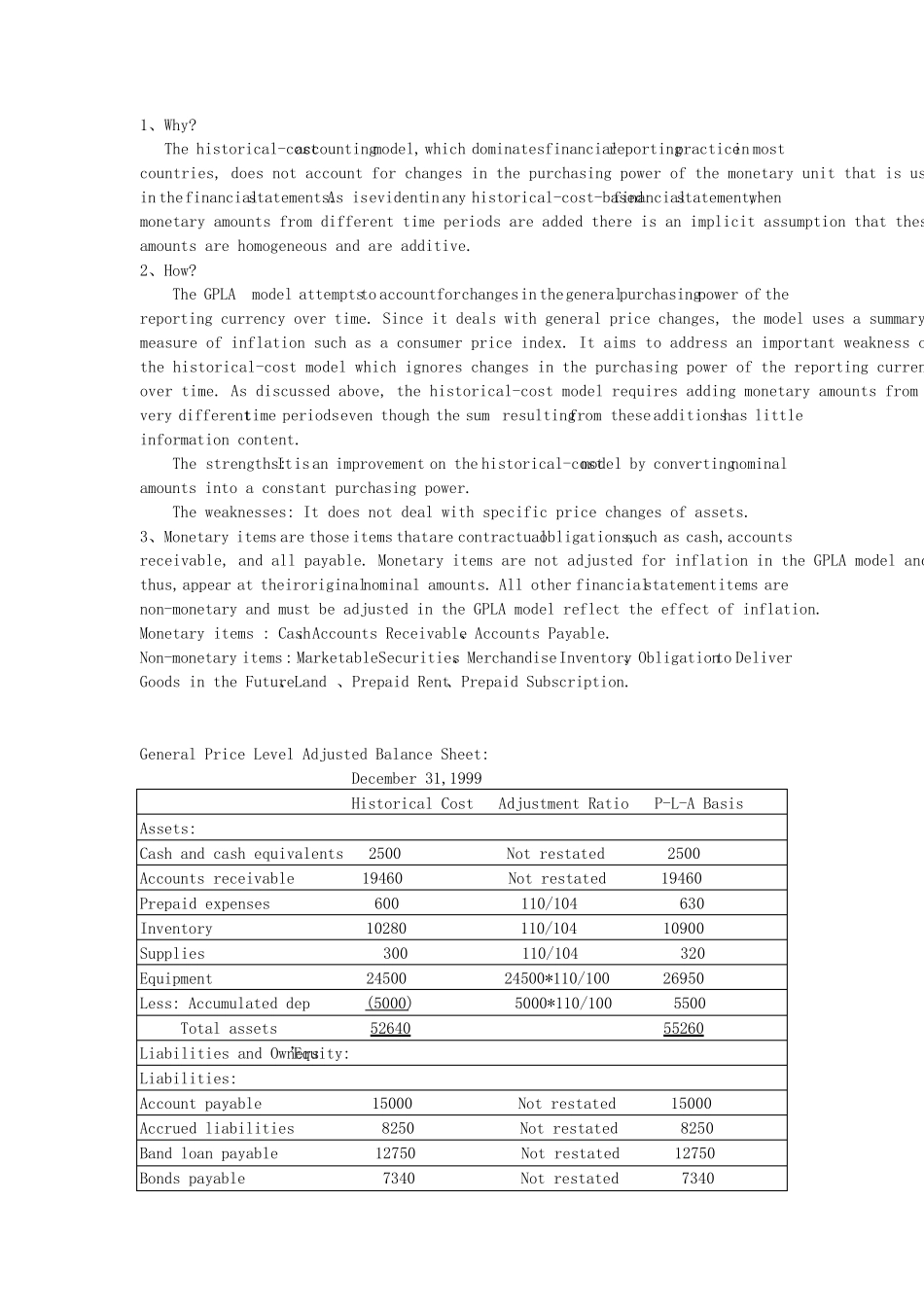

1、 Why? The historical-cost accounting model, which dominates financial reporting practice in most countries, does not account for changes in the purchasing power of the monetary unit that is used in the financial statements. As is evident in any historical-cost-based financial statement, when monetary amounts from different time periods are added there is an implicit assumption that these amounts are homogeneous and are additive. 2、 How? The GPLA model attempts to account for changes in the general purchasing power of the reporting currency over time. Since it deals with general price changes, the model uses a summary measure of inflation such as a consumer price index. It aims to address an important weakness of the historical-cost model which ignores changes in the purchasing power of the reporting currency over time. As discussed above, the historical-cost model requires adding monetary amounts from very different time periods even though the sum resulting from these additions has little information content. The strengths: It is an improvement on the historical-cost model by converting nominal amounts into a constant purchasing power. The weaknesses: It does not deal with specific price changes of assets. 3、 Monetary items are those items that are contractual obligations, such as cash, accounts receivable, and all payable. Monetary items are not adjusted for inflation in the GPLA model and, thus, appear at their original nominal amounts. All other financial statement items are non-monetary and must be adjusted in the GPLA model reflect the effect of inflation. Monetary items : Cash 、 Accounts Receivable 、 Accounts Payable. Non-monetary items : Marketable Securities 、 Merchandise Inventory、 Obli...