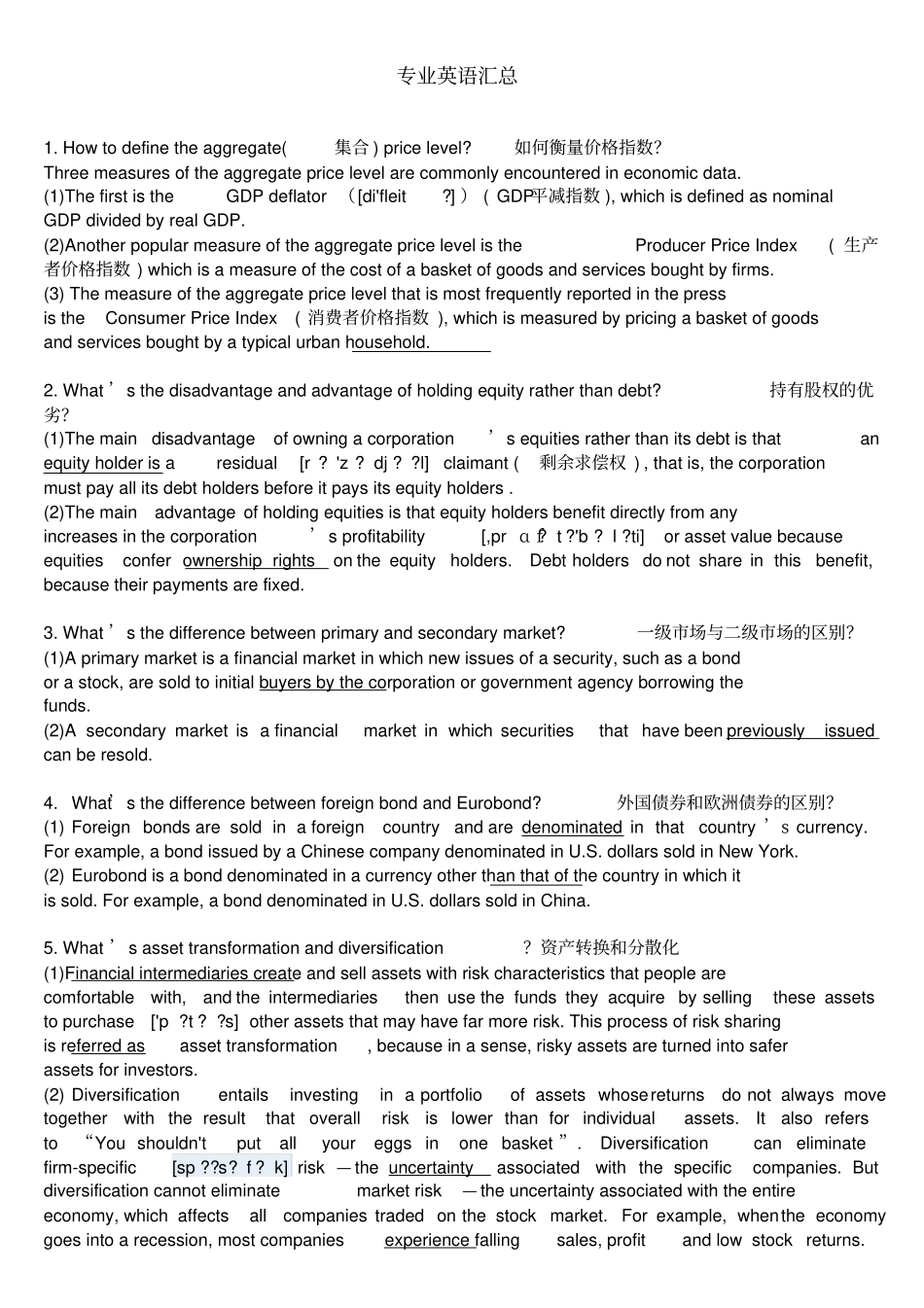

专业英语汇总1.Howtodefinetheaggregate(集合)pricelevel?如何衡量价格指数?Threemeasuresoftheaggregatepricelevelarecommonlyencounteredineconomicdata.(1)ThefirstistheGDPdeflator([di'fleit?])(GDP平减指数),whichisdefinedasnominalGDPdividedbyrealGDP.(2)AnotherpopularmeasureoftheaggregatepricelevelistheProducerPriceIndex(生产者价格指数)whichisameasureofthecostofabasketofgoodsandservicesboughtbyfirms.(3)ThemeasureoftheaggregatepricelevelthatismostfrequentlyreportedinthepressistheConsumerPriceIndex(消费者价格指数),whichismeasuredbypricingabasketofgoodsandservicesboughtbyatypicalurbanhousehold.2.What’sthedisadvantageandadvantageofholdingequityratherthandebt?持有股权的优劣?(1)Themaindisadvantageofowningacorporation’sequitiesratherthanitsdebtisthatanequityholderisaresidual[r?'z?dj??l]claimant(剩余求偿权),thatis,thecorporationmustpayallitsdebtholdersbeforeitpaysitsequityholders.(2)Themainadvantageofholdingequitiesisthatequityholdersbenefitdirectlyfromanyincreasesinthecorporation’sprofitability[,prɑf?t?'b?l?ti]orassetvaluebecauseequitiesconferownershiprightsontheequityholders.Debtholdersdonotshareinthisbenefit,becausetheirpaymentsarefixed.3.What’sthedifferencebetweenprimaryandsecondarymarket?一级市场与二级市场的区别?(1)Aprimarymarketisafinancialmarketinwhichnewissuesofasecurity,suchasabondorastock,aresoldtoinitialbuyersbythecorporationorgovernmentagencyborrowingthefunds.(2)Asecondarymarketisafinancialmarketinwhichsecuritiesthathavebeenpreviouslyissuedcanberesold.4.What’sthedifferencebetweenforeignbondandEurobond?外国债券和欧洲债券的区别?(1)Foreignbondsaresoldinaforeigncountryandaredenominatedinthatcountry’scurrency.Forexample,abondissuedbyaChinesecompanydenominatedinU.S.dollarssoldinNewYork.(2)Eurobondisabonddenominatedinacurrencyotherthanthatofthecountryinwhichitissold.Forexample,abonddenominatedinU.S.dollarssoldinChina.5.What’sassettransformationanddiversification?资产转换和分散化(1)Financialintermediariescreateandsellassetswithriskcharacteristicsthatpeoplearecomfortablewith,andtheintermediariesthenusethefundstheyacquirebysellingtheseassetstopurchase['p?t??s]otherassetsthatmayhavefarmorerisk.Thisprocessofrisksharingisreferredasassettransformation,becauseinasense,riskyassetsareturnedintosaferassetsforinvestors.(2)Diversificationentailsinvestinginaportfolioofassetswhosereturnsdonotalwaysmovetogetherwiththeresultthatoverallriskislowerthanforindividualassets.Italsorefersto“Youshouldn'tputallyoureggsinonebasket”.Diversificationcaneliminatefirm-specific[sp??s?f?k]risk—theuncertaintyassociatedwiththespecificcompanies.Butdiversificationcannoteliminatemarketrisk—theuncertaintyassociatedwiththeentireeconomy,whichaffectsallcompaniestradedonthestockmarket.Forexample,whentheeconomygoesintoarecession,mostcompaniesexperiencefallingsales,profitandlowstockreturns.Diversificationreducestheriskofholdingstocks,butitdoesnoteliminateit.6.Explainthefollowingconcepts:asymmetric[,es?'m?tr?k]information,adverseselectionandmoralhazard.(1)Asymmetricinformation(信息不对称)referstothatonepartyoftendoesnotknowenoughabouttheotherpartytomakeaccuratedecisions.Forexample,aborrowerwhotakesoutaloanusuallyhasbetterinformationaboutthepotentialreturnsandriskassociatedwiththeinvestmentprojectsforwhichthefundsareinvestedthanthelenderdoes.(2)Adverseselection(逆向选择)istheproblemcreatedbyasymmetricinformati...