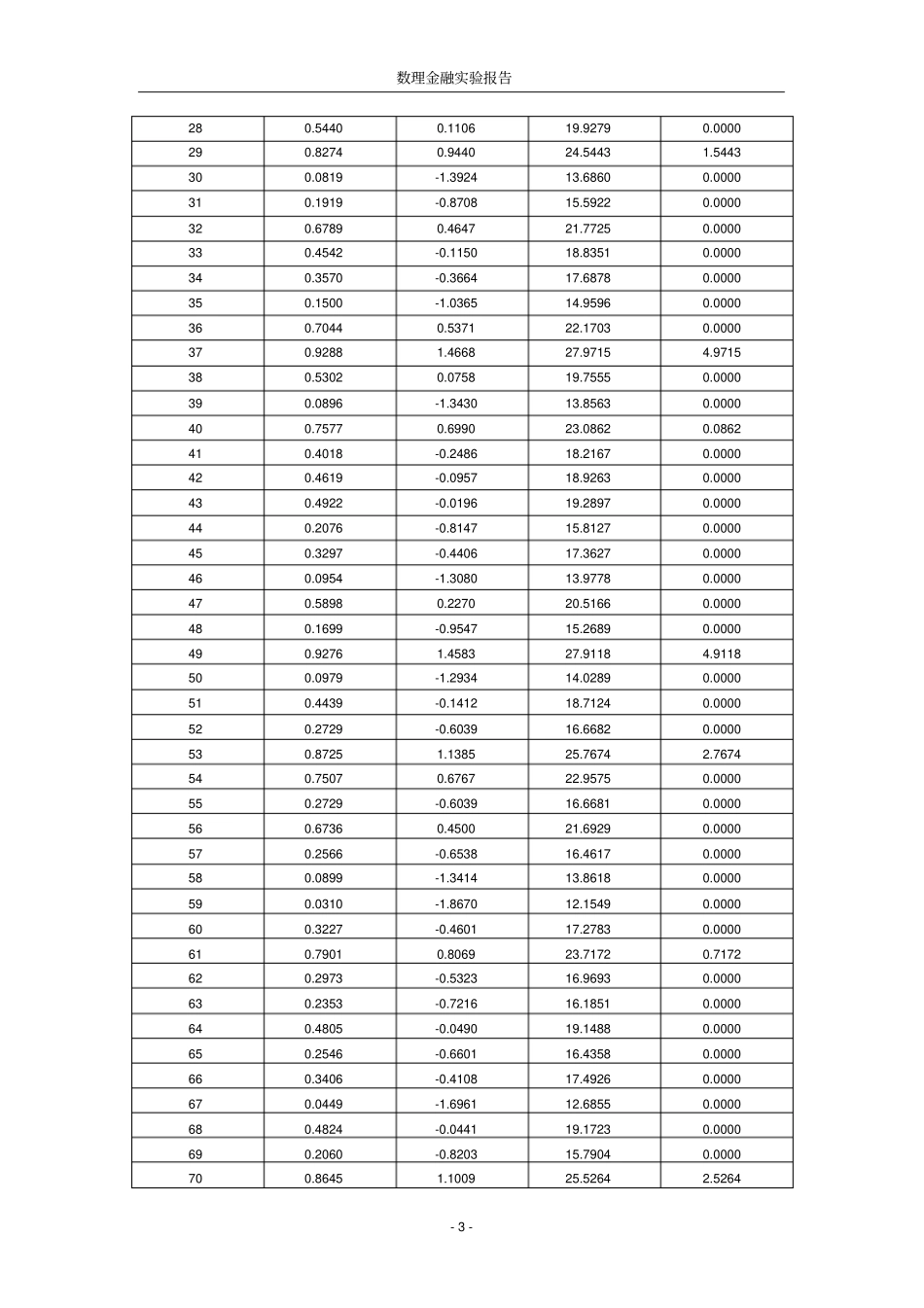

陕西科技大学实验报告课程:数理金融实验日期:2015年6月11日班级:数学122交报告日期:2015年6月12日姓名:报告退发:(订正、重做)学号:201212010119教师:刘利明实验名称:标准欧式看涨期权定价的蒙特卡洛模拟一、实验预习:1.标准欧式看涨期权的定价模型。2.标的资产到期日价格的运动轨迹或分布.3.蒙特卡洛模拟的过程二、实验的目的和要求:通过对标准的欧式期权进行定价模拟,掌握标的资产到期日价格的分布,会熟练运用蒙特卡洛模拟进行期权的定价模拟,并学会分析模拟次数、模拟精度之间的关系,最后和标准的欧式期权的解析解比较给出相对误差。三、实验过程:(实验步骤、原理和实验数据记录等)参数:起初(或0时刻)S取学号后3位除以10取整,然后加上学号最后一位(例如:201212010119,S=[119/10]+9=20);X取S加3;r取0.03;T取0.25;σ取0.5。(模拟100次取最后结果平均值)注意:实验为标准的欧式看涨期权。实验步骤、原理蒙特卡罗模拟进行期权定价的核心在于生成股票价格的随机过程。模型假定在期权到期的T时刻。标的股票价格的随机方程为:其中,随机变量ε服从标准正态分布,即服从N(0,1),随机变量YT服从正态分布,其均值为TuuT25.0,方差为TT,u为股票的收益率,σ为股票的波动率。期权的收益依赖于ST在风险中性世界里的期望值,因此对于风险中性定价,股票的收益率u可以用无风险利率r减去连续红利收益率q代替,也就是(r-q)。风险中性定价的随机方程为:TTqrSST25.0exp其中ε服从标准正态分布。成绩TTTTuSYSSexpexp陕西科技大学理学院实验报告-2-实验数据记录表1期权基本信息股票现价期权执行价格无风险连续复利有效期年波动率(标准差度量)股票每年红利期权类型代码期权类型20.0023.003.00%0.2550.00%3.00%1看涨期权表2蒙特卡洛参数μτσSqrt(τ)Exp(-rT)Nsim-0.03130.25000.9925100表3期权价格期权价格0.78表4蒙特卡洛模拟表模拟次数均匀分布随机数标准正态随机变量值股票价格期权收益10.3650-0.345117.78220.000020.4899-0.025319.26230.000030.1557-1.012415.04990.000040.4745-0.064119.07670.000050.2573-0.651816.46990.000060.62880.328521.04410.000070.54210.105719.90350.000080.1563-1.009815.06000.000090.93851.542728.50705.5070100.65450.397521.41000.0000110.50610.015319.45880.0000120.3905-0.278118.08280.0000130.1074-1.240614.21550.0000140.78400.785823.59230.5923150.4596-0.101318.89970.0000160.75370.686123.01200.0120170.59610.243320.60010.0000180.83270.965024.67361.6736190.0188-2.080111.52430.0000200.2104-0.805115.85040.0000210.0740-1.447013.50070.0000220.1055-1.251114.17830.0000230.3317-0.435217.38610.0000240.1282-1.134714.59690.0000250.0002-3.49038.10030.0000260.53680.092419.83750.0000270.65710.404421.44720.0000数理金融实验报告-3-280.54400.110619.92790.0000290.82740.944024.54431.5443300.0819-1.392413.68600.0000310.1919-0.870815.59220.0000320.67890.464721.77250.0000330.4542-0.115018.83510.0000340.3570-0.366417.68780.0000350.1500-1.036514.95960.0000360.70440.537122.17030.0000370.92881.466827.97154.9715380.53020.075819.75550.0000390.0896-1.343013.85630.0000400.75770.699023.08620.0862410.4018-0.248618.21670.0000420.4619-0.095718.92630.0000430.4922-0.019619.28970.0000440.2076-0.814715.81270.0000450.3297-0.440617.36270.0000460.0954-1.308013.97780.0000470.58980.227020.51660.0000480.1699-0.954715.26890.0000490.92761.458327.91184.9118500.0979-1.293414.02890.0000510.4439-0.141218.71240.0000520.2729-0.603916.66820.0000530.87251.138525.76742.7674540.75070.676722.95750.0000550.2729-0.603916.66810.0000560.67360.450021.69290.0000570.2566-0.653816.46170.0000580.0899-1.341413.86180.0000590.0310-1.867012.15490.0000600.3227-0.460117.27830.0000610.79010.806923.71720.7172620.2973-0.532316.96930.0000630.2353-0.721616.1...