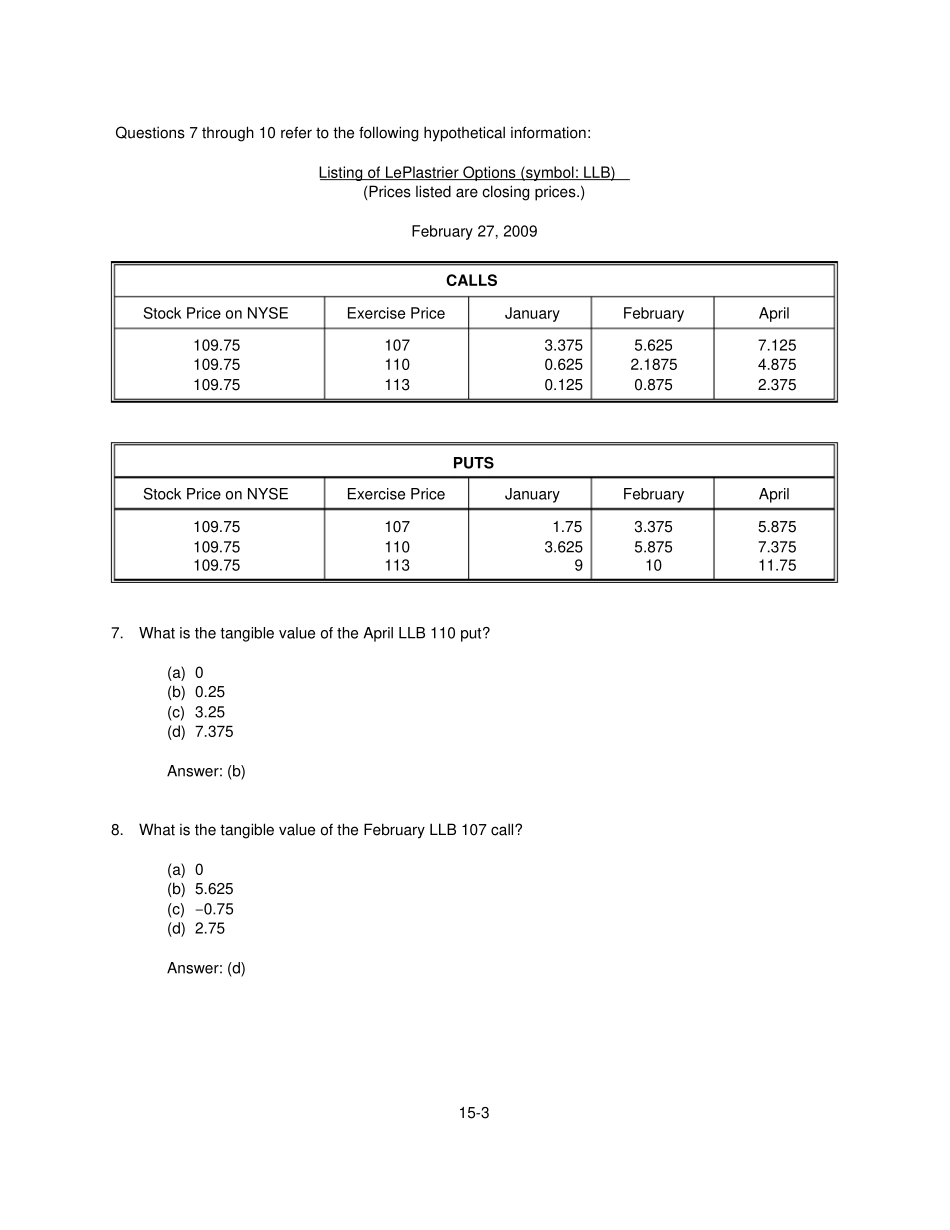

15-1ChapterFifteenMarketsforOptionsandContingentClaimsThischaptercontains50multiplechoicequestions,15shortproblems,and9longerproblems.MultipleChoice1.Anoptiontobuyaspecifieditematafixedpriceisa(n)________;anoptiontosellisa________.(a)put;call(b)spotoption,call(c)call;put(d)put;spotoptionAnswer:(c)2.A(n)________optioncanbeexerciseduptoandontheexpirationdate,whereasa(n)________optioncanonlybeexercisedontheexpirationdate.(a)American-type;Bermudan-type(b)American-type;European-type(c)European-type;American-type(d)Bermudan-type;European-typeAnswer:(b)3.Thedifferencebetweenexercisepriceandcurrentstockpriceisthetangiblevalueofan________,andthedifferencebetweenthecurrentstockpriceandexercisepriceisthetangiblevalueofan________.(a)outofthemoneyputoption;inthemoneycalloption(b)inthemoneyputoption;outofthemoneycalloption(c)intheputmoneyoption;atthemoneycalloption(d)atthemoneyputoption;inthemoneyputoptionAnswer:(b)15-24.Acalloptionissaidtobe“outofthemoney”ifits________.(a)exercisepriceisequaltothepriceoftheunderlyingstock(b)currentstockpriceisgreaterthanitsstrikeprice(c)strikepriceisgreaterthanthecurrentstockprice(d)strikepriceislessthanitscurrentstockpriceAnswer:(c)5.Thetimevalueofanoptionis________.(a)thedifferencebetweenanoption’sstockpriceanditstangiblevalue(b)thedifferencebetweenthecurrentstockpriceandexerciseprice(c)thedifferencebetweentheexercisepriceandthestockprice(d)thedifferencebetweenanoption’smarketpriceanditstangiblevalueAnswer:(d)6.Thepricesofputsare________thehighertheexerciseprice,andthepricesofcallsare________thehigheristheexerciseprice.(a)lower;higher(b)higher;lower(c)lower;lower(d)higher;higherAnswer:(b)15-3Questions7through10refertothefollowinghypotheticalinformation:ListingofLePlastrierOptions(symbol:LLB)(Priceslistedareclosingprices.)February27,2009CALLSStockPriceonNYSEExercisePriceJanuaryFebruaryApril109.75109.75109.751071101133.3750.6250.1255.6252.18750.8757.1254.8752.375PUTSStockPriceonNYSEExercisePriceJanuaryFebruaryApril109.75109.75109.751071101131.753.62593.3755.875105.8757.37511.757.WhatisthetangiblevalueoftheAprilLLB110put?(a)0(b)0.25(c)3.25(d)7.375Answer:(b)8.WhatisthetangiblevalueoftheFebruaryLLB107call?(a)0(b)5.625(c)–0.75(d)2.75Answer:(d)15-49.InwhatstateistheJanuaryLLB107call?(a)in-the-money(b)out-of-the-money(c)at-the-money(d)zerostateAnswer:(a)10.InwhatstateistheFebruaryLLB113put?(a)in-the-money(b)out-of-the-money(c)at-the-money(d)zerostateAnswer:(a)11.Whichisthecorrectformuladescribingtheput-callparityrelation?(a)S+C=E(1+r)+Pr(b)S+P=Er+CT(c)S+P=E(1+r)+CT(d)S+C=Er+PTAnswer:(c)12.A“protective-put”strategyiswhereone________.(a)buysashareofstockandacalloption(b)buysaputoptionandacalloption(c)buysaputoptionandashareofstock(d)sellsaputoptionandbuysacalloptionAnswer:(c)15-513.SPXoptionsareeffectivelycallsorputsonahypotheticalindexfundthatinvestsinaportfoliocomposedofthestocksthatmakeuptheS&P500index,eachofthe500companies________.(a)equallyrepresentedwithrespecttotheothers(b)inproportiontothetotalvalueofitssharesoutstanding(c)inproportiontothetradingvolumeofitsshares(d)rotatingonaproportionalbasisdependentonearningsAnswer:(b)14.TheSPXcontractspecifiesthatifthecalloptionisexercised,theowneroftheoptions__________.(a)paysacashsettlementof$100timesthedifferencebetweentheindexvalueandthestrikeprice(b)receivesacashpaymentof$100timesthedifferencebetwee...