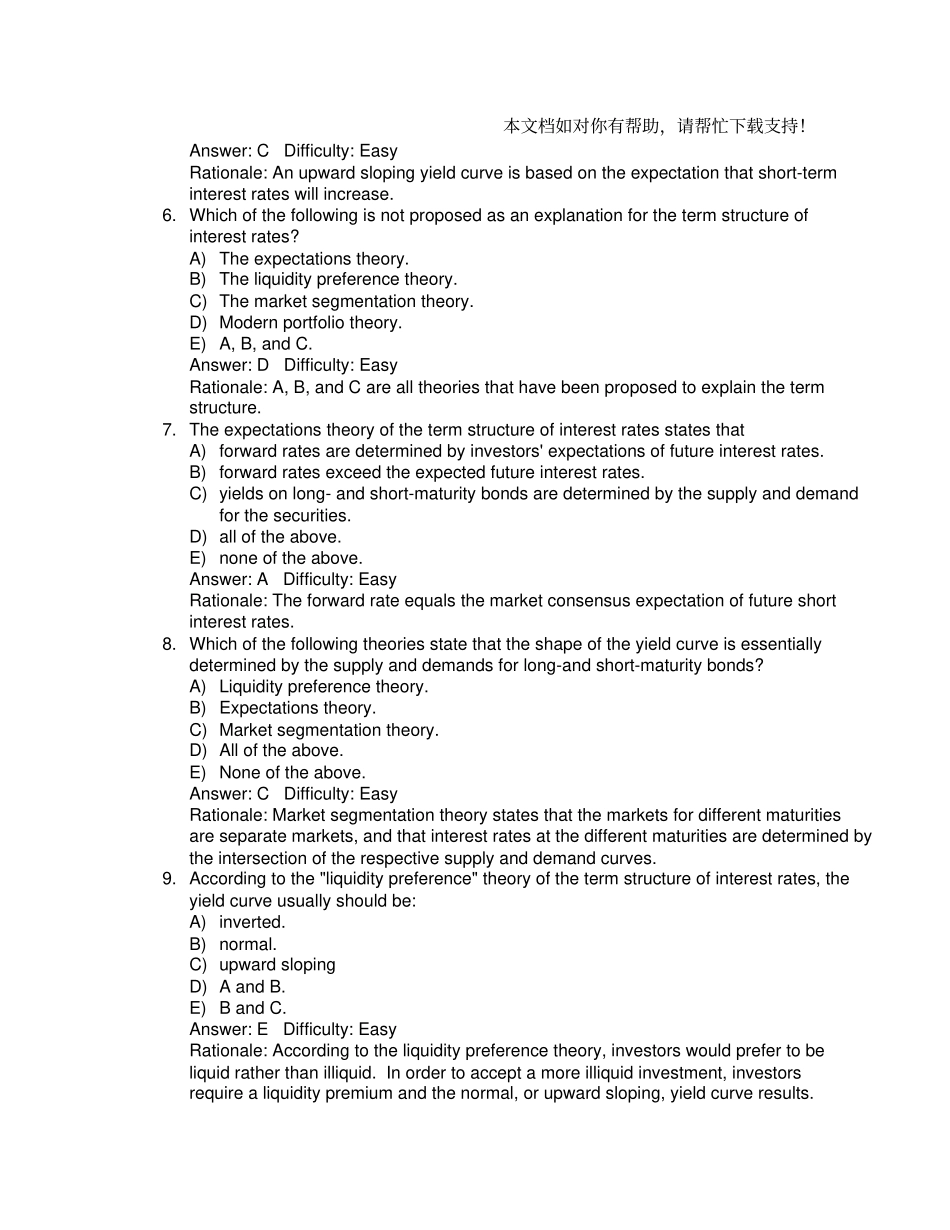

本文档如对你有帮助,请帮忙下载支持!Multiple Choice Questions1. The term structure of interest rates is: A) The relationship between the rates of interest on all securities. B) The relationship between the interest rate on a security and its time to maturity. C) The relationship between the yield on a bond and its default rate. D) All of the above. E) None of the above. Answer: B Difficulty: Easy Rationale: The term structure of interest rates is the relationship between two variables, years and yield to maturity (holding all else constant). 2. The yield curve shows at any point in time: A) The relationship between the yield on a bond and the duration of the bond. B) The relationship between the coupon rate on a bond and time to maturity of the bond. C) The relationship between yield on a bond and the time to maturity on the bond. D) All of the above. E) None of the above. Answer: C Difficulty: Easy 3. An inverted yield curve implies that: A) Long-term interest rates are lower than short-term interest rates. B) Long-term interest rates are higher than short-term interest rates. C) Long-term interest rates are the same as short-term interest rates. D) Intermediate term interest rates are higher than either short- or long-term interest rates. E) none of the above. Answer: A Difficulty: Easy Rationale: The inverted, or downward sloping, yield curve is one in which short-term rates are higher than long-term rates. The inverted yield curve has been observed frequently, although not as frequently as the upward sloping, or normal, yield curve. 4. An upward sloping yield curve is a(n) _______ yield curve. A) normal. B) humped. C) inverted. D) flat. E) none of the above. Answer: A Difficulty: ...