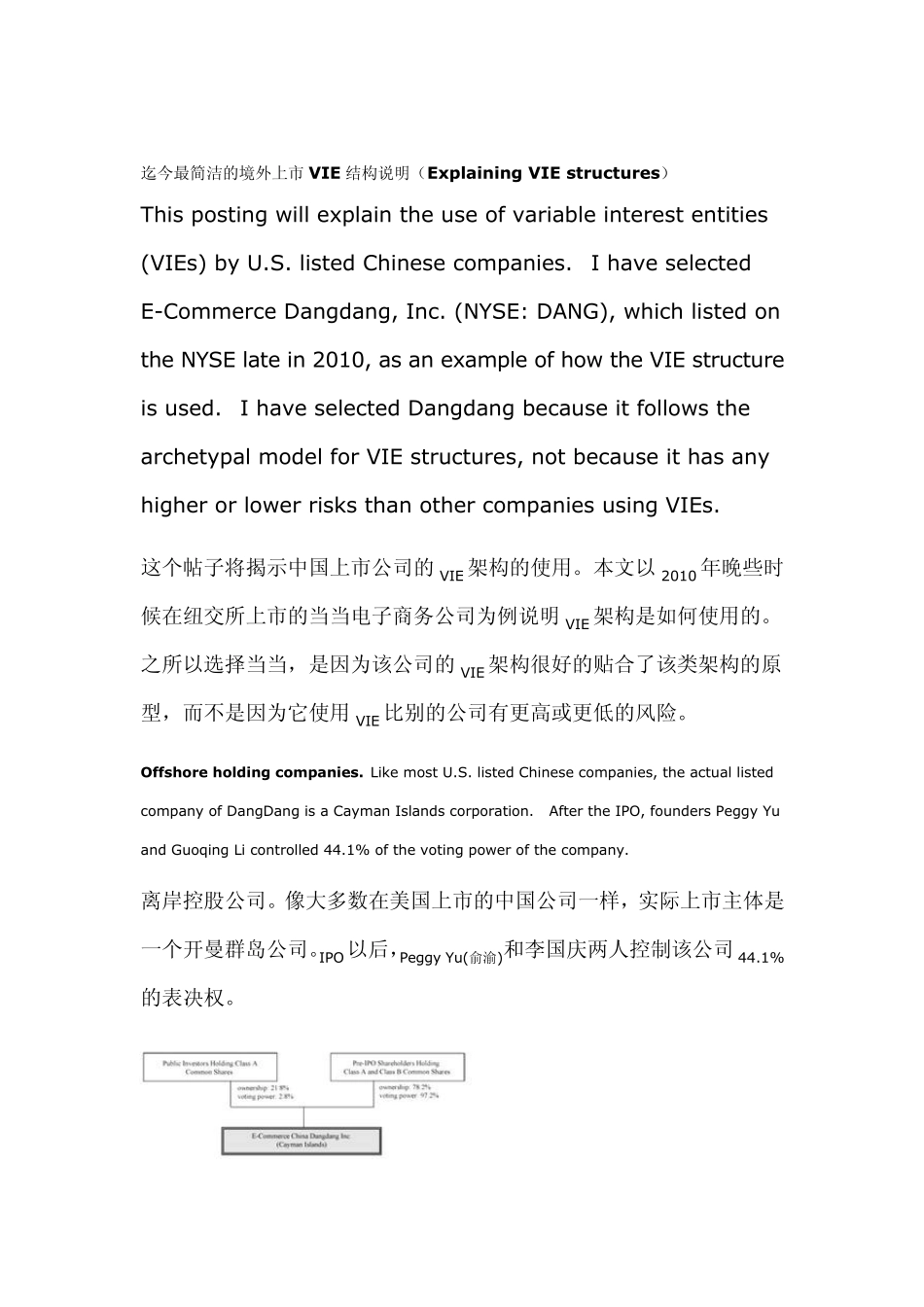

迄今最简洁的境外上市VIE 结构说明(Explaining VIE structures) This posting will explain the use of variable interest entities (VIEs) by U.S. listed Chinese companies. I have selected E-Commerce Dangdang, Inc. (NYSE: DANG), which listed on the NYSE late in 2010, as an example of how the VIE structure is used. I have selected Dangdang because it follows the archetypal model for VIE structures, not because it has any higher or lower risks than other companies using VIEs. 这个帖子将揭示中国上市公司的VIE 架构的使用。本文以 2010 年晚些时候在纽交所上市的当当电子商务公司为例说明VIE 架构是如何使用的。之所以选择当当,是因为该公司的VIE 架构很好的贴合了该类架构的原型,而不是因为它使用VIE 比别的公司有更高或更低的风险。 Offshore holding companies. Like most U.S. listed Chinese companies, the actual listed company of DangDang is a Cayman Islands corporation. After the IPO, founders Peggy Yu and Guoqing Li controlled 44.1% of the voting power of the company. 离岸控股公司。像大多数在美国上市的中国公司一样,实际上市主体是一个开曼群岛公司。IPO以后,Peggy Yu(俞渝)和李国庆两人控制该公司44.1%的表决权。 Chinese companies that list in the U.S. mostly use a foreign incorporated company as the listed company. The exceptions are large former state-owned enterprises like PetroChina or China Life, which list the Chinese incorporated parent company. The foreign parent companies are usually incorporated in the Cayman Islands because it is a favored location for offshore companies due to its tax-free status and established legal system that is built on English law. Some companies have used corporations formed in the British Virgin Islands or the U.S. U.S. holding companies are usually a poor choice, since this brings the corporate group into the U.S. tax net. Such arrangeme...