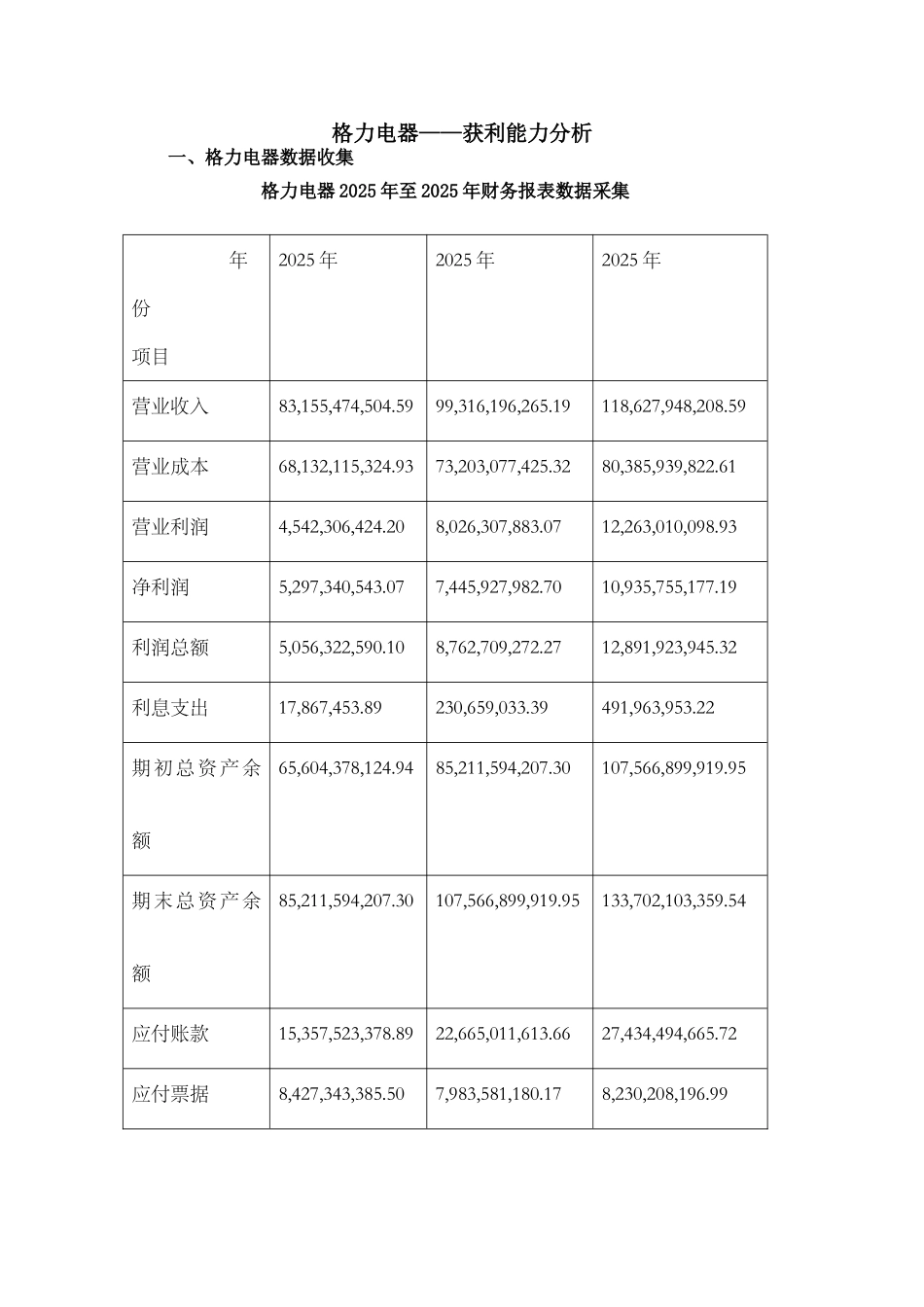

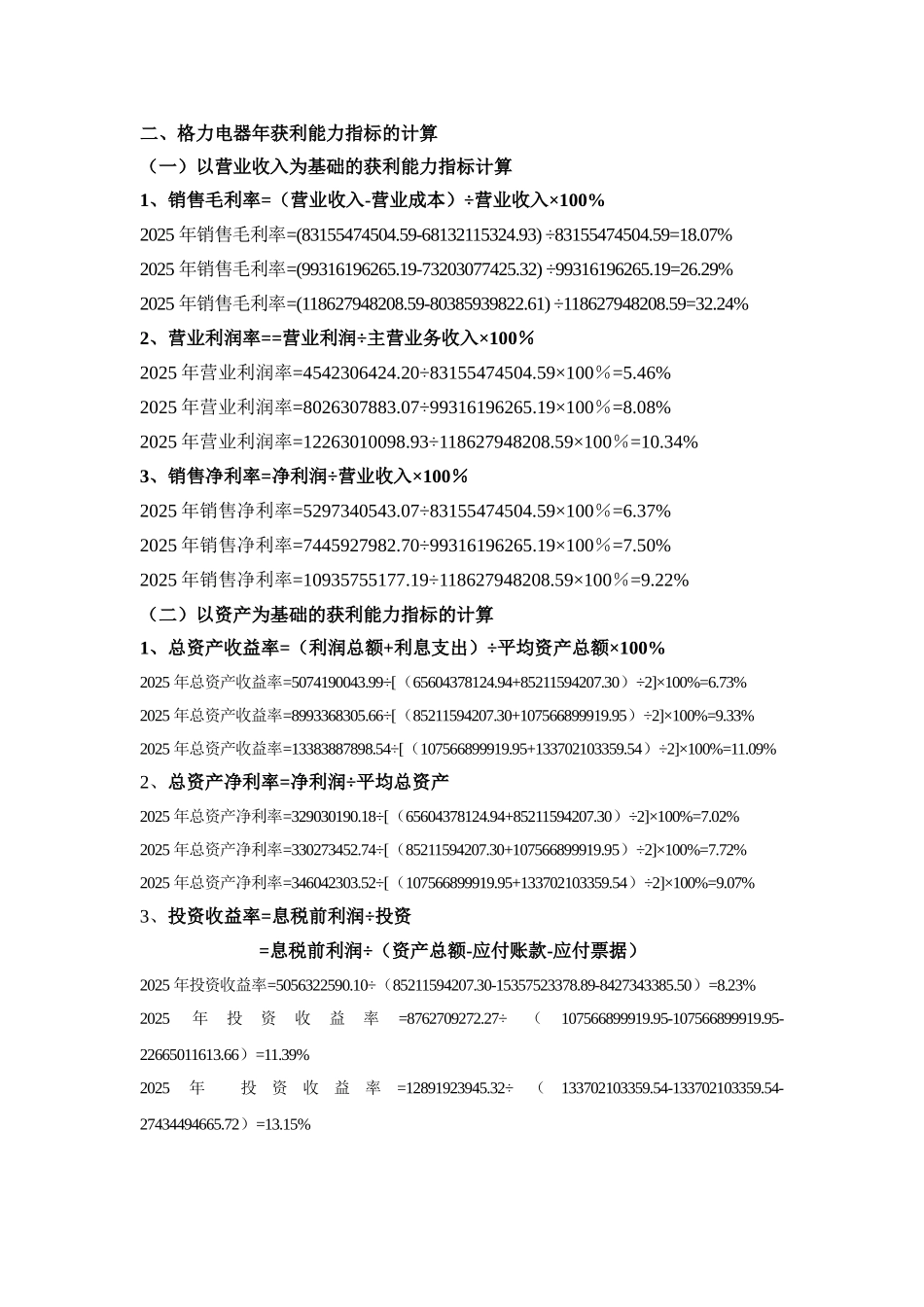

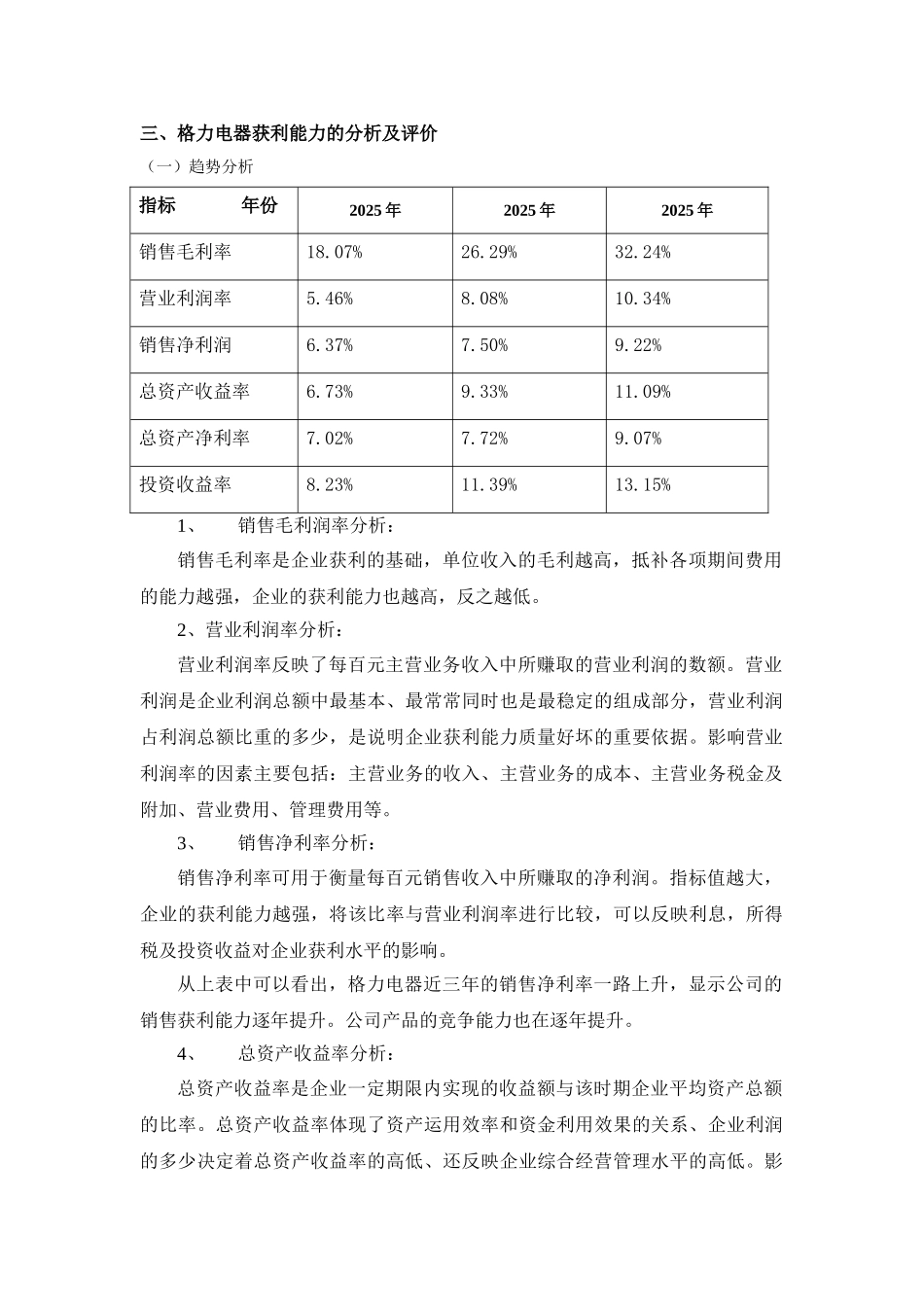

格力电器——获利能力分析 一、格力电器数据收集格力电器 2025 年至 2025 年财务报表数据采集年份项目 2025 年2025 年2025 年营业收入83,155,474,504.5999,316,196,265.19118,627,948,208.59营业成本68,132,115,324.9373,203,077,425.3280,385,939,822.61营业利润4,542,306,424.208,026,307,883.0712,263,010,098.93净利润5,297,340,543.077,445,927,982.7010,935,755,177.19利润总额5,056,322,590.108,762,709,272.2712,891,923,945.32利息支出17,867,453.89230,659,033.39491,963,953.22期初总资产余额65,604,378,124.9485,211,594,207.30107,566,899,919.95期末总资产余额85,211,594,207.30107,566,899,919.95133,702,103,359.54应付账款15,357,523,378.8922,665,011,613.6627,434,494,665.72应付票据8,427,343,385.507,983,581,180.178,230,208,196.99二、格力电器年获利能力指标的计算(一)以营业收入为基础的获利能力指标计算1、销售毛利率=(营业收入-营业成本)÷营业收入×100%2025 年销售毛利率=(83155474504.59-68132115324.93) ÷83155474504.59=18.07%2025 年销售毛利率=(99316196265.19-73203077425.32) ÷99316196265.19=26.29%2025 年销售毛利率=(118627948208.59-80385939822.61) ÷118627948208.59=32.24%2、营业利润率==营业利润÷主营业务收入×100%2025 年营业利润率=4542306424.20÷83155474504.59×100%=5.46%2025 年营业利润率=8026307883.07÷99316196265.19×100%=8.08%2025 年营业利润率=12263010098.93÷118627948208.59×100%=10.34%3、销售净利率=净利润÷营业收入×100%2025 年销售净利率=5297340543.07÷83155474504.59×100%=6.37%2025 年销售净利率=7445927982.70÷99316196265.19×100%=7.50%2025 年销售净利率=10935755177.19÷118627948208.59×100%=9.22%(二)以资产为基础的获利能力指标的计算1、总资产收益率=(利润总额+利息支出)÷平均资产总额×100%2025 年总资产收益率=5074190043.99÷[(65604378124.94+85211594207.30)÷2]×100%=6.73%2025 年总资产收益率=8993368305.66÷[(85211594207.30+107566899919.95)÷2]×100%=9.33%2025 年总资产收益率=13383887898.54÷[(107566899919.95+133702103359.54)÷2]×100%=11.09%2、总资产净利率=净利润÷平均总资产2025 年总资产净利率=329030190.18÷[(65604378124.94+85211594207.30)÷2]×100%=7.02%2025 ...