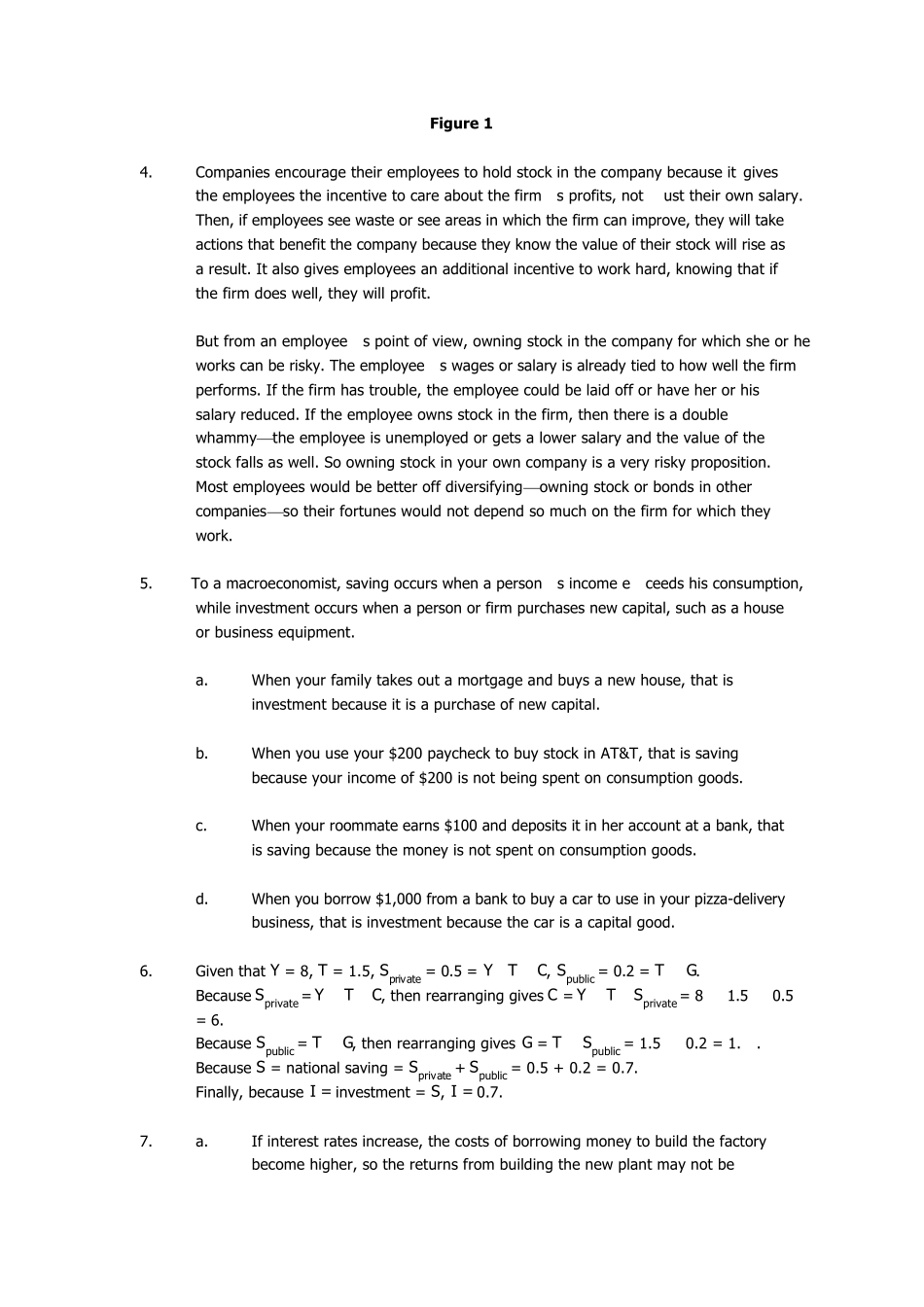

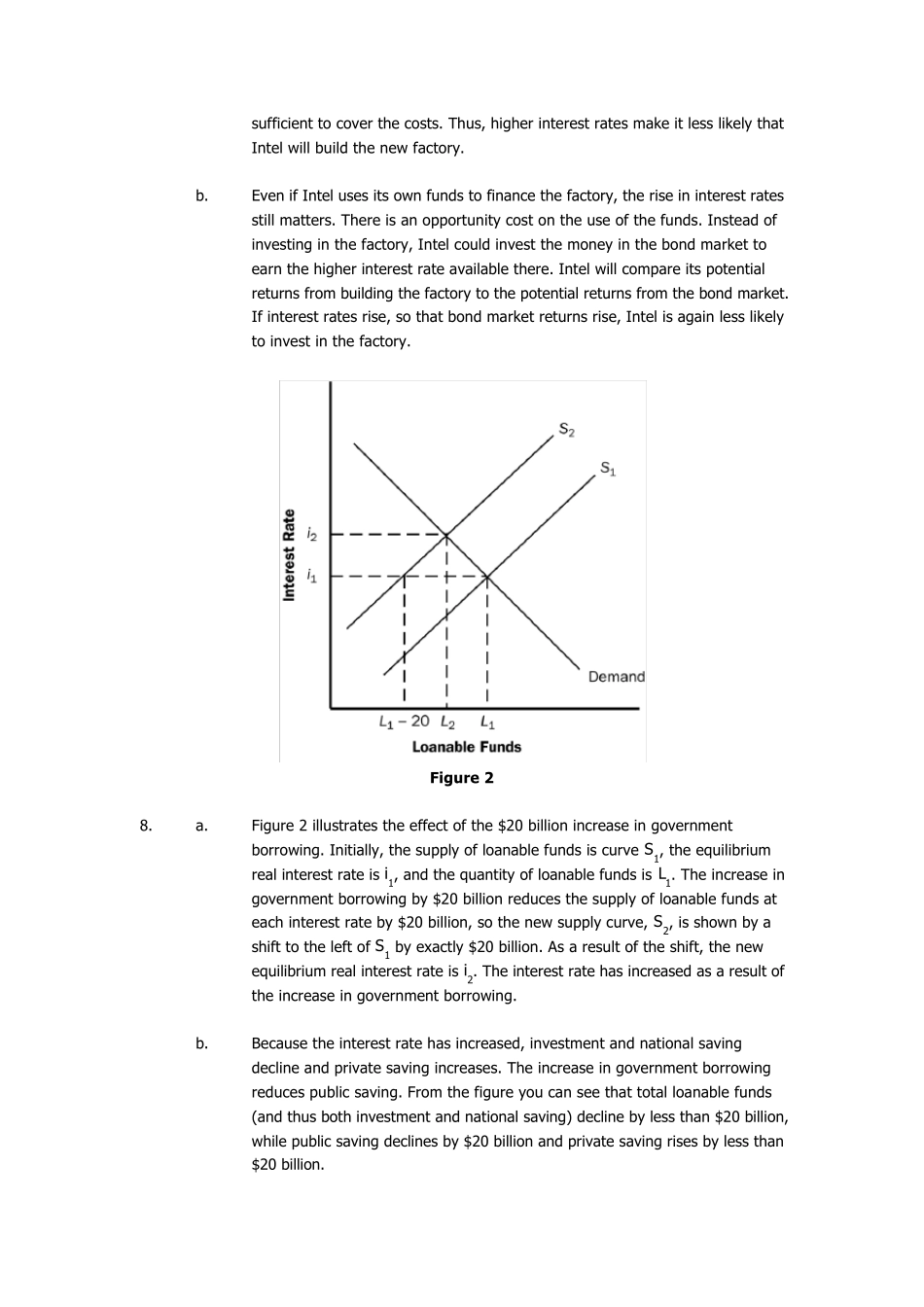

Chapter 26 Problems and Applications 1. a. The bond of an eastern European government would pay a higher interest rate than the bond of the U.S. government because there would be a greater risk of default. b. A bond that repays the principal in 2025 would pay a higher interest rate than a bond that repays the principal in 2005 because it has a longer term to maturity, so there is more risk to the principal. c. A bond from a software company you run in your garage would pay a higher interest rate than a bond from Coca-Cola because your software company has more credit risk. d. A bond issued by the federal government would pay a higher interest rate than a bond issued by New York State because an investor does not have to pay federal income tax on the bond from New York state. 2. The stock market does have a social purpose. Firms obtain funds for investment by issuing new stock. People are more likely to buy that stock because there are organized stock markets, so people know that they can sell their stock if they want to. 3. When the Russian government defaulted on its debt, investors perceived a higher chance of default (than they had before) on similar bonds sold by other developing countries. Thus, the supply of loanable funds shifted to the left, as shown in Figure 1. The result was an increase in the interest rate. Figu re 1 4. Companies encourage their employees to hold stock in the company because it gives the employees the incentive to care about the firm’s profits, not just their own salary. Then, if employees see waste or see areas in which the firm can improve, they will take actions that benefit the company because they know the value of their stock w...