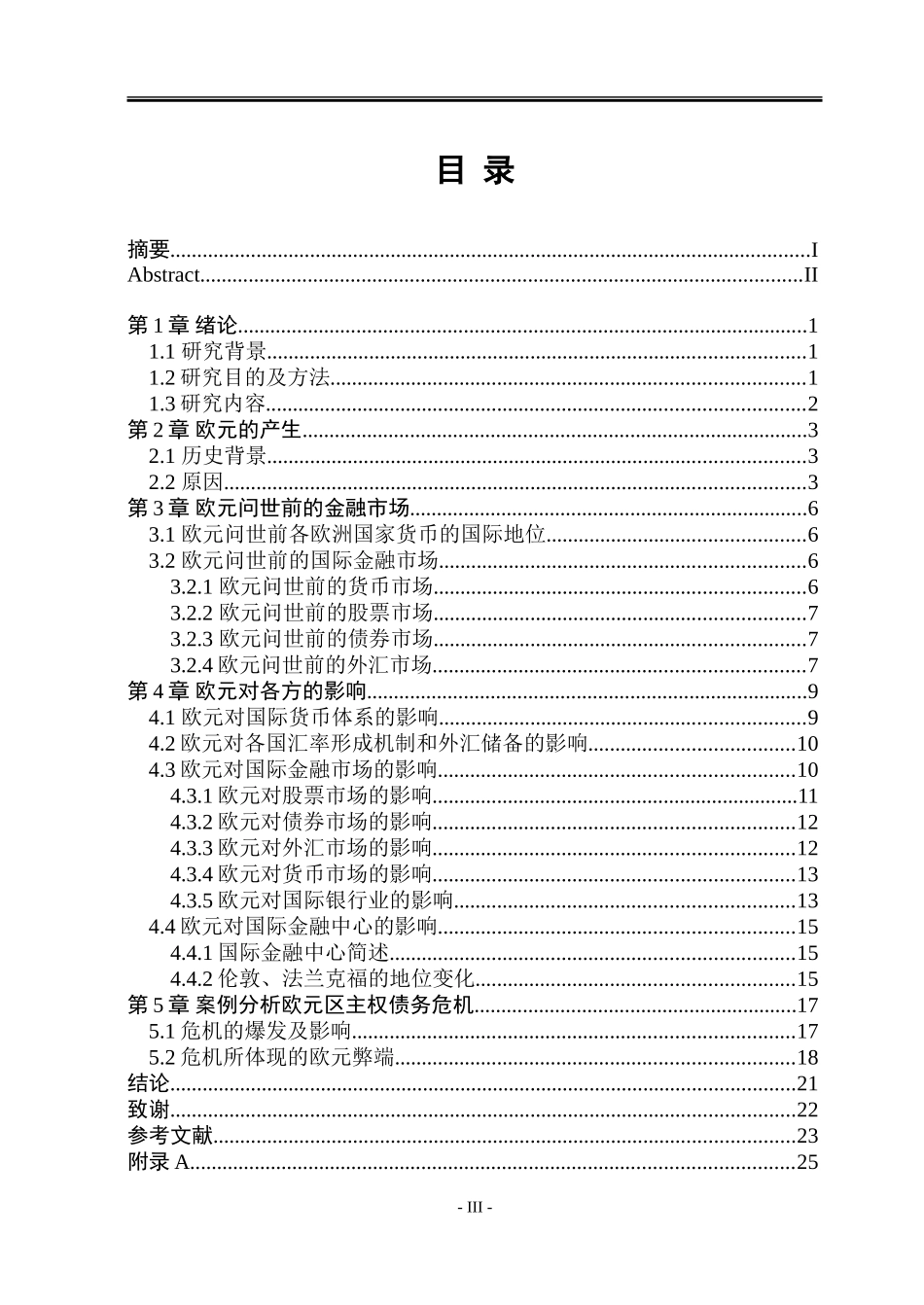

浅析欧元对国际金融市场的影响摘 要国际金融影响着国际经济的发展,近年来在国际上发生了数起引人瞩目的金融事件,例如:1997 年的亚洲金融风暴、2008 年的美国金融危机、2009 年的欧元区主权债务危机以及 2011 年的希腊债务危机等。金融界层出不穷的重大事件也越发引起人们对影响国际金融市场变化的因素的各种分析。在现如今的世界金融体系之中,美元一直起着举足轻重的作用,欧元紧追美元也在世界金融体系之中位于相当高的地位。欧元与美元,欧洲与美国总是被人们联系在一起,既然一直以来美元的影响力都对国际金融市场产生着巨大的影响,那么欧元能够对国际金融市场产生的影响力自然也是不可忽视的。故而本论文在此分别交代本文的研究目的及方法,从欧元产生的背景原因、欧元对国际货币体系的影响、对比欧元问世前的国际金融市场和欧元问世后欧元对国际金融市场的影响、欧元对国际金融中心产生的影响、欧元区主权债务危机爆发及体现的欧元体制的弊端等方面来对欧元对国际金融市场的影响作以浅析。关键词 欧元;国际金融市场;影响;债务危机- I -Analyze the impact of the euro on international financial marketsAbstractInternational finance affects the development of international economy, in recent years there has been a number of high-profile international financial events, For example, The Asian financial crisis of 1997, The U.S. financial crisis of 2008, The euro zone sovereign debt crisis of 2009 and The Greek debt crisis of 2011 and so on. The big events in the financial world have also increased the analysis of factors that affect the dynamics of international financial markets. In today’s world financial system, the dollar has always played a key role, chasing the dollar, the euro is also in a fairly high position in the world financial system, The euro and the dollar, the Europe and the United States are always linked together. Since the dollar's influence has had a huge impact on international financial markets, the impact of the euro on international financial markets is a...