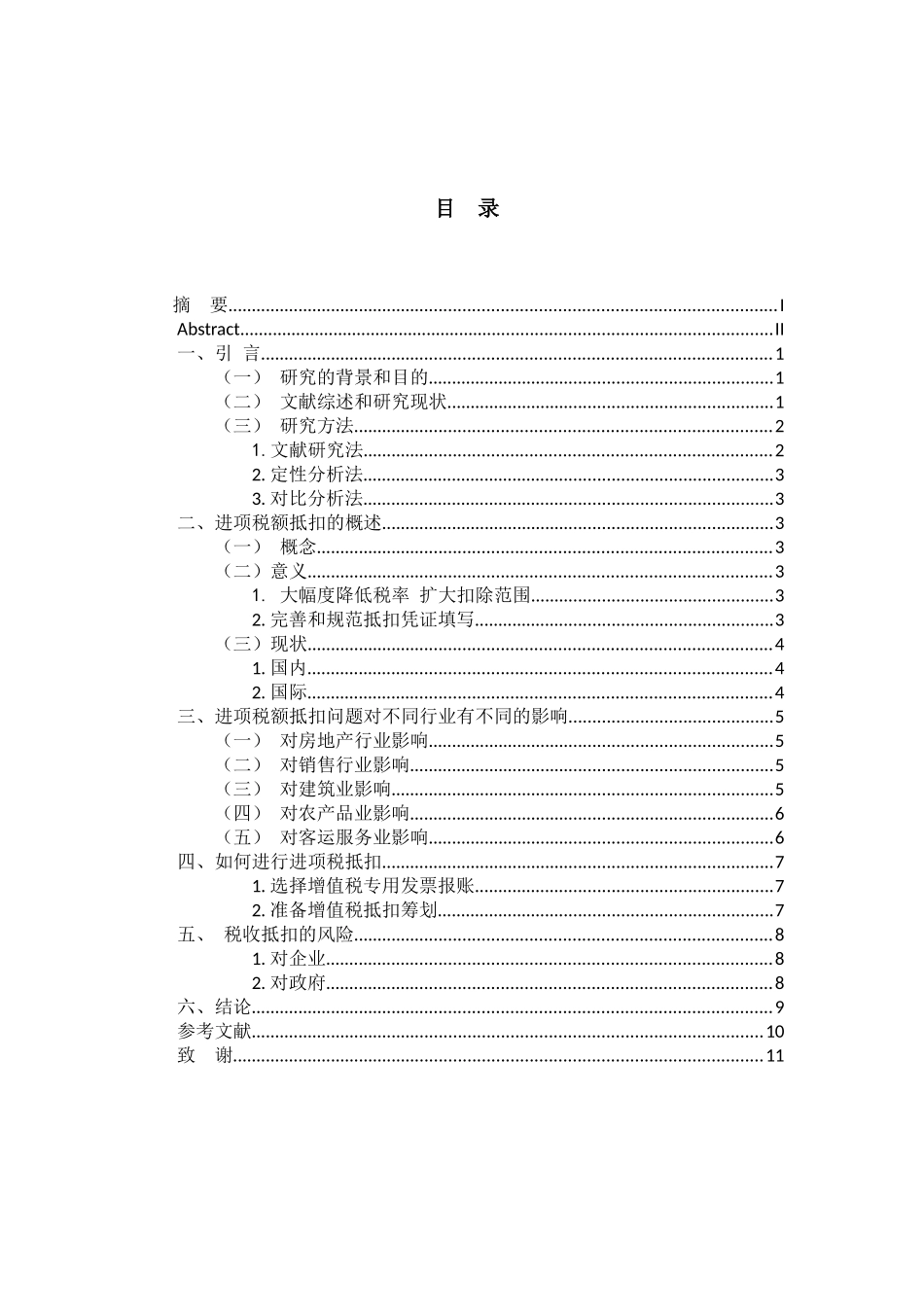

I浅谈增值税进项税额抵扣摘 要近年来,由于我国的经济实力不断增长,对税收的影响很大,企业的税收情况十分不容乐观,国家为了解决这个燃眉之急以保证经济继续快速发展。也为了与我国的经济实力相匹配,税收制度做了相应的调整。从营改增以来,增值税成 为我国行业的主要税种。从某种程度上占据我国税收收入的大部分,但从纳税人来说,由于进项税额可以扣减且不重复征税,大大 减轻了纳税的负担。本文从增值税扣税原理入手,研究不同行业进项税额抵扣的问题。首先本文明确了增值税销项税额和进项税的关系,从企业的济经活动入手阐述进项税额的抵扣问题及账务处理;其次,通过不同行业增值税额的缴纳情况对比分析其进项税额抵扣给企业带来的影响;其三,阐明国家增值税税收抵扣的优惠政策;最后,通过对增值税税收优惠政策分析,阐明企业应如何进行进项税额抵扣的意见和建议,为企业今后的增值税进项税额抵扣提供参考。关键词:增值税额;进项税额;税额抵扣IIInput VAT Deduction of the ResearchAbstractIn recent years, to continuous growth of China's economic strength, the impact on tax revenue is very important, the tax situation of enterprises is not optimistic, in order to solve the urgent need to ensure the continued rapid economic development of the country. Due to match China's economic strength, the tax system has been adjusted accordingly. Since replacing the business tax with a value-added tax, value-added tax has become the main tax in China's industries. To some extent, it accounts for the majority of China's tax revenue, but for taxpayers, the input tax can be deducted without double taxation, which greatly reduces the burden of tax payment. Starting from the principle of VAT deduction, the studies the deduction of input tax in different industries. First of all, this paper makes clear the relationship between output VAT and input tax and expounds the deduction of input tax and accounting treatment from the economic activities of enterprises. Secondly, the impact...