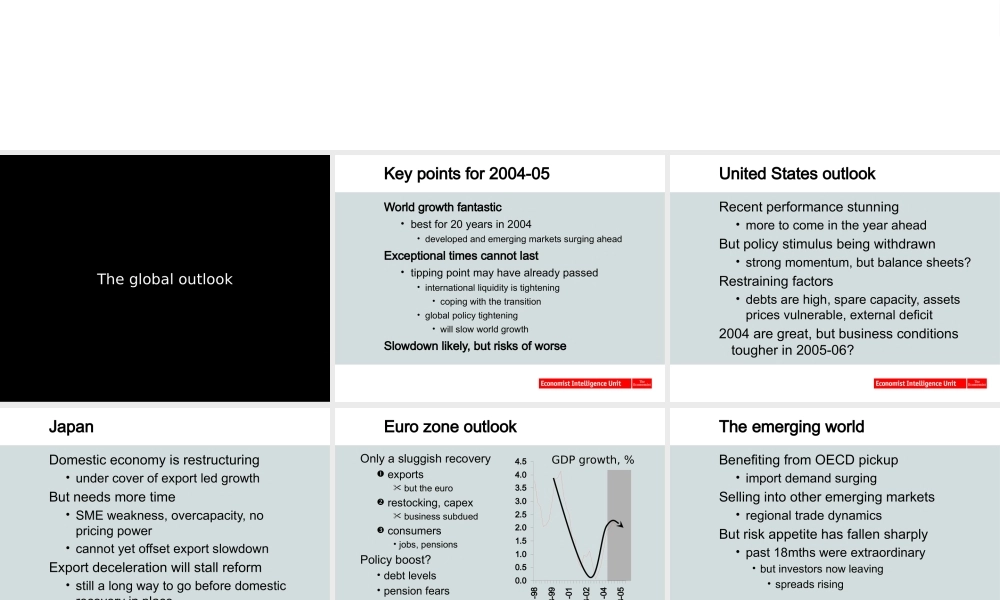

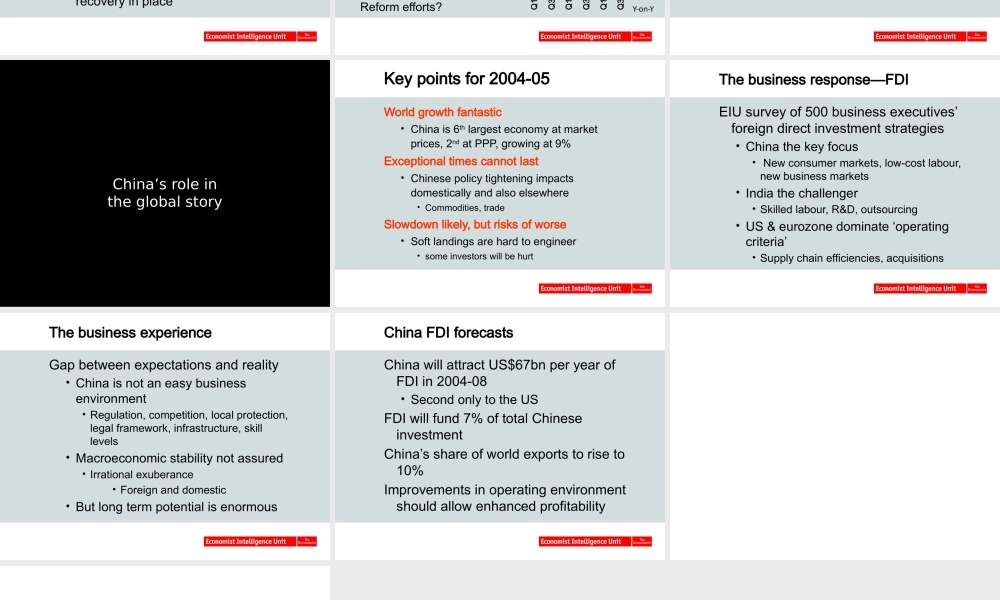

China and the global economyWhy ignoring China is no longer an option.....Robin Bew, Chief EconomistJune 2004The global outlookKey points for 2004-05World growth fantastic best for 20 years in 2004 developed and emerging markets surging aheadExceptional times cannot last tipping point may have already passed international liquidity is tightening coping with the transition global policy tightening will slow world growthSlowdown likely, but risks of worseUnited States outlookRecent performance stunning more to come in the year aheadBut policy stimulus being withdrawn strong momentum, but balance sheets? Restraining factors debts are high, spare capacity, assets prices vulnerable, external deficit2004 are great, but business conditions tougher in 2005-06?JapanDomestic economy is restructuring under cover of export led growthBut needs more time SME weakness, overcapacity, no pricing power cannot yet offset export slowdownExport deceleration will stall reform still a long way to go before domestic recovery in placeEuro zone outlookOnly a sluggish recovery exports but the euro restocking, capex business subdued consumers jobs, pensionsPolicy boost? debt levels pension fearsReform efforts?0.00.51.01.52.02.53.03.54.04.5Q1-98Q3-99Q1-01Q3-02Q1-04Q3-05GDP growth, %Y-on-YThe emerging worldBenefiting from OECD pickup import demand surgingSelling into other emerging markets regional trade dynamicsBut risk appetite has fallen sharply past 18mths were extraordinary but investors now leaving spreads risingChina’s role in the global storyKey points for 2004-05World growth fantastic China is 6th largest economy at market prices, 2nd at PPP, growing at 9%Exceptional times cannot last Chinese policy tig...