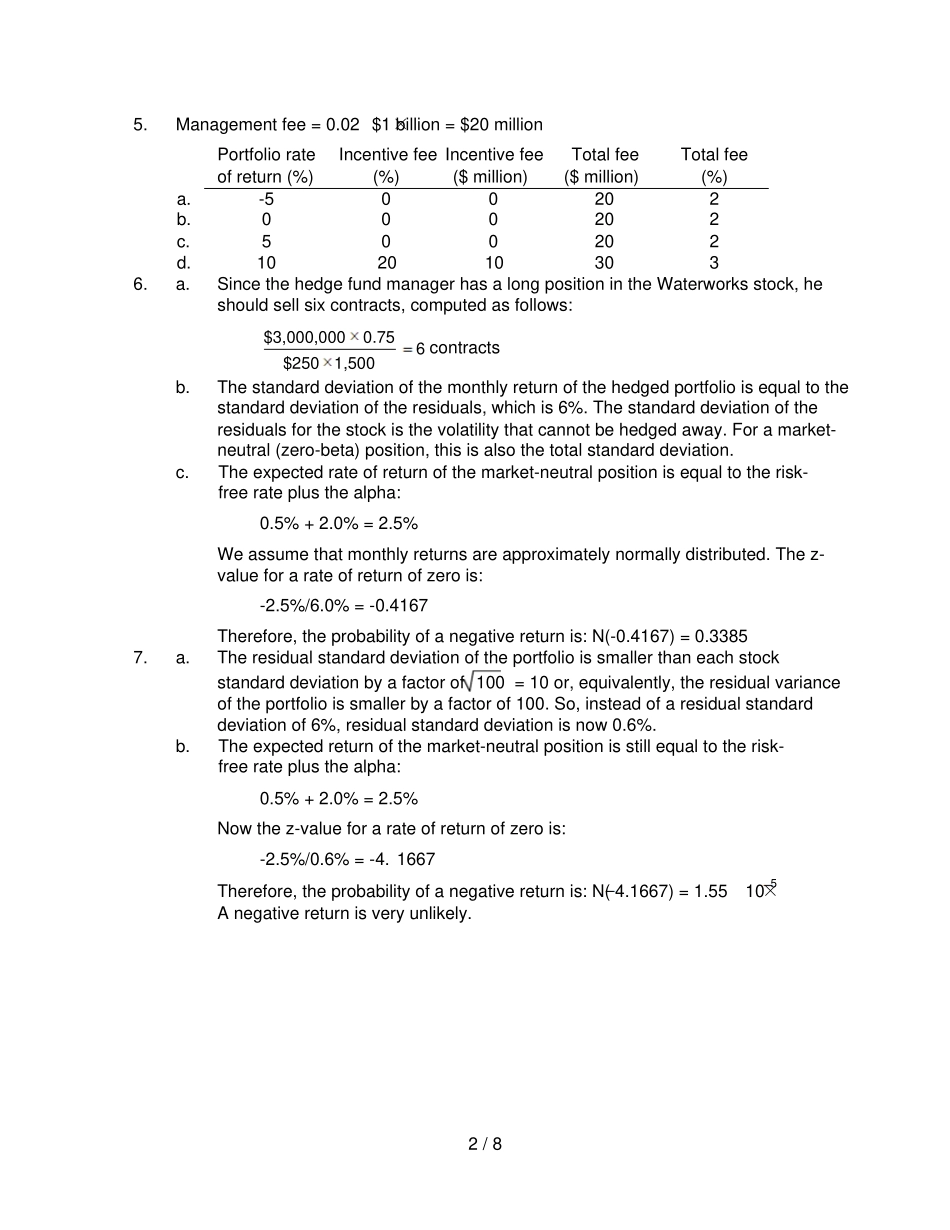

1/8CHAPTER26:HEDGEFUNDSPROBLEMSETS1.No,amarket-neutralhedgefundwouldnotbeagoodcandidateforaninvestor’sentireretirementportfoliobecausesuchafundisnotadiversifiedportfolio.Theterm‘market-neutral’referstoaportfoliopositionwithrespecttoaspecifiedmarketinefficiency.However,therecouldbearoleforamarket-neutralhedgefundintheinvestor’soverallportfolio;themarket-neutralhedgefundcanbethoughtofasanapproachfortheinvestortoaddalphatoamorepassiveinvestmentpositionsuchasanindexmutualfund.2.Theincentivefeeofahedgefundispartofthehedgefundcompensationstructure;theincentivefeeistypicallyequalto20%ofthehedgefund’sprofitsbeyondaparticularbenchmarkrateofreturn.Therefore,theincentivefeeresemblesthepayofftoacalloption,whichismorevaluablewhenvolatilityishigher.Consequently,thehedgefundportfoliomanagerismotivatedtotakeonhigh-riskassetsintheportfolio,therebyincreasingvolatilityandthevalueoftheincentivefee.3.Thereareanumberoffactorsthatmakeithardertoassesstheperformanceofahedgefundportfoliomanagerthanatypicalmutualfundmanager.Someofthesefactorsare:Hedgefundstendtoinvestinmoreilliquidassetssothatanapparentalphamaybeinfactsimplycompensationforilliquidity.Hedgefunds’valuationoflessliquidassetsisquestionable.Survivorshipbiasandbackfillbiasresultinhedgefunddatabasesthatreportperformanceonlyformoresuccessfulhedgefunds.Hedgefundstypicallyhaveunstableriskcharacteristicsmakingperformanceevaluationthatdependsonaconsistentriskprofileproblematic.Taileventsskewthedistributionofhedgefundoutcomes,makingitdifficulttoobtainarepresentativesampleofreturnsoverrelativelyshortperiodsoftime.4.No,statisticalarbitrageisnottruearbitragebecauseitdoesnotinvolveestablishingrisk-freepositionsbasedonsecuritymispricing.Statisticalarbitrageisessentiallyaportfolioofriskybets.Thehedgefundtakesalargenumberofsmallpositionsbasedonapparentsmall,temporarymarketinefficiencies,relyingontheprobabilitythattheexpectedreturnforthetotalityofthesebetsispositive.2/85.Managementfee=0.02×$1billion=$20millionPortfoliorateofreturn(%)Incentivefee(%)Incentivefee($million)Totalfee($million)Totalfee(%)a.-500202b.000202c.500202d.1020103036.a.SincethehedgefundmanagerhasalongpositionintheWaterworksstock,heshouldsellsixcontracts,computedasfollows:61,500$2500.75$3,000,000contractsb.Thestandarddeviationofthemonthlyreturnofthehedgedportfolioisequaltothestandarddeviationoftheresiduals,whichis6%.Thestandarddeviationoftheresidualsforthestockisthevolatilitythatcannotbehedgedaway.Foramarket-neutral(zero-beta)position,thisisalsothetotalstandarddeviation.c.Theexpectedrateofreturnofthemarket-neutralpositionisequaltotherisk-freerateplusthealpha:0.5%+2.0%=2.5%Weassumethatmonthlyreturnsareapproximatelynormallydistributed.Thez-valueforarateofreturnofzerois:-2.5%/6.0%=-0.4167Therefore,theprobabilityofanegativereturnis:N(-0.4167)=0.33857.a.Theresidualstandarddeviationoftheportfolioissmallerthaneachstock’sstandarddeviationbyafactorof100=10or,equivalently,theresidualvarianceoftheportfolioissmallerbyafactorof100.So,insteadofaresidualstandarddeviationof6%,residualstandarddeviationisnow0.6%.b.Theexpectedreturnofthemarket-neutralpositionisstillequaltotherisk-freerateplusthealpha:0.5%+2.0%=2.5%Nowthez-valueforarateofreturnofzerois:-2.5%/0.6%=-4.1667Therefore,theprobabilityofanegativereturnis:N(4.1667)=1.55×105Anegativereturnisveryunlikely.3/88.a.Forthe(nowimproperly)hedged...