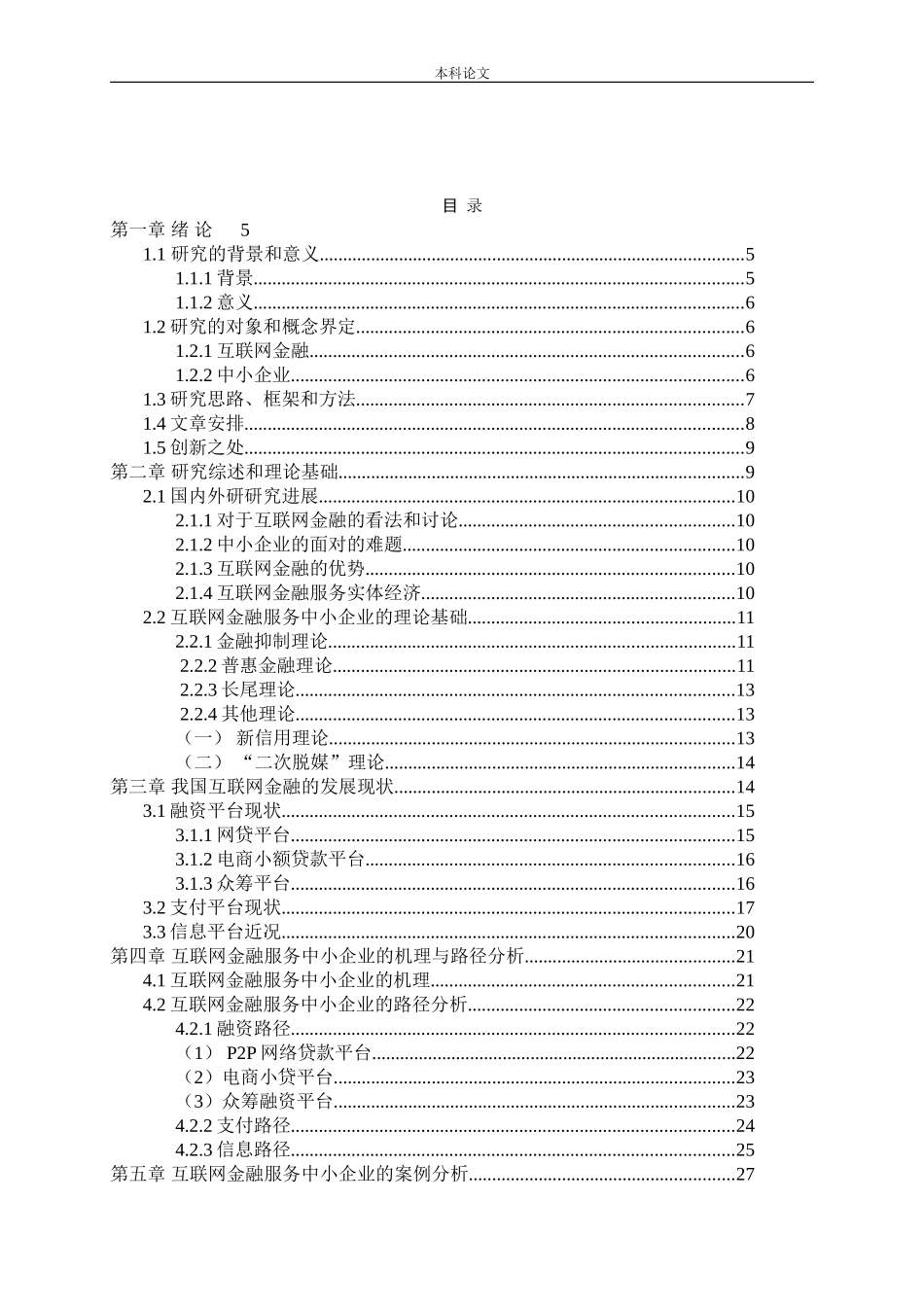

本科论文摘 要随着 5G 的商用,以及大数据、云、AI 的普及,金融业和互联网在 2013 年就已经实现结合,“互联网金融”带来的金融产品和服务一直围绕在我们身边。根据 2020 年 3 月 20日的最新数据显示,在工商税务部门注册的已经有 4000 多万家中小企业,而这些中小企业数量占企业总数的 99%,贡献了一半以上的税收、六成的 GDP,同时提供了近八成的就业岗位,而且中小企业还是我国科研成果的主力军。但是而今,中小企业在起步的时候因为自身企业规模小、管理模式陈旧等原因,起步的时候难免会遇到种种困难,比如融资困难,信息利用困难,企业资质申报条件苛刻等,本文通过对文献和理论的梳理,以及结合笔者一年多的大型集团工作经验和对典型案例的分析,认为“互联网金融”通过融资路径、支付路径、信息路合这几条路径来服务实体经济中的中小企业,并对这三条路径进行具体分析,和对应平台的研究。并且用一个典型案例来印证自己的互联网服务中小企业路径研究的结论,并针对自己的研究提出了笔者的建议。关键词:互联网金融,中小企业,服务路径本科论文AbstractWith the commercial application of 5g and the popularization of big data, cloud and AI, the combination of financial industry and Internet has been realized in 2013. The financial products and services brought by "Internet finance" have always been around us. According to the latest data on March 20, 2020, there are more than 40 million small and medium-sized enterprises registered in the industrial and commercial tax authorities, and the number of these small and medium-sized enterprises accounts for 99% of the total number of enterprises, contributing more than half of the tax revenue and 60% of the GDP, while providing nearly 80% of the jobs, and small and medium-sized enterprises are the main force of scientific research achievements in China. But now, small and medium-sized enterprises will inevitably encounter various difficulties when they start because of their small scale and old management mode, such as financing diff...