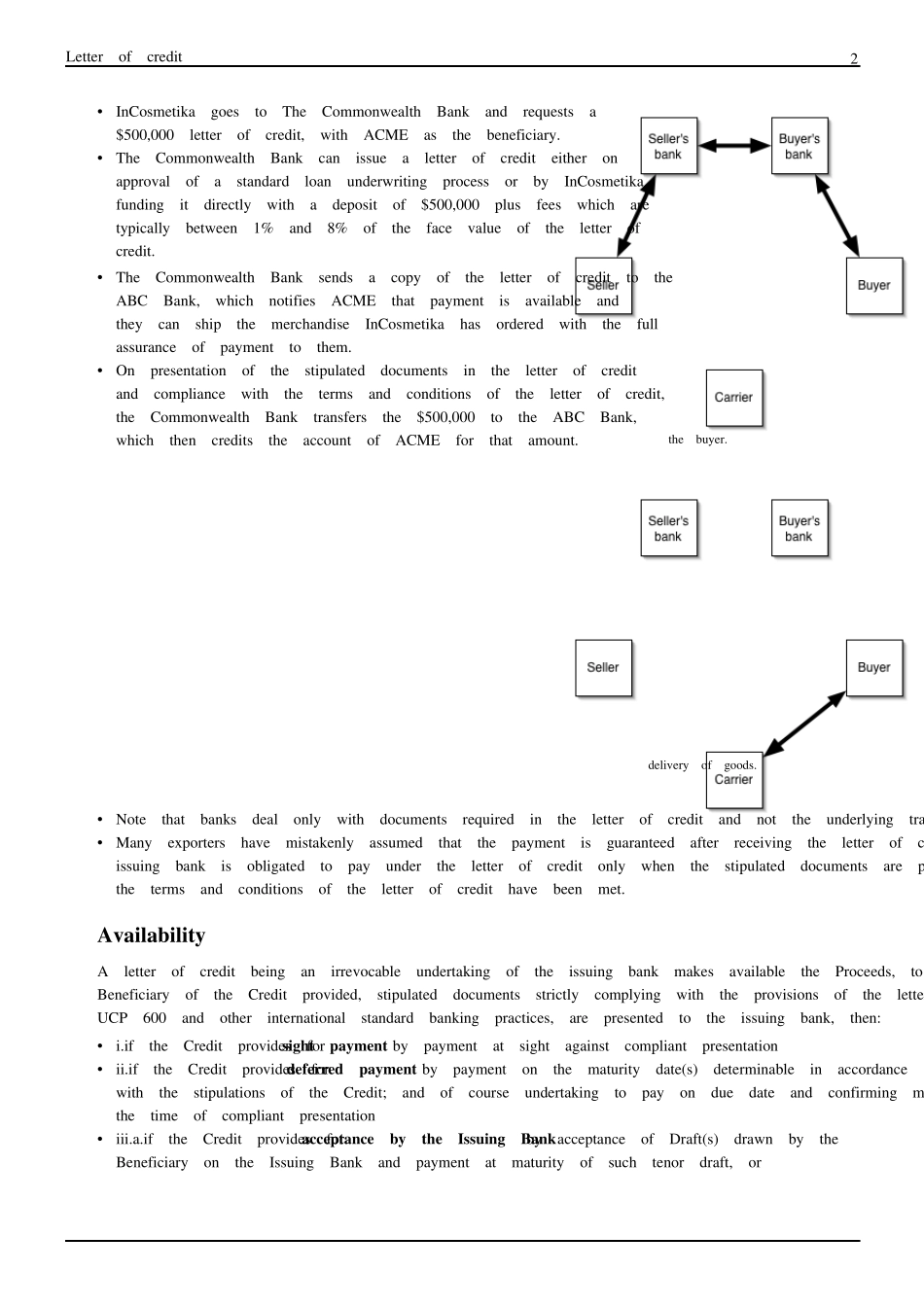

Letter of credit1Letter of creditAfter a contract is concluded between buyer andseller, buyer's bank supplies a letter of credit toseller.Seller consigns the goods to a carrier in exchangefor a bill of lading.A standard, commercial letter of credit is a document issued mostlyby a financial institution, used primarily in trade finance, which usuallyprovides an irrevocable payment undertaking.The letter of credit can also be source of payment for a transaction,meaning that redeeming the letter of credit will pay an exporter. Lettersof credit are used primarily in international trade transactions ofsignificant value, for deals between a supplier in one country and acustomer in another. They are also used in the land developmentprocess to ensure that approved public facilities (streets, sidewalks,stormwater ponds, etc.) will be built. The parties to a letter of credit areusually a beneficiary who is to receive the money, the issuing bank ofwhom the applicant is a client, and the advising bank of whom thebeneficiary is a client. Almost all letters of credit are irrevocable, i.e.,cannot be amended or cancelled without prior agreement of thebeneficiary, the issuing bank and the confirming bank, if any. Inexecuting a transaction, letters of credit incorporate functions commonto giros and Traveler's cheques. Typically, the documents a beneficiaryhas to present in order to receive payment include a commercialinvoice, bill of lading, and documents proving the shipment wasinsured against loss or damage in transit. However, the list and form ofdocuments is open to imagination and negotiation and might containrequirements to present documents issued by a neutral third partyevidencing the quality of the goods shipped, or thei...