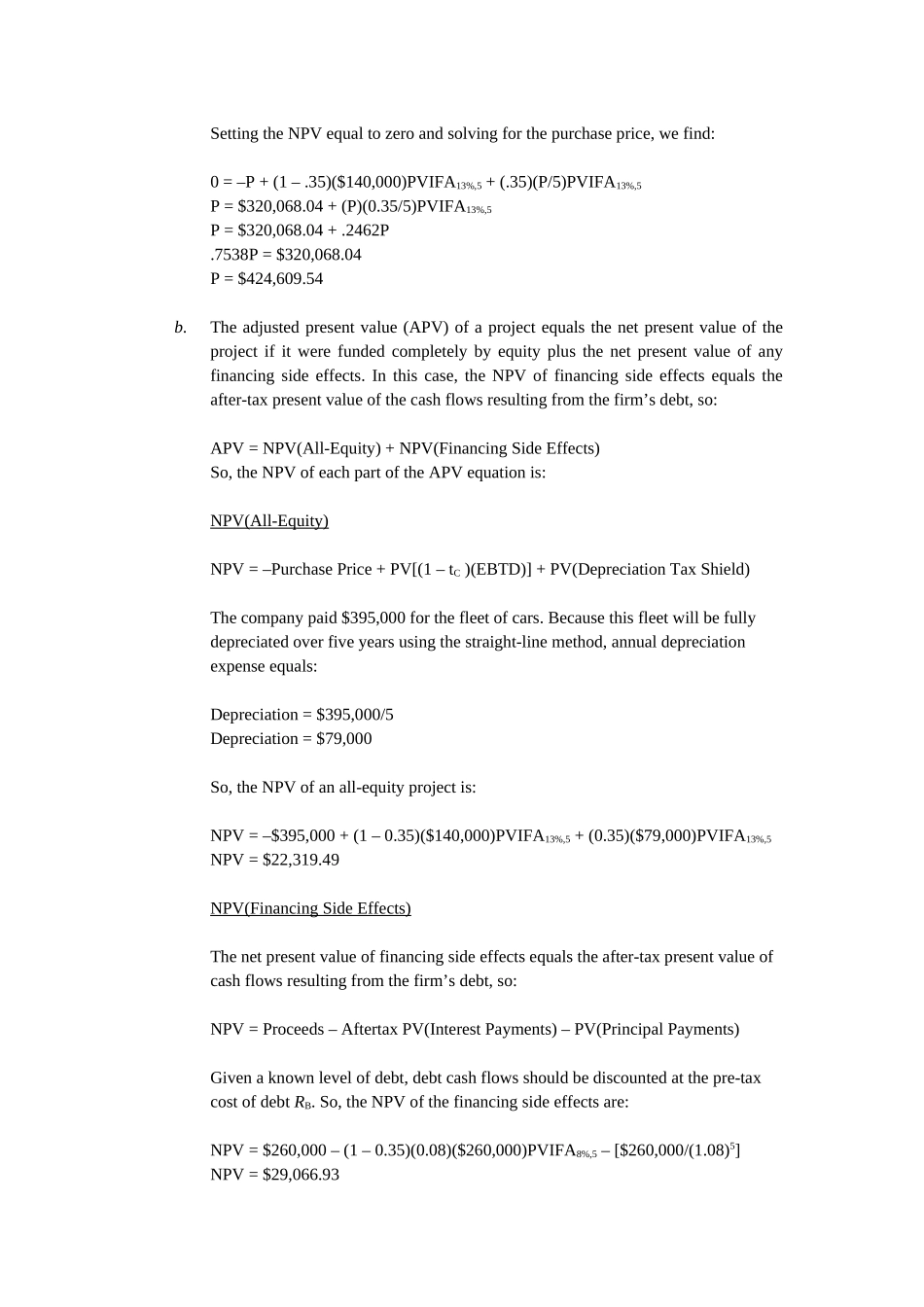

CHAPTER18VALUATIONANDCAPITALBUDGETINGFORTHELEVEREDFIRMAnswerstoConceptsReviewandCriticalThinkingQuestions1.APVisequaltotheNPVoftheproject(i.e.thevalueoftheprojectforanunleveredfirm)plustheNPVoffinancingsideeffects.2.TheWACCisbasedonatargetdebtlevelwhiletheAPVisbasedontheamountofdebt.3.FTEusesleveredcashflowandothermethodsuseunleveredcashflow.4.TheWACCmethoddoesnotexplicitlyincludetheinterestcashflows,butitdoesimplicitlyincludetheinterestcostintheWACC.Ifheinsiststhattheinterestpaymentsareexplicitlyshown,youshouldusetheFTEmethod.5.Youcanestimatetheunleveredbetafromaleveredbeta.Theunleveredbetaisthebetaoftheassetsofthefirm;assuch,itisameasureofthebusinessrisk.Notethattheunleveredbetawillalwaysbelowerthantheleveredbeta(assumingthebetasarepositive).Thedifferenceisduetotheleverageofthecompany.Thus,thesecondriskfactormeasuredbyaleveredbetaisthefinancialriskofthecompany.SolutionstoQuestionsandProblemsNOTE:Allend-of-chapterproblemsweresolvedusingaspreadsheet.Manyproblemsrequiremultiplesteps.Duetospaceandreadabilityconstraints,whentheseintermediatestepsareincludedinthissolutionsmanual,roundingmayappeartohaveoccurred.However,thefinalanswerforeachproblemisfoundwithoutroundingduringanystepintheproblem.Basic1.a.Themaximumpricethatthecompanyshouldbewillingtopayforthefleetofcarswithall-equityfundingisthepricethatmakestheNPVofthetransactionequaltozero.TheNPVequationfortheprojectis:NPV=–PurchasePrice+PV[(1–tC)(EBTD)]+PV(DepreciationTaxShield)IfweletPequalthepurchasepriceofthefleet,thentheNPVis:NPV=–P+(1–.35)($140,000)PVIFA13%,5+(.35)(P/5)PVIFA13%,5SettingtheNPVequaltozeroandsolvingforthepurchaseprice,wefind:0=–P+(1–.35)($140,000)PVIFA13%,5+(.35)(P/5)PVIFA13%,5P=$320,068.04+(P)(0.35/5)PVIFA13%,5P=$320,068.04+.2462P.7538P=$320,068.04P=$424,609.54b.Theadjustedpresentvalue(APV)ofaprojectequalsthenetpresentvalueoftheprojectifitwerefundedcompletelybyequityplusthenetpresentvalueofanyfinancingsideeffects.Inthiscase,theNPVoffinancingsideeffectsequalstheafter-taxpresentvalueofthecashflowsresultingfromthefirm’sdebt,so:APV=NPV(All-Equity)+NPV(FinancingSideEffects)So,theNPVofeachpartoftheAPVequationis:NPV(All-Equity)NPV=–PurchasePrice+PV[(1–tC)(EBTD)]+PV(DepreciationTaxShield)Thecompanypaid$395,000forthefleetofcars.Becausethisfleetwillbefullydepreciatedoverfiveyearsusingthestraight-linemethod,annualdepreciationexpenseequals:Depreciation=$395,000/5Depreciation=$79,000So,theNPVofanall-equityprojectis:NPV=–$395,000+(1–0.35)($140,000)PVIFA13%,5+(0.35)($79,000)PVIFA13%,5NPV=$22,319.49NPV(FinancingSideEffects)Thenetpresentvalueoffinancingsideeffectsequalstheafter-taxpresentvalueofcashflowsresultingfromthefirm’sdebt,so:NPV=Proceeds–AftertaxPV(InterestPayments)–PV(PrincipalPayments)Givenaknownlevelofdebt,debtcashflowsshouldbediscountedatthepre-taxcostofdebtRB.So,theNPVofthefinancingsideeffectsare:NPV=$260,000–(1–0.35)(0.08)($260,000)PVIFA8%,5–[$260,000/(1.08)5]NPV=$29,066.93So,theAPVoftheprojectis:APV=NPV(All-Equity)+NPV(FinancingSideEffects)APV=$22,319.49+29,066.93APV=$51,386.422.Theadjustedpresentvalue(APV)ofaprojectequalsthenetpresentvalueoftheprojectifitwerefundedcompletelybyequityplusthenetpresentvalueofanyfinancingsideeffects.Inthiscase,theNPVoffinancingsideeffectsequalstheafter-taxpresentvalueofthecashflowsresultingfromthefirm’sdebt,so:APV=NPV(All-Equity)+NPV(FinancingSideEffects)So,...