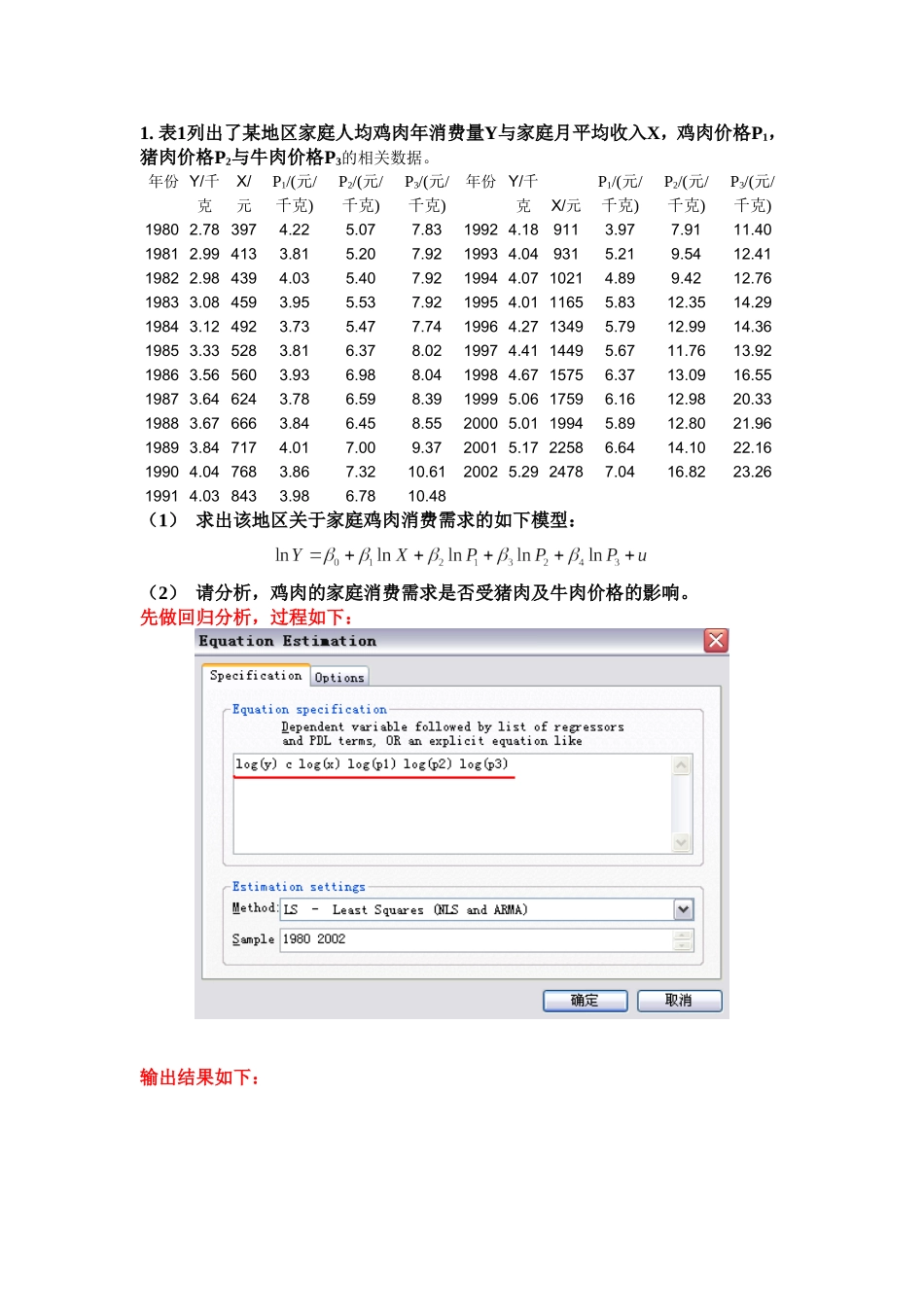

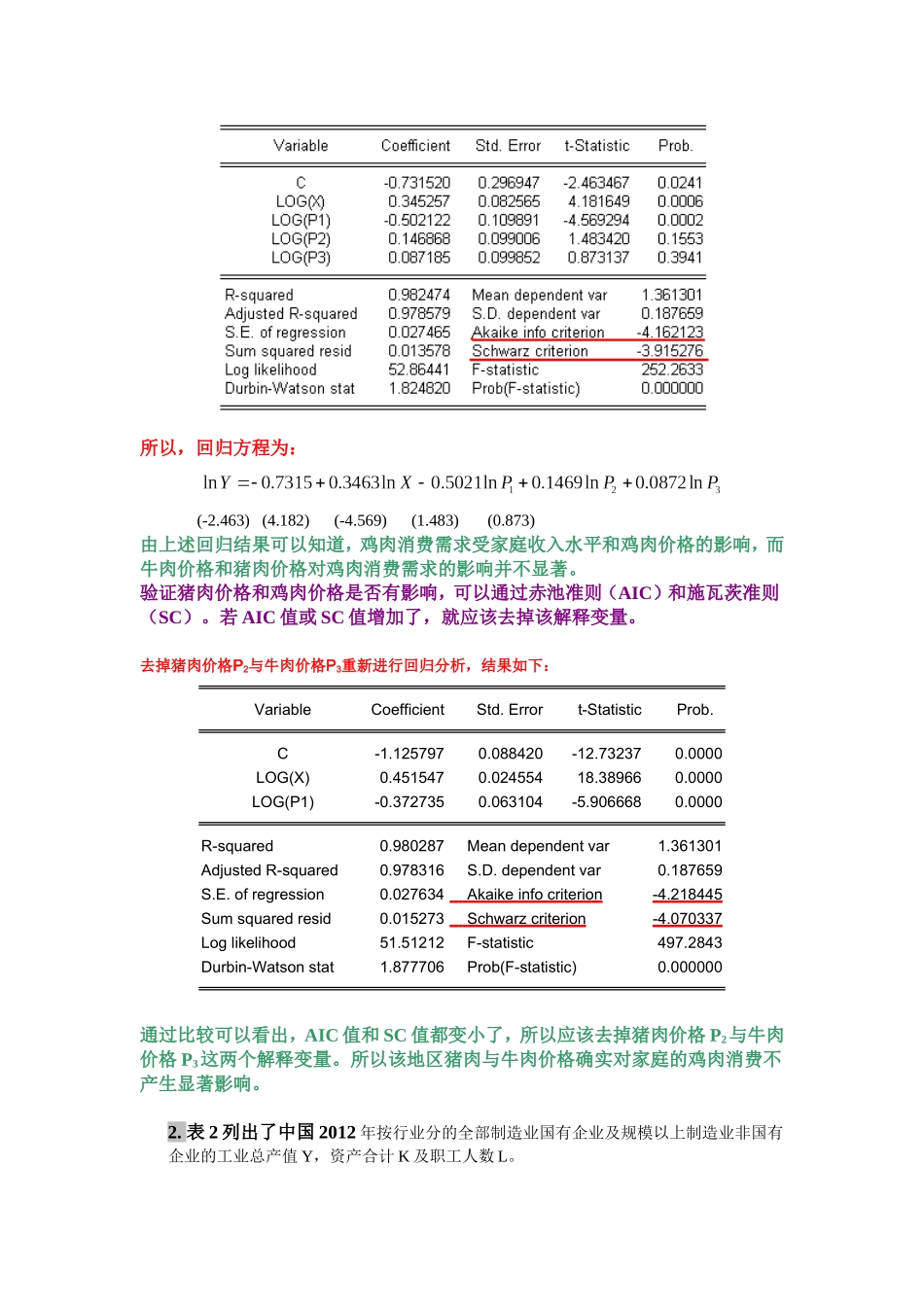

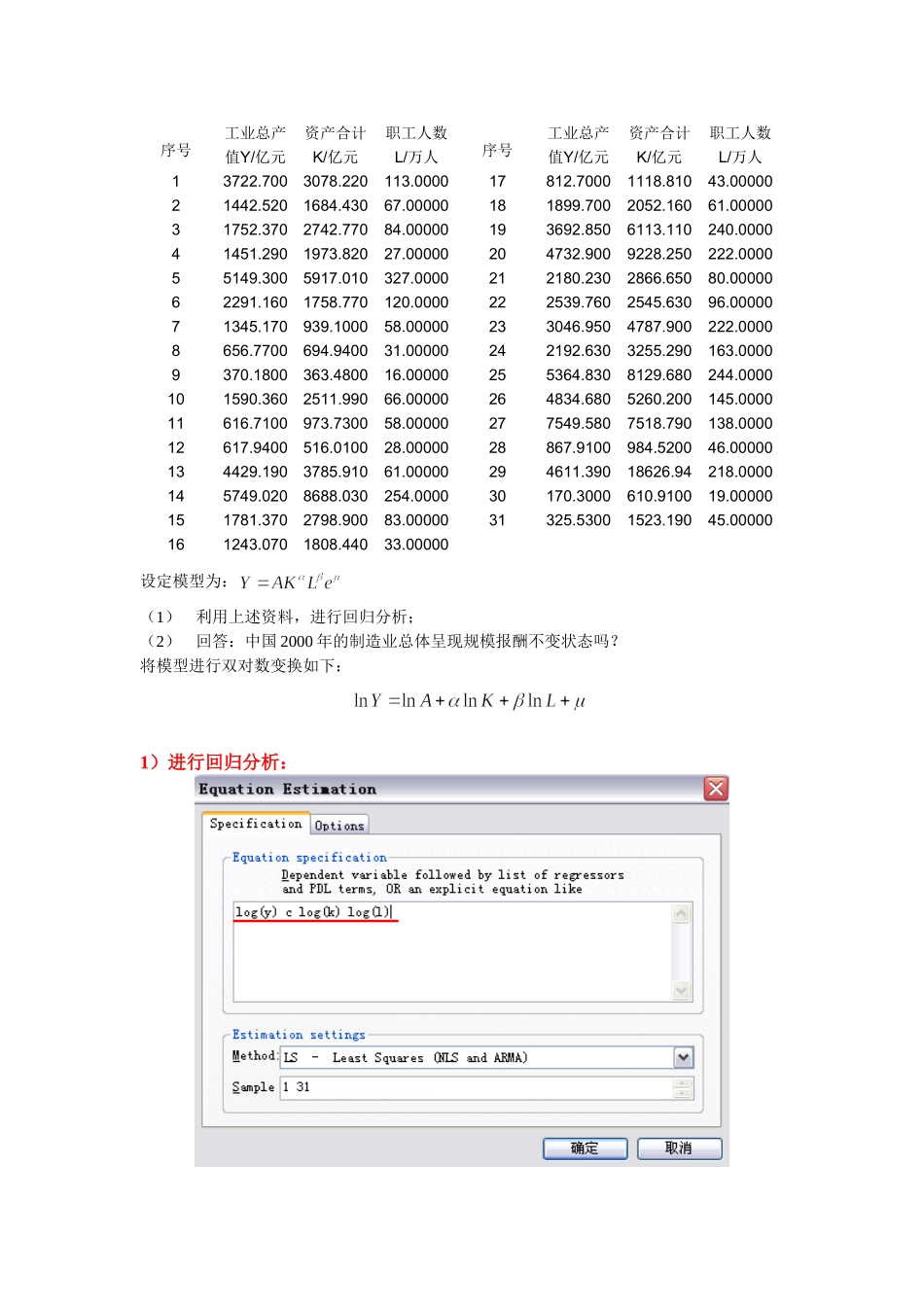

1.表1列出了某地区家庭人均鸡肉年消费量Y与家庭月平均收入X,鸡肉价格P1,猪肉价格P2与牛肉价格P3的相关数据。年份Y/千克X/元P1/(元/千克)P2/(元/千克)P3/(元/千克)年份Y/千克X/元P1/(元/千克)P2/(元/千克)P3/(元/千克)19802.783974.225.077.8319924.189113.977.9111.4019812.994133.815.207.9219934.049315.219.5412.4119822.984394.035.407.9219944.0710214.899.4212.7619833.084593.955.537.9219954.0111655.8312.3514.2919843.124923.735.477.7419964.2713495.7912.9914.3619853.335283.816.378.0219974.4114495.6711.7613.9219863.565603.936.988.0419984.6715756.3713.0916.5519873.646243.786.598.3919995.0617596.1612.9820.3319883.676663.846.458.5520005.0119945.8912.8021.9619893.847174.017.009.3720015.1722586.6414.1022.1619904.047683.867.3210.6120025.2924787.0416.8223.2619914.038433.986.7810.48(1)求出该地区关于家庭鸡肉消费需求的如下模型:(2)请分析,鸡肉的家庭消费需求是否受猪肉及牛肉价格的影响。先做回归分析,过程如下:输出结果如下:所以,回归方程为:(-2.463)(4.182)(-4.569)(1.483)(0.873)由上述回归结果可以知道,鸡肉消费需求受家庭收入水平和鸡肉价格的影响,而牛肉价格和猪肉价格对鸡肉消费需求的影响并不显著。验证猪肉价格和鸡肉价格是否有影响,可以通过赤池准则(AIC)和施瓦茨准则(SC)。若AIC值或SC值增加了,就应该去掉该解释变量。去掉猪肉价格P2与牛肉价格P3重新进行回归分析,结果如下:VariableCoefficientStd.Errort-StatisticProb.C-1.1257970.088420-12.732370.0000LOG(X)0.4515470.02455418.389660.0000LOG(P1)-0.3727350.063104-5.9066680.0000R-squared0.980287Meandependentvar1.361301AdjustedR-squared0.978316S.D.dependentvar0.187659S.E.ofregression0.027634Akaikeinfocriterion-4.218445Sumsquaredresid0.015273Schwarzcriterion-4.070337Loglikelihood51.51212F-statistic497.2843Durbin-Watsonstat1.877706Prob(F-statistic)0.000000通过比较可以看出,AIC值和SC值都变小了,所以应该去掉猪肉价格P2与牛肉价格P3这两个解释变量。所以该地区猪肉与牛肉价格确实对家庭的鸡肉消费不产生显著影响。2.表2列出了中国2012年按行业分的全部制造业国有企业及规模以上制造业非国有企业的工业总产值Y,资产合计K及职工人数L。序号工业总产值Y/亿元资产合计K/亿元职工人数L/万人序号工业总产值Y/亿元资产合计K/亿元职工人数L/万人13722.7003078.220113.000017812.70001118.81043.0000021442.5201684.43067.00000181899.7002052.16061.0000031752.3702742.77084.00000193692.8506113.110240.000041451.2901973.82027.00000204732.9009228.250222.000055149.3005917.010327.0000212180.2302866.65080.0000062291.1601758.770120.0000222539.7602545.63096.0000071345.170939.100058.00000233046.9504787.900222.00008656.7700694.940031.00000242192.6303255.290163.00009370.1800363.480016.00000255364.8308129.680244.0000101590.3602511.99066.00000264834.6805260.200145.000011616.7100973.730058.00000277549.5807518.790138.000012617.9400516.010028.0000028867.9100984.520046.00000134429.1903785.91061.00000294611.39018626.94218.0000145749.0208688.030254.000030170.3000610.910019.00000151781.3702798.90083.0000031325.53001523.19045.00000161243.0701808.44033.00000设定模型为:(1)利用上述资料,进行回归分析;(2)回答:中国2000年的制造业总体呈现规模报酬不变状态吗?将模型进行双对数变换如下:1)进行回归分析:得到如下回归结果:于是,样本回归方程为:(1.59)(3.45)(1.79)从回归结果可以看出,模型的拟合度较好,在显著性水平0.1的条件下,各项系数均通过了t检验。从F检验可以看出,方程对Y的解释程度较少。表明,工业总产值对数值的79.6%的变化可以由资产合计对数与职工的对数值的变化来解释,但仍有20.4%的变化是由其他因素的变化影响的。从上述回归结果看,,即资产与劳动的产出...