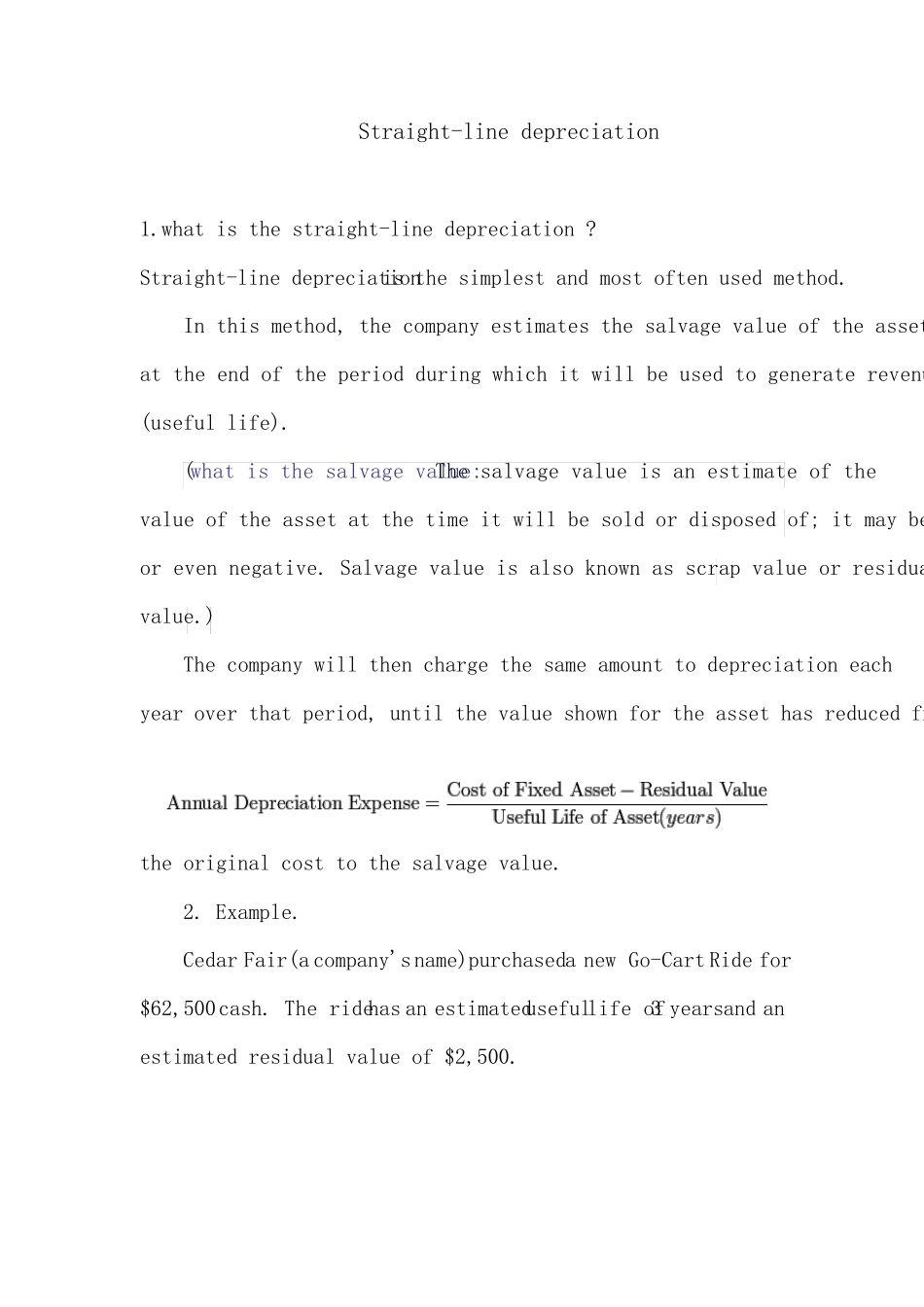

Straight-line depreciation 1.what is the straight-line depreciation ? Straight-line depreciation is the simplest and most often used method. In this method, the company estimates the salvage value of the asset at the end of the period during which it will be used to generate revenues (useful life). (what is the salvage value: The salvage value is an estimate of the value of the asset at the time it will be sold or disposed of; it may be zero or even negative. Salvage value is also known as scrap value or residual value.) The company will then charge the same amount to depreciation each year over that period, until the value shown for the asset has reduced from the original cost to the salvage value. 2. Example. Cedar Fair (a company's name)purchased a new Go-Cart Ride for $62,500 cash. The ride has an estimated useful life of 3 years and an estimated residual value of $2,500. 3.The limited most of China's enterprises are still using the straight-line method depreciation and seriously hindered the pace of fixed assets to update. Depreciation AccumulatedAccumulatedUndepreciatedExpenseDepreciationDepreciationBalanceYear(debit)(credit)(credit balance)(book value)62,500$ 120,000$ 20,000$ 20,000$ 42,500 220,000 20,000 40,000 22,500 320,000 20,000 60,000 2,500 60,000$ 60,000$