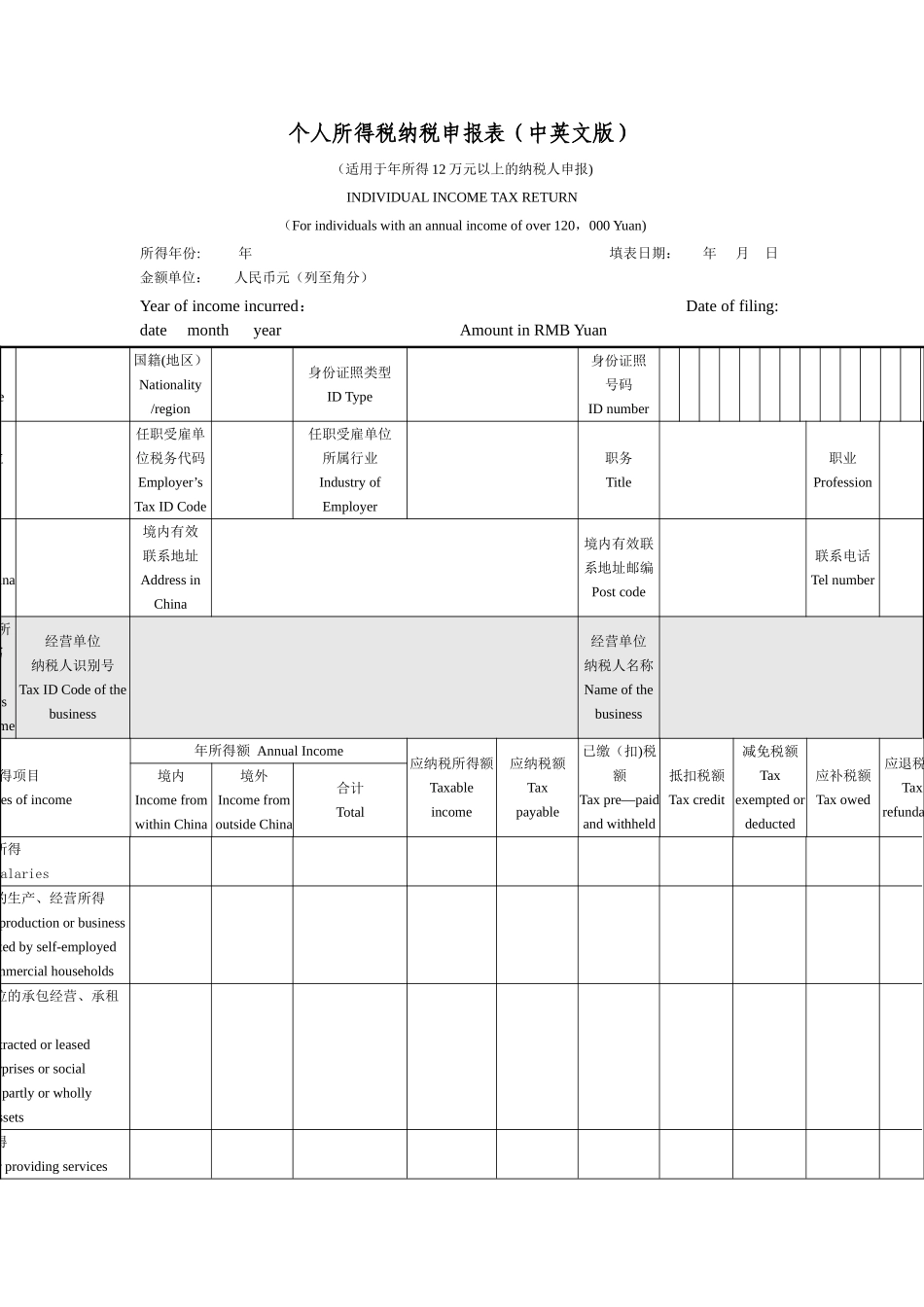

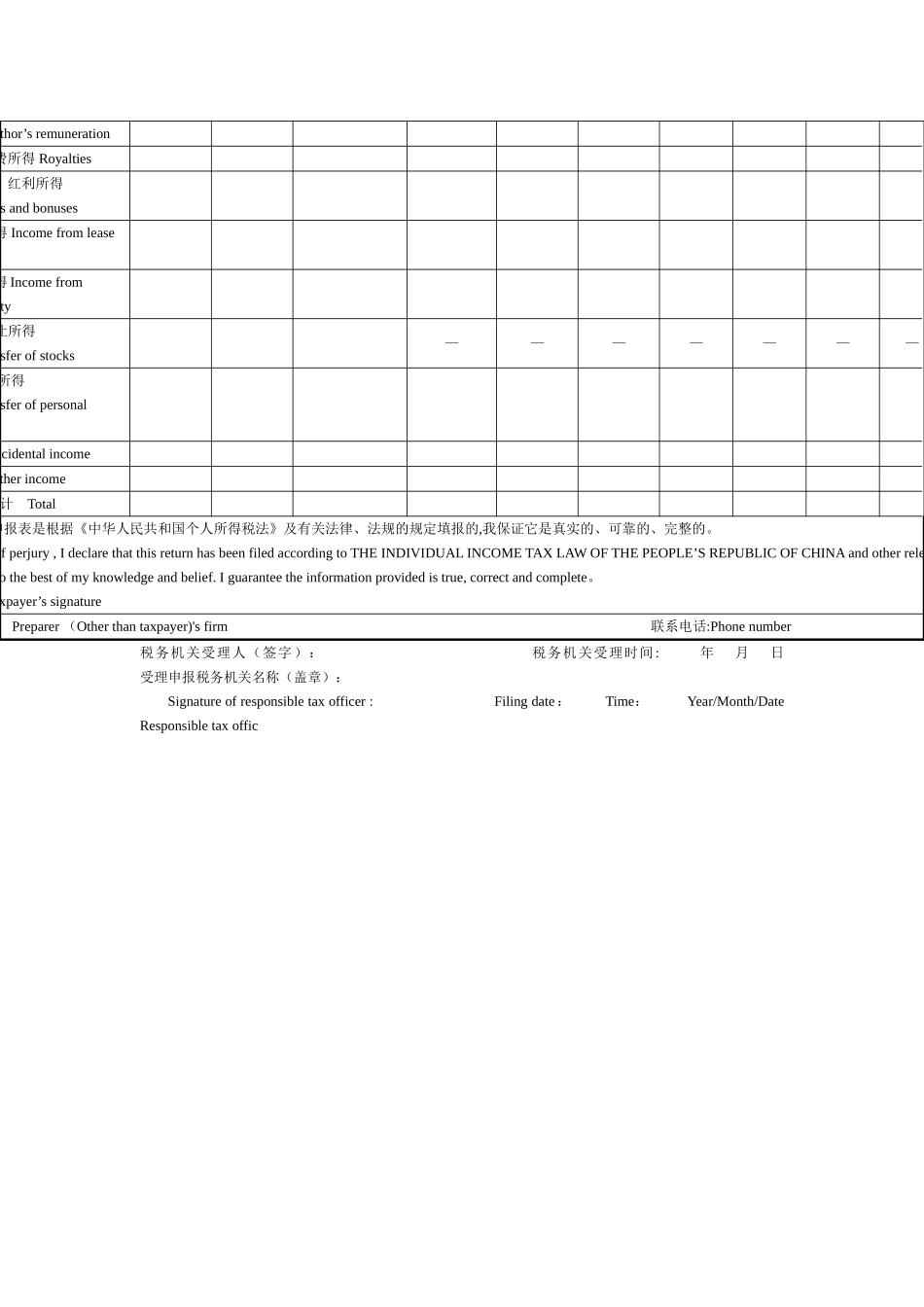

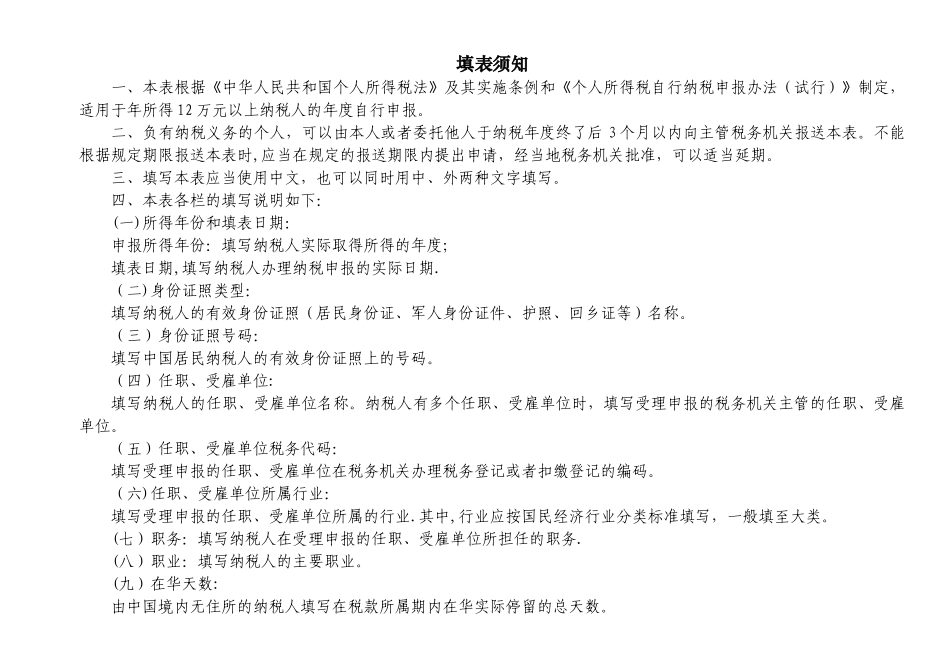

个人所得税纳税申报表(中英文版)(适用于年所得 12 万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份: 年 填表日期: 年 月 日 金额单位: 人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB YuanTax payer’s name国籍(地区)Nationality/region身份证照类型ID Type身份证照号码ID number任职、受雇单位任职受雇单位税务代码Employer’s Tax ID Code任职受雇单位所属行业Industry of Employer职务Title职业ProfessionDays of stay in China境内有效联系地址Address in China境内有效联系地址邮编Post code联系电话Tel number此行由取得经营所得的纳税人填写This line is to be filled by taxpayers with business income经营单位纳税人识别号Tax ID Code of the business经营单位纳税人名称Name of the business所得项目Categories of income年所得额 Annual Income应纳税所得额Taxable income应纳税额Tax payable已缴(扣)税额Tax pre—paid and withheld抵扣税额Tax credit减免税额Tax exempted or deducted应补税额Tax owed应退税额Tax refundable境内Income from within China境外Income from outside China合计Total工资、薪金所得 Wages and salaries个体工商户的生产、经营所得Income from production or business operation conducted by self-employed industrial and commercial households对企事业单位的承包经营、承租Income from contracted or leased operation of enterprises or social service providers partly or wholly funded by state assets劳务酬劳所得Remuneration for providing servicesAuthor’s remuneration特许权使用费所得 Royalties利息、股息、红利所得Interest, dividends and bonuses财产租赁所得 Income from lease 财产转让所得 Income from transfer of property股票转让所得Income from transfer of stocks———————个人房屋转让所得Income from transfer of personal Incidental incomeOther income 计 Total此纳税申报表是根据《中华人民共和国个人所得税法》及有关法律、法规的规定填报的,我保证它是真...