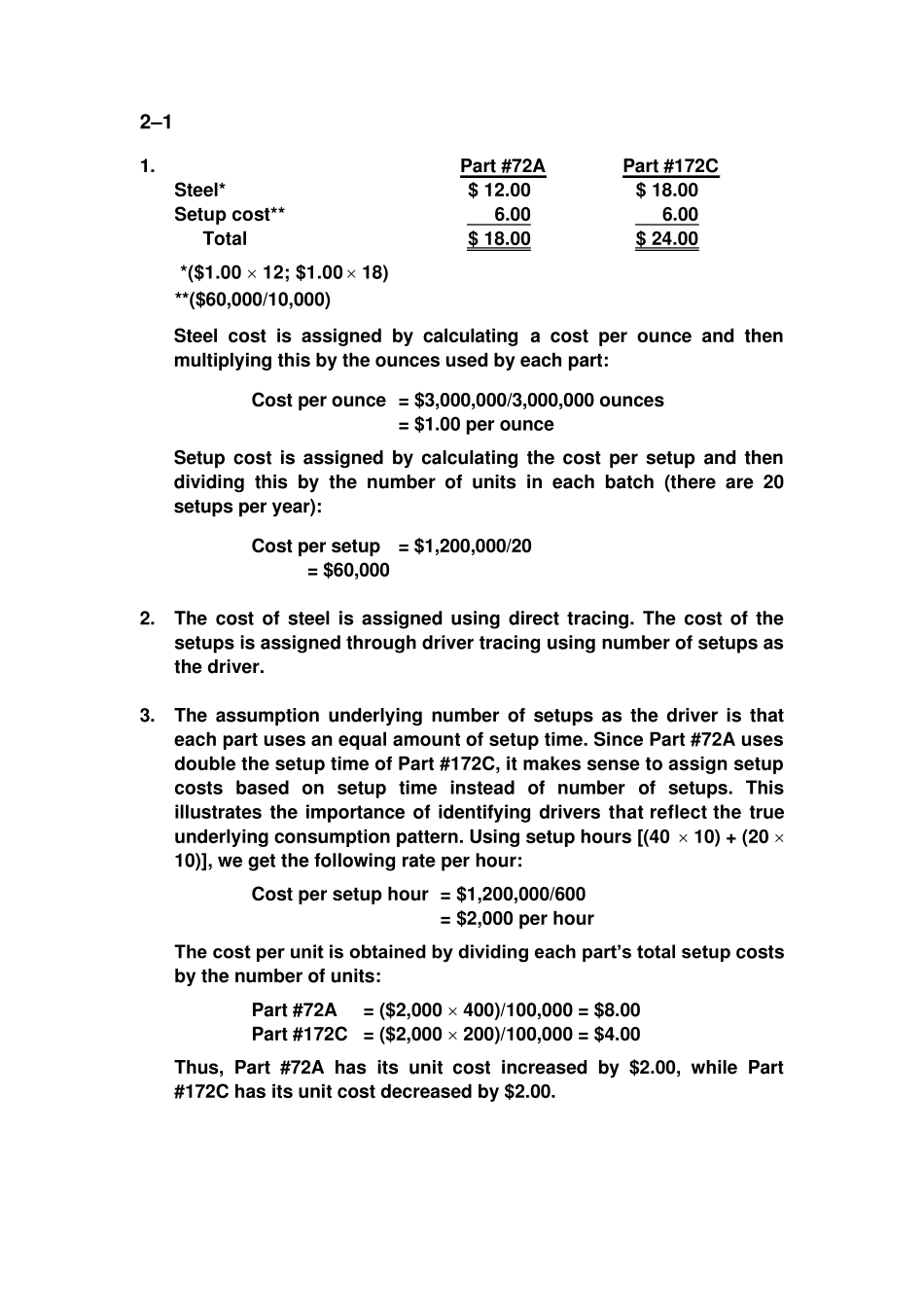

2–1 1. Part #72A Part #172C Steel* $ 12.00 $ 18.00 Setup cost** 6.00 6.00 Total $ 18.00 $ 24.00 *($1.00 12; $1.00 18) **($60,000/10,000) Steel cost is assigned by calculating a cost per ounce and then multiplying this by the ounces used by each part: Cost per ounce = $3,000,000/3,000,000 ounces = $1.00 per ounce Setup cost is assigned by calculating the cost per setup and then dividing this by the number of units in each batch (there are 20 setups per year): Cost per setup = $1,200,000/20 = $60,000 2. The cost of steel is assigned using direct tracing. The cost of the setups is assigned through driver tracing using number of setups as the driver. 3. The assumption underlying number of setups as the driver is that each part uses an equal amount of setup time. Since Part #72A uses double the setup time of Part #172C, it makes sense to assign setup costs based on setup time instead of number of setups. This illustrates the importance of identifying drivers that reflect the true underlying consumption pattern. Using setup hours [(40 10) + (20 10)], we get the following rate per hour: Cost per setup hour = $1,200,000/600 = $2,000 per hour The cost per unit is obtained by dividing each part’s total setup costs by the number of units: Part #72A = ($2,000 400)/100,000 = $8.00 Part #172C = ($2,000 200)/100,000 = $4.00 Thus, Part #72A has its unit cost increased by $2.00, while Part #172C has its unit cost decreased by $2.00. 2–4 1. Given the description provided, we can conclude that Cariari uses a functional-based accounting system. First, evidence exists that product costs are only determined by production costs. Apparently, the financial accounting system is...