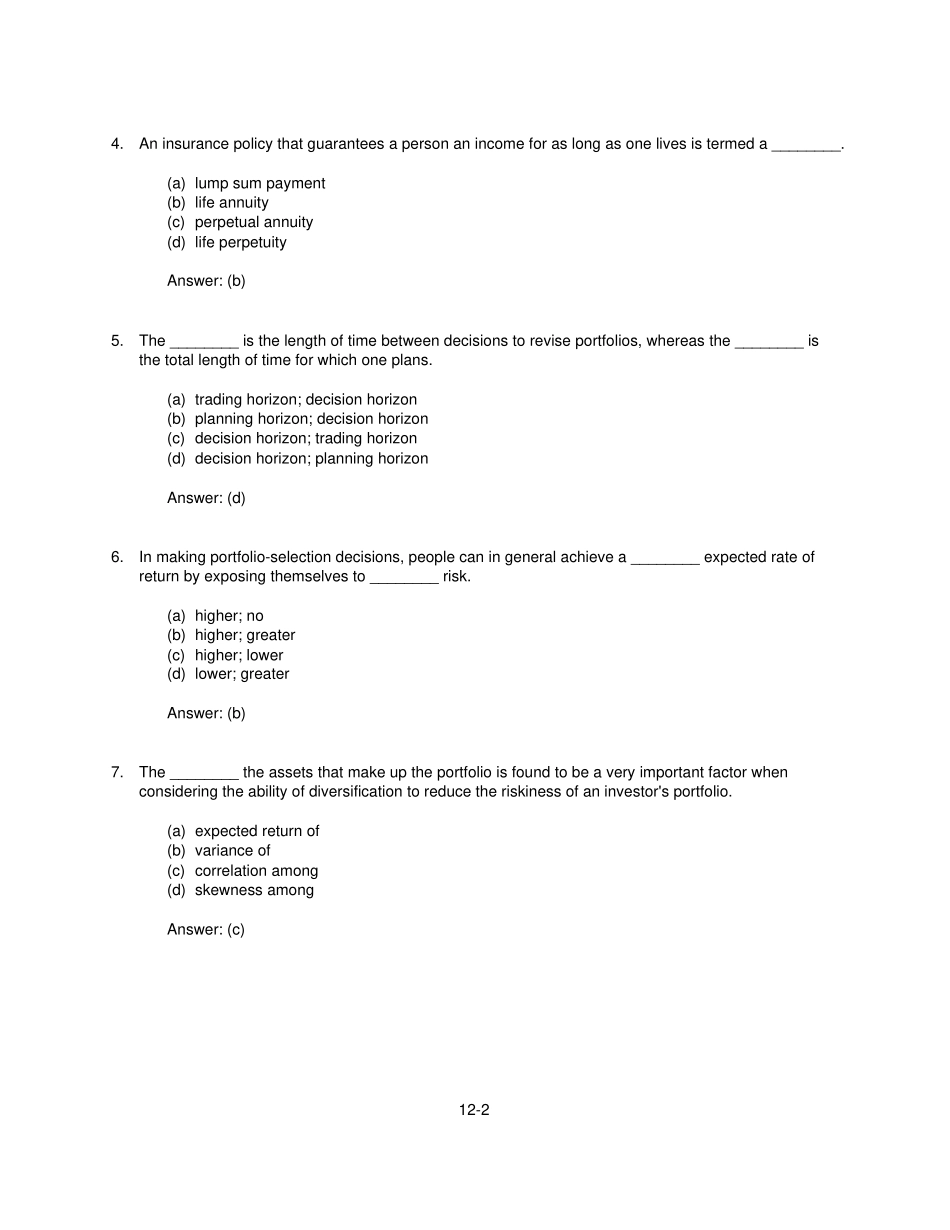

12-1ChapterTwelvePortfolioOpportunitiesandChoiceThischaptercontains30multiplechoicequestions,10shortproblems,and5longerproblems.MultipleChoice1.Aperson'swealthportfolioconsistsofallone’s________and________.(a)retainedearnings;credit(b)stocks;bonds(c)assets;liabilities(d)studentloans;mortgagesAnswer:(c)2.Theprincipleofdiversificationusuallyappliestoall________.(a)riskaversepeople(b)riskneutralpeople(c)risktolerantpeople(d)bandcAnswer:(a)3.Whichofthefollowingdecisionscanbeconsideredpartofportfolioselection?(a)Whethertobuyorrentone’shouse(b)Whatkindoflifeinsurancetopurchase(c)Whethertoinvestinstocksorbonds(d)AlloftheaboveAnswer:(d)12-24.Aninsurancepolicythatguaranteesapersonanincomeforaslongasonelivesistermeda________.(a)lumpsumpayment(b)lifeannuity(c)perpetualannuity(d)lifeperpetuityAnswer:(b)5.The________isthelengthoftimebetweendecisionstoreviseportfolios,whereasthe________isthetotallengthoftimeforwhichoneplans.(a)tradinghorizon;decisionhorizon(b)planninghorizon;decisionhorizon(c)decisionhorizon;tradinghorizon(d)decisionhorizon;planninghorizonAnswer:(d)6.Inmakingportfolio-selectiondecisions,peoplecaningeneralachievea________expectedrateofreturnbyexposingthemselvesto________risk.(a)higher;no(b)higher;greater(c)higher;lower(d)lower;greaterAnswer:(b)7.The________theassetsthatmakeuptheportfolioisfoundtobeaveryimportantfactorwhenconsideringtheabilityofdiversificationtoreducetheriskinessofaninvestor'sportfolio.(a)expectedreturnof(b)varianceof(c)correlationamong(d)skewnessamongAnswer:(c)12-38.Risktolerancecanbeinfluencedbywhichofthefollowingcharacteristics?(a)jobstatus(b)age(c)wealth(d)alloftheaboveAnswer:(d)9.The________isdefinedasasecuritythatoffersaperfectlypredictablerateofreturnintermsoftheunitofaccountandthelengthoftheinvestor'sdecisionhorizon.(a)risklessasset(b)riskyasset(c)30-daybond(d)30-daydebentureAnswer:(a)10.Aportfoliocontainsoneriskyassetandonerisklessasset.Theexpectedrateofreturnontheriskyassetis0.13andtherisklessrateis0.05.Thestandarddeviationoftheriskyassetis0.2,andthestandarddeviationoftheportfoliois0.075.Whatistheexpectedrateofreturnontheportfoliousingthetrade-offline?(a)0.0490(b)0.0800(c)0.0980(d)0.1175Answer:(b)11.Aninvestorhasa$100,000investmenttoallocatebetweenariskyassetandarisklessasset.Theequationforthetrade-offlineisdeterminedtobeE(r)=0.05+0.09w.Iftheinvestorisrequiringaportfoliocompositioncorrespondingtoanexpectedrateofreturnof0.11,howmuchshouldbeinvestedintheriskyasset?(a)$18,181(b)$33,333(c)$66,667(d)$81,819Answer:(c)12-412.Aninvestorhasa$100,000investmenttoallocatebetweenariskyassetandarisklessasset.Theequationforthetrade-offlineisdeterminedtobeE(r)=0.07+0.12w.Iftheinvestorisrequiringaportfoliocompositioncorrespondingtoanexpectedrateofreturnof0.17,howmuchshouldbeinvestedintherisklessasset?(a)$16,667(b)$29,412(c)$70,588(d)$83,333Answer:(a)13.Aninvestorhasa$100,000investmenttoallocatebetweenariskyassetandarisklessasset.Theequationforthetrade-offlineisdeterminedtobeE(r)=0.07+0.12w.Iftheinvestorrequiresaportfoliocompositioncorrespondingtoanexpectedrateofreturnof0.17,whatisthecorrespondingstandarddeviationoftheportfolio?Thestandarddeviationofriskyassetis0.3.(a)0.05(b)0.25(c)0.49(d)0.83Answer:(b)14.Theexpectedrateofreturnonariskyassetis0.13andtherisklessrateis0.06.Thestandarddeviationoftheriskyassetis0.25.Whathappenstotheslopeofthetrade-offlineiftheri...