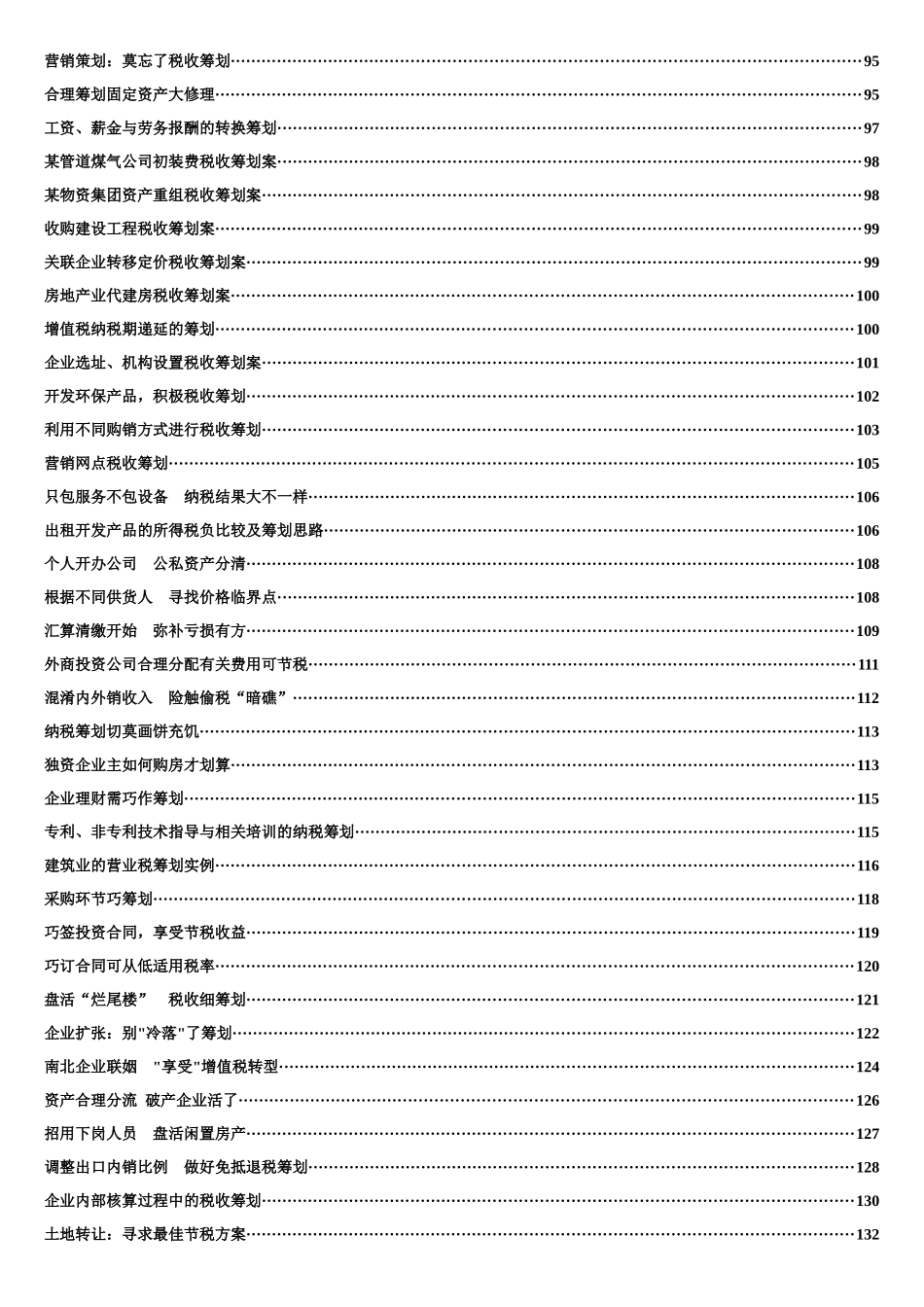

税务案例目录税务案例目录·············································································································································1公司董事领取报酬可筹划······························································································································6新办商业企业慎选优惠年度···························································································································8减免期多分利可以少补税······························································································································8委托开会可避免会议费被认定为是价外费用······································································································9巧签投资合同享受节税收益·························································································································10合理设置机构享受最低税率·························································································································11合理利用资源综合利用税收优惠政策·············································································································12个人独资企业财产出租转让的筹划策略··········································································································13醋酸制法不同节税效果迥异······················································································································15房地产开发经营与资产管理活动税务筹划思维与方法························································································16废旧物资收购、加工可筹划·························································································································20合法避税:纳税人“辩护律师”······································································...