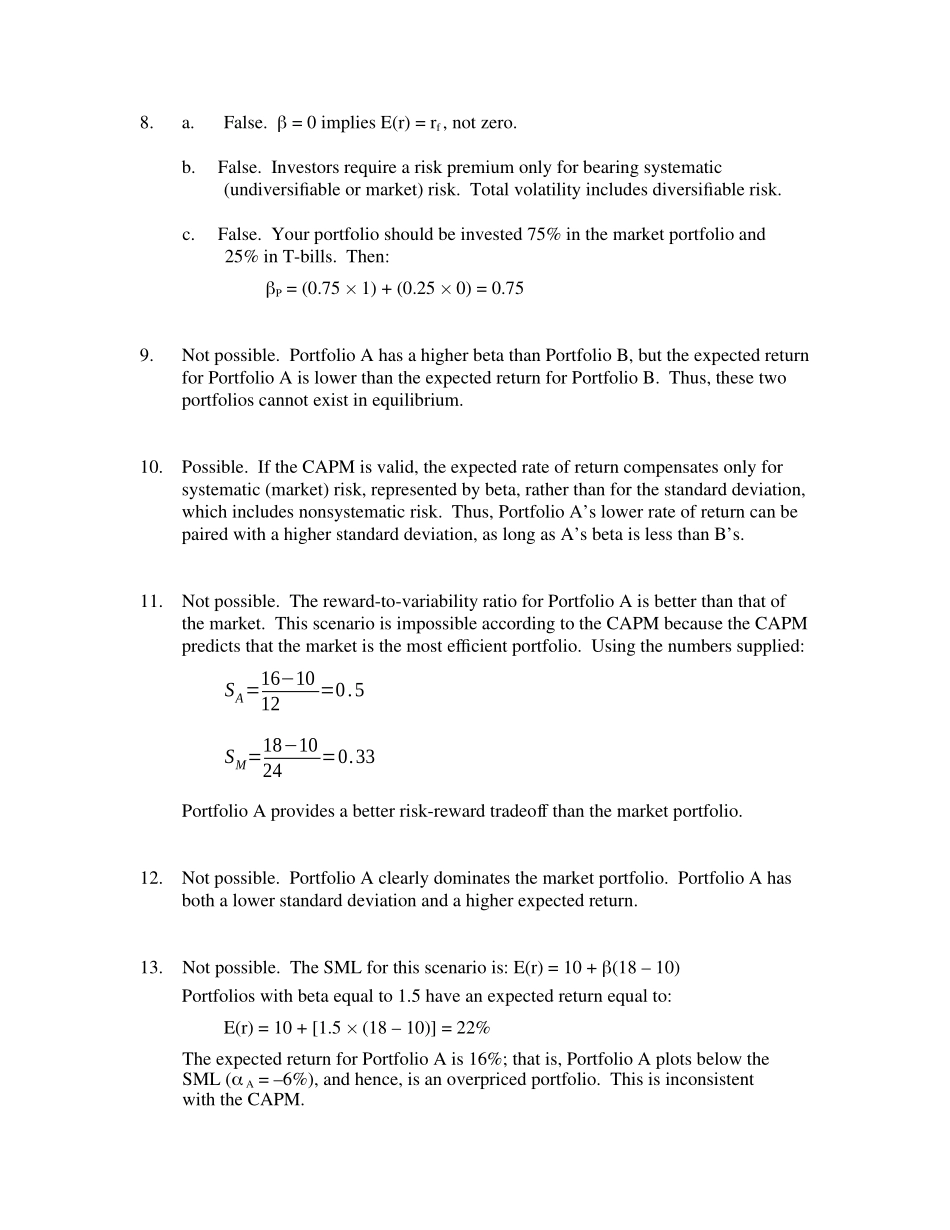

CHAPTER9:THECAPITALASSETPRICINGMODEL1.c.2.d.FromCAPM,thefairexpectedreturn=8+1.25(158)=16.75%Actuallyexpectedreturn=17%=1716.75=0.25%3.Sincethestock’sbetaisequalto1.2,itsexpectedrateofreturnis:6+[1.2(16–6)]=18%E(r)=D1+P1−¿P0P0¿0.18=6+P1−¿5050⇒P1=$53¿4.Theseriesof$1,000paymentsisaperpetuity.Ifbetais0.5,thecashflowshouldbediscountedattherate:6+[0.5(16–6)]=11%PV=$1,000/0.11=$9,090.91If,however,betaisequalto1,thentheinvestmentshouldyield16%,andthepricepaidforthefirmshouldbe:PV=$1,000/0.16=$6,250Thedifference,$2,840.91,istheamountyouwilloverpayifyouerroneouslyassumethatbetais0.5ratherthan1.5.UsingtheSML:4=6+(16–6)=–2/10=–0.26.a.7.E(rP)=rf+P[E(rM)–rf]18=6+P(14–6)P=12/8=1.58.a.False.=0impliesE(r)=rf,notzero.b.False.Investorsrequireariskpremiumonlyforbearingsystematic(undiversifiableormarket)risk.Totalvolatilityincludesdiversifiablerisk.c.False.Yourportfolioshouldbeinvested75%inthemarketportfolioand25%inT-bills.Then:P=(0.751)+(0.250)=0.759.Notpossible.PortfolioAhasahigherbetathanPortfolioB,buttheexpectedreturnforPortfolioAislowerthantheexpectedreturnforPortfolioB.Thus,thesetwoportfolioscannotexistinequilibrium.10.Possible.IftheCAPMisvalid,theexpectedrateofreturncompensatesonlyforsystematic(market)risk,representedbybeta,ratherthanforthestandarddeviation,whichincludesnonsystematicrisk.Thus,PortfolioA’slowerrateofreturncanbepairedwithahigherstandarddeviation,aslongasA’sbetaislessthanB’s.11.Notpossible.Thereward-to-variabilityratioforPortfolioAisbetterthanthatofthemarket.ThisscenarioisimpossibleaccordingtotheCAPMbecausetheCAPMpredictsthatthemarketisthemostefficientportfolio.Usingthenumberssupplied:SA=16−1012=0.5SM=18−1024=0.33PortfolioAprovidesabetterrisk-rewardtradeoffthanthemarketportfolio.12.Notpossible.PortfolioAclearlydominatesthemarketportfolio.PortfolioAhasbothalowerstandarddeviationandahigherexpectedreturn.13.Notpossible.TheSMLforthisscenariois:E(r)=10+(18–10)Portfolioswithbetaequalto1.5haveanexpectedreturnequalto:E(r)=10+[1.5(18–10)]=22%TheexpectedreturnforPortfolioAis16%;thatis,PortfolioAplotsbelowtheSML(A=–6%),andhence,isanoverpricedportfolio.ThisisinconsistentwiththeCAPM.14.Notpossible.TheSMListhesameasinProblem13.Here,PortfolioA’srequiredreturnis:10+(0.98)=17.2%Thisisgreaterthan16%.PortfolioAisoverpricedwithanegativealpha:A=–1.2%15.Possible.TheCMListhesameasinProblem11.PortfolioAplotsbelowtheCML,asanyassetisexpectedto.ThisscenarioisnotinconsistentwiththeCAPM.16.Ifthesecurity’scorrelationcoefficientwiththemarketportfoliodoubles(withallothervariablessuchasvariancesunchanged),thenbeta,andthereforetheriskpremium,willalsodouble.Thecurrentriskpremiumis:14–6=8%Thenewriskpremiumwouldbe16%,andthenewdiscountrateforthesecuritywouldbe:16+6=22%Ifthestockpaysaconstantperpetualdividend,thenweknowfromtheoriginaldatathatthedividend(D)mustsatisfytheequationforthepresentvalueofaperpetuity:Price=Dividend/Discountrate50=D/0.14D=500.14=$7.00Atthenewdiscountrateof22%,thestockwouldbeworth:$7/0.22=$31.82Theincreaseinstockriskhaslowereditsvalueby36.36%.17.d.18.a.Sincethemarketportfolio,bydefinition,hasabetaof1,itsexpectedrateofreturnis12%.b.=0meansnosystematicrisk.Hence,thestock’sexpectedrateofreturninmarketequilibriumistherisk-freerate,5%.c.UsingtheSML,thefairexpectedrateofreturnforastockwith=–0.5is:E(r)=5+[(–0...