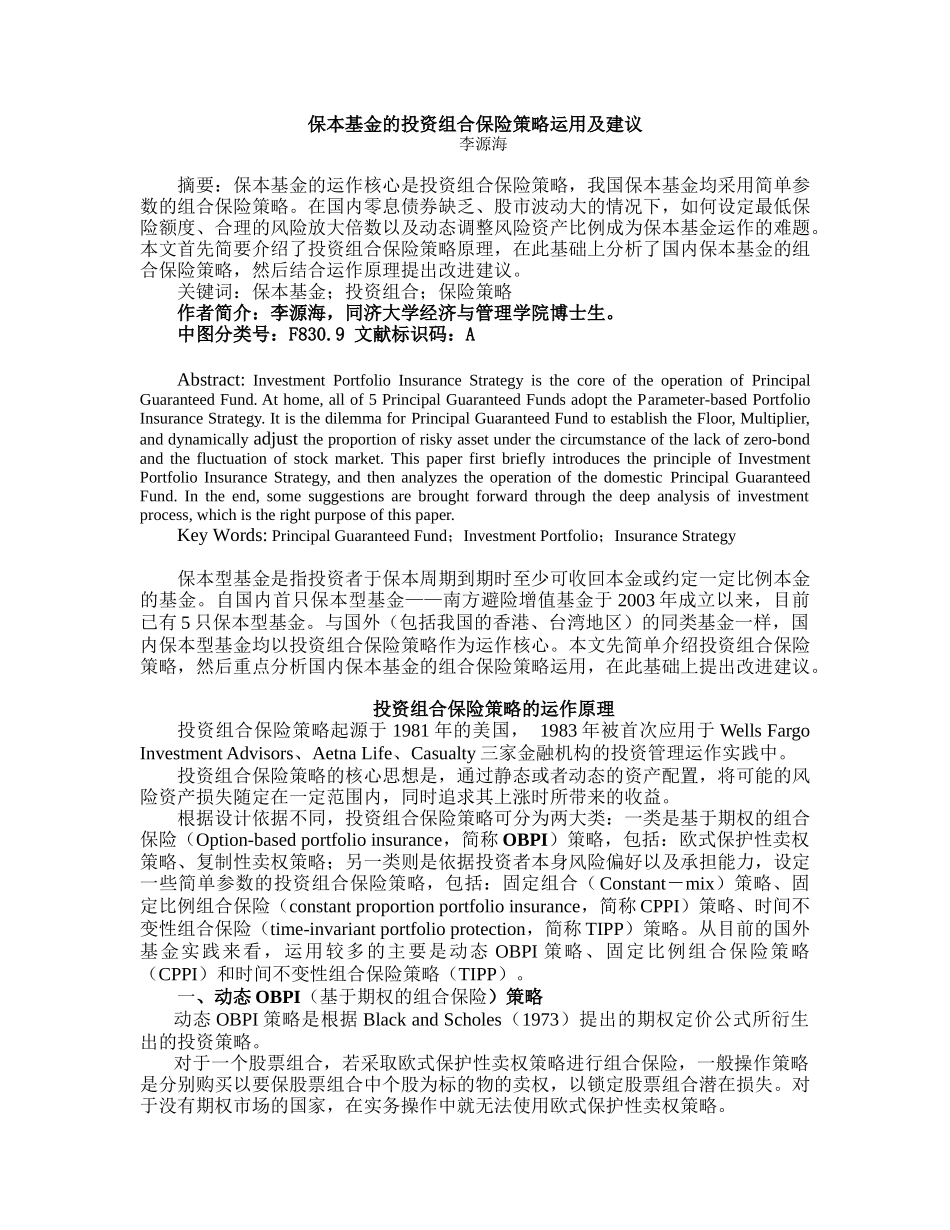

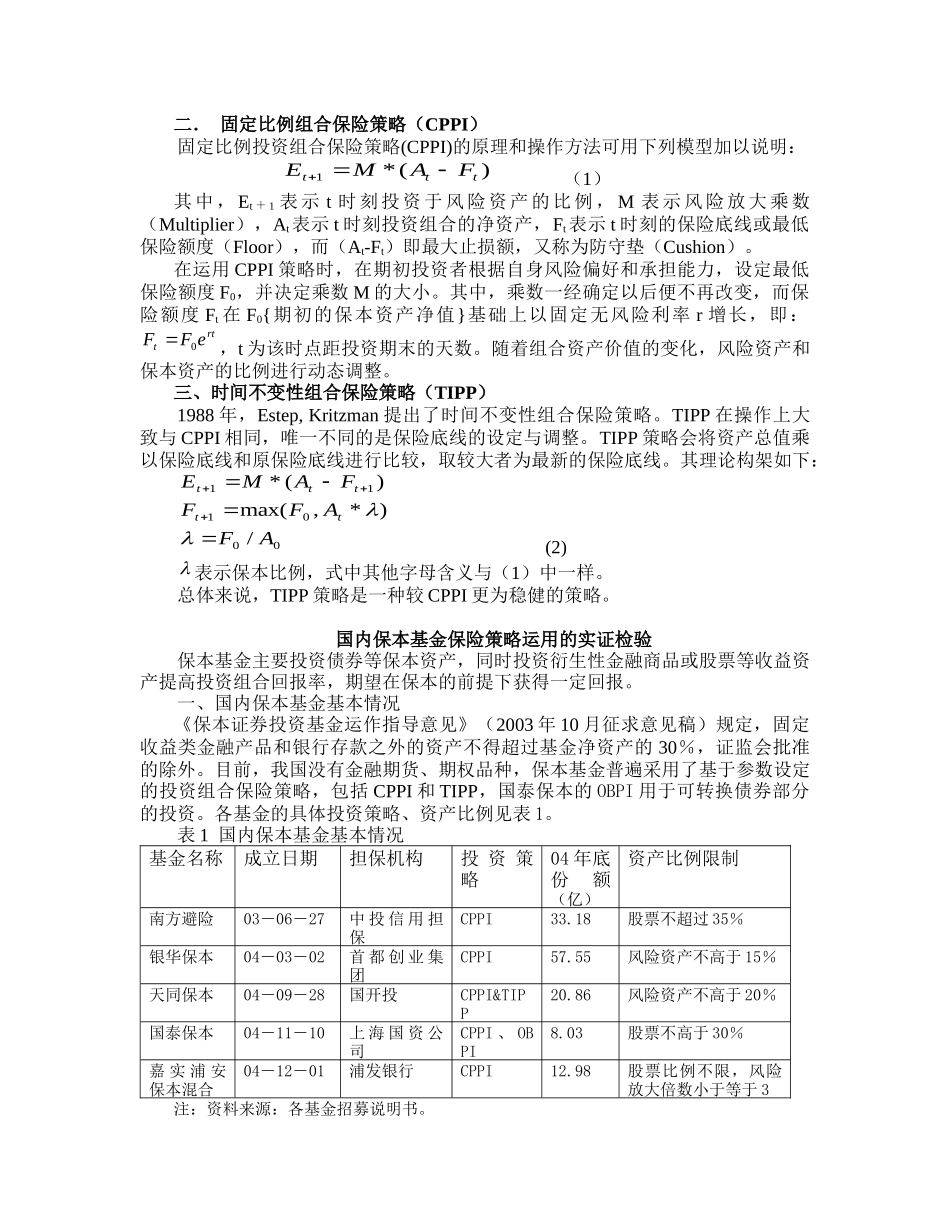

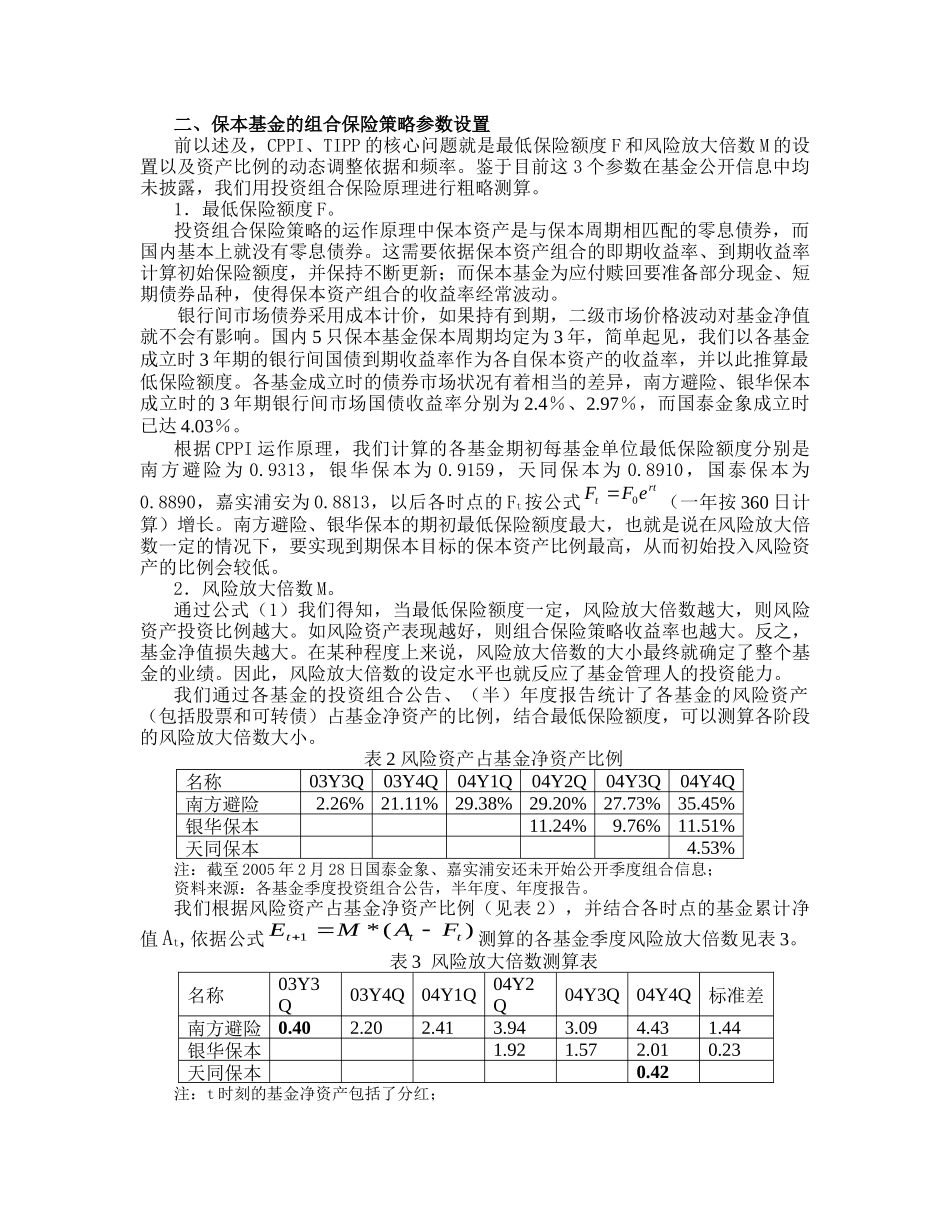

保本基金的投资组合保险策略运用及建议 李源海摘要:保本基金的运作核心是投资组合保险策略,我国保本基金均采用简单参数的组合保险策略。在国内零息债券缺乏、股市波动大的情况下,如何设定最低保险额度、合理的风险放大倍数以及动态调整风险资产比例成为保本基金运作的难题。本文首先简要介绍了投资组合保险策略原理,在此基础上分析了国内保本基金的组合保险策略,然后结合运作原理提出改进建议。关键词:保本基金;投资组合;保险策略作者简介:李源海,同济大学经济与管理学院博士生。中图分类号:F830.9 文献标识码:AAbstract: Investment Portfolio Insurance Strategy is the core of the operation of Principal Guaranteed Fund. At home, all of 5 Principal Guaranteed Funds adopt the Parameter-based Portfolio Insurance Strategy. It is the dilemma for Principal Guaranteed Fund to establish the Floor, Multiplier, and dynamically adjust the proportion of risky asset under the circumstance of the lack of zero-bond and the fluctuation of stock market. This paper first briefly introduces the principle of Investment Portfolio Insurance Strategy, and then analyzes the operation of the domestic Principal Guaranteed Fund. In the end, some suggestions are brought forward through the deep analysis of investment process, which is the right purpose of this paper.Key Words: Principal Guaranteed Fund;Investment Portfolio;Insurance Strategy保本型基金是指投资者于保本周期到期时至少可收回本金或约定一定比例本金的基金。自国内首只保本型基金——南方避险增值基金于 2003 年成立以来,目前已有 5 只保本型基金。与国外(包括我国的香港、台湾地区)的同类基金一样,国内保本型基金均以投资组合保险策略作为运作核心。本文先简单介绍投资组合保险策略,然后重点分析国内保本基金的组合保险策略运用,在此基础上提出改进建议。投资组合保险策略的运作原理投资组合保险策略起源于 1981 年的美国, 1983 年被首次应用于 Wells Fargo Investment Advisors、Aetna Life、Casualty 三家金融机构的投资管理运作实践中。投资组合保险策略的核心思想是...